Why Apple Should be Trading at $1000, Tech Stocks Market Mispricing

Companies / Tech Stocks Nov 08, 2012 - 03:09 AM GMT At the risk of jumping on the everybody’s-writing-articles-on-Apple-bandwagon, this article is offered at the request of a loyal reader. Our objective is to put not only Apple’s valuation into perspective, but also what we believe to be the current undervaluation of technology stocks in general.

At the risk of jumping on the everybody’s-writing-articles-on-Apple-bandwagon, this article is offered at the request of a loyal reader. Our objective is to put not only Apple’s valuation into perspective, but also what we believe to be the current undervaluation of technology stocks in general.

If looking at how the stock market has historically priced technology stocks doesn’t convince you that the market is not only not efficient, but in fact totally irrational much of the time-then nothing will. It was approximately 15 years ago that the market was telling us that technology stocks had almost unlimited value. Mr. Market was placing literally insanely high valuations on everything tech that made no economic or even mathematical sense. During this era, the simple Treasury bond was throwing off riskless interest that was many times greater than even the most optimistic expectations of what technology stocks earnings would be. To be clear, you could earn Treasury bond interest payments that were many times greater than the total earnings being generated by technology stocks.

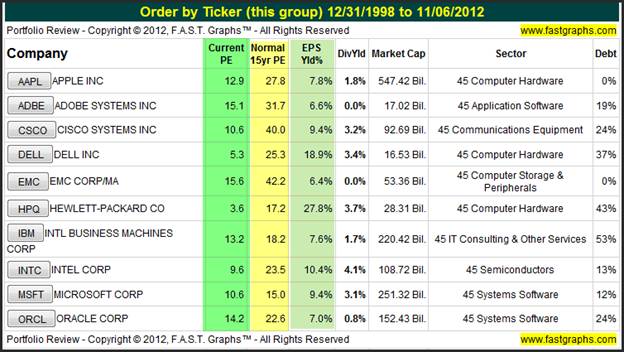

Today, we find Mr. Market treating anything tech, in an exact opposite manner. In 2012, and as we head into 2013, technology is being priced at some of the lowest valuations it ever has. In fact, the valuations on technology are actually less than those on the average company as measured by the S&P 500. This is true notwithstanding the fact that technology has historical growth rates much greater than the average company, and continues to have forecast growth that is expected to be much greater than the average company. Mathematically, this is simply not rational. Logic would dictate that technology should command valuations that are much higher than the market, or at least equal to the market. It makes absolutely no sense that technology should be being priced below the average company.

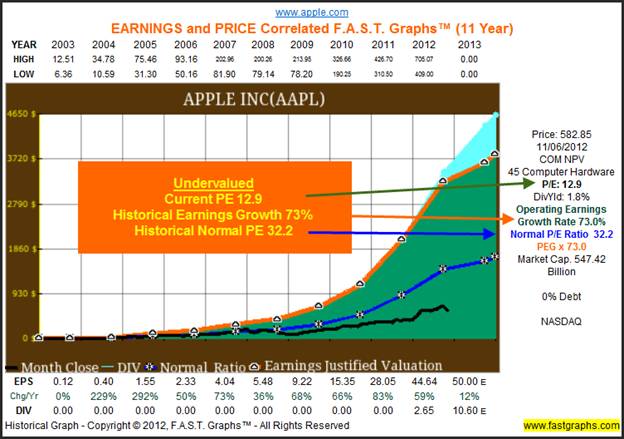

The following table looks at 10 of the most prominent high profile technology stocks on the planet. The first three columns on the table are the most important supporting the thesis of this introduction. When you compare the current PE ratio on each technology stock in the table to its historical normal PE ratio since 1998, it is clear that technology is being priced at an abnormally low valuation. But perhaps even more importantly, the earnings yield available from these technology stalwarts is remarkably high, especially when contrasted to the current interest yields available from fixed income. Moreover, when you consider that technology is on the threshold of achieving exponential future growth, today’s low valuations seem even more absurd.

The only explanation that makes any sense to us is that investors’ exaggerated levels of fear, coupled with the unknown nature of this rapidly-evolving industry is generating pessimistic valuations. Therefore, the thesis of this article is to illustrate that not just the technology sector itself, but more specifically that Apple Inc. is an absurdly undervalued strong business today. Moreover, based on the fundamentals underpinning Apple, we believe that this company should be rationally trading at a PE ratio somewhere between 20 to 25 times earnings.

This would be justified not only on its historical record, but more importantly based on reasonable projections of future growth. If expected growth does occur, then the fair value earnings justified price for Apple Inc. is approximately $900 to $1200 per share, and increasing every quarter. We arrive at these numbers by applying a PEG ratio (PE=Growth Rate) valuation to Apple Inc.’s current and near future earnings expectations. We will develop this in greater detail later in the article.

Apple Inc.: The 800-Pound Gorilla in Technology By The Numbers (Fundamentals)

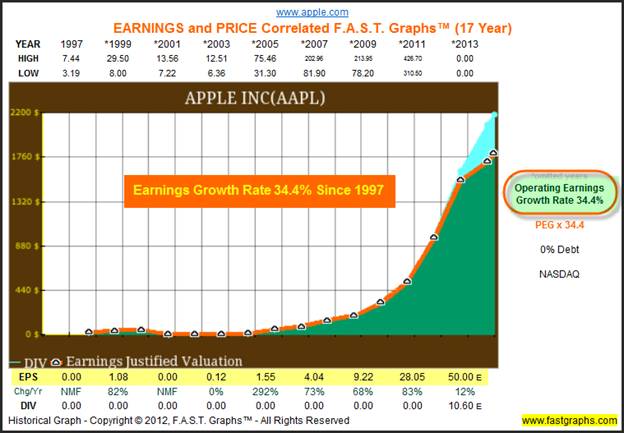

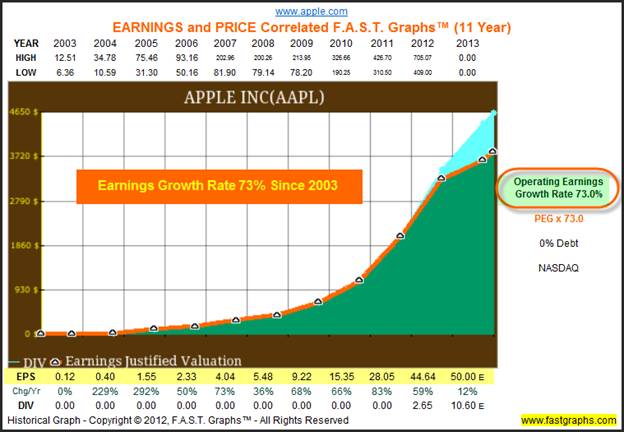

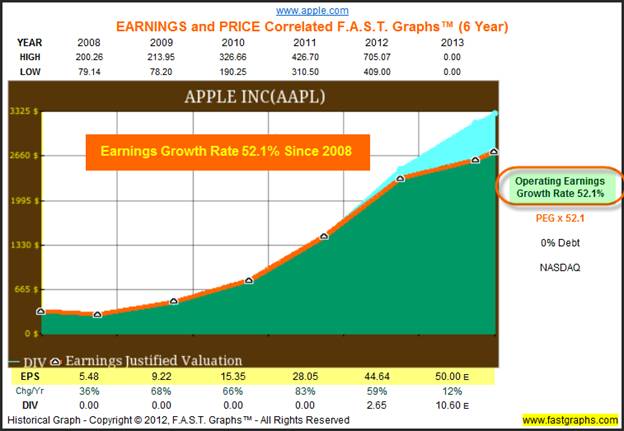

From the time that Steve Jobs returned to Apple in 1996, the company has clearly been the technology profit growth superstar. Since the beginning of 1997, Apple has grown earnings at a compounded annual rate of 34.4% per annum. Even more remarkably, since the beginning of calendar year 2003, Apple has grown earnings at a compounded growth rate of 73% per annum. And, even more remarkably yet, since the great recession of calendar year 2008 (which incidentally Apple’s earnings growth was 36% that year, in contrast to the average stock as measured by the S&P 500 whose earnings fell by 40%), Apple’s average annual earnings per share growth rate has been 52% per annum.

The following three earnings and dividends only F.A.S.T. Graphs™ on Apple Inc. illustrate this remarkable record of consistent and strong earnings growth. This is an amazing accomplishment that would seem to us to justify an expanded PE ratio, rather than a contracted PE ratio, as the market is currently applying. The company has no debt, and as we will see later, generates prodigious amounts of free cash flow.

Powerful Historical Earnings Growth

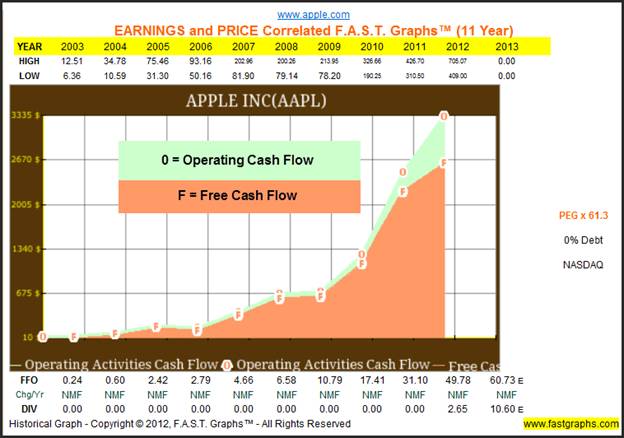

Prodigious Cash Flow and Free Cash Flow Generation

Now that we’ve established Apple Inc.’s amazing historical earnings achievements, let’s look at other fundamental metrics that relate to properly valuing a business. Our next graphic plot Apple’s operating cash flow and free cash flow generation since 2003. At the end of this fiscal year, Apple had over $117 billion of cash and investments with no debt.

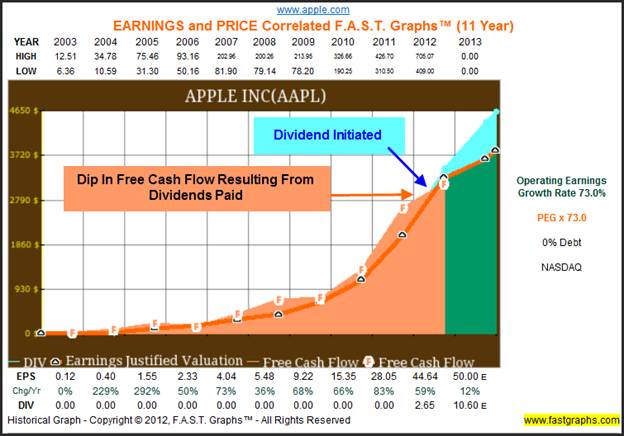

This next graphic tells an interesting story about Apple’s cash flows. The graph plots Apple based on operating earnings, with free cash flow overlaid. The discerning reader will notice that Apple’s free cash flow dropped or flattened in fiscal 2011. However, they will also notice that Apple initiated a dividend as depicted by the light blue shaded area on the graph. It is the dividend that caused the drop in free cash flow, because our definition of free cash flow is as follows:

This concept is Operating Activities - Net Cash Flow minus Cash Dividends minus Capital Expenditures. This is divided by Common Shares Outstanding - Company.

In other words, we calculate free cash flow after dividends and after capital expenditures. The point is that Apple generates prodigious amounts of free cash, which is indicative of a very strong and healthy business.

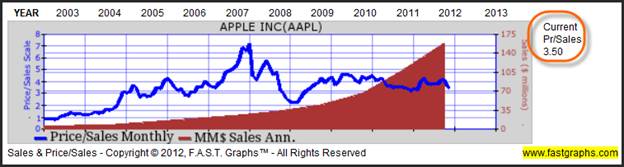

A Historically Low Price to Sales Ratio

When you look at Apple’s current price to sales ratio, you discover that it’s at the low range of its historical norms. This is in spite of the fact that Apple is setting record sales on its most recently launched product lines. On November 5, 2012, Apple announced that they had sold 3 million of their new iPad mini and Fourth Generation iPad in three days, doubling their previous first weekend sales milestone. Meanwhile, iPhone 5s sales have only been limited by not having enough supply to meet the demand. Nevertheless, there is no shortage of analysts and pundits wanting to dismiss Apple’s future growth, in spite of its recent successes. Somehow, new sales records are quote, unquote “disappointing the analysts and pundits.”

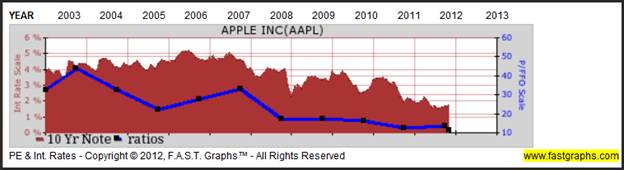

The PE Has Shrunk as Earnings Have Accelerated?

Based on everything that’s been written so far, the shrinking PE ratio on Apple shares since calendar year 2003 seems somehow bizarre. Record earnings, record cash flows, record sales and Mr. Market continues to devalue Apple’s business. The dark blue line on the following graph plots Apple’s fiscal year-end PE ratios (the black squares on the line) since fiscal year-end 2003 (the highest black square on the line). In fiscal year-end 2003 Apple’s PE ratio was 86.33, at fiscal year-end 2004 it fell to 49.05, then in fiscal year-end 2005 it fell to 35.59,fiscal year-end 2006 it fell to 33.04, fiscal year-end 2007 it increased slightly to 37.99, but in fiscal year-end 2008 (the great recession year) the PE fell to 20.74. Then in fiscal year-end 2009 the PE fell to 20.10, in fiscal year-end 2010 the PE fell to 18.49, in fiscal year-end 2011 the PE fell to 13.59, and in fiscal 2012 inched up slightly to 14.94. Today, Apple shares only command a PE ratio of 12.9.

Putting Apple’s Current Valuation Into Perspective

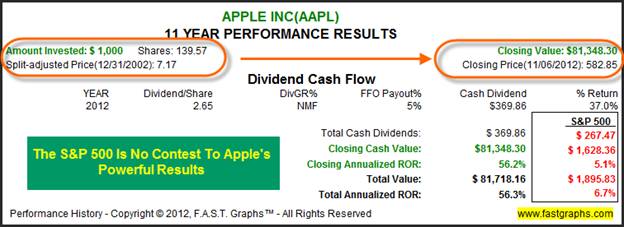

Even though Apple shares are trading at one of their lowest valuations in history, even in spite of their amazing record of earnings and cash flow growth, shareholder rewards have been exceptional. A $1000 investment in Apple shares on December 31, 2002 would be worth $81,348.30 today. That equates to a compounded annual total return of 56.2% per annum. Add in the new dividend of $369.86 paid in 2012, and the total annual return equals 56.3% per annum. Not too shabby for a stock that the market is currently undervaluing.

The final complete earnings and price correlated F.A.S.T. Graphs™ clearly illustrates how undervalued Apple shares really are. We don’t think you can find another example of such an extremely high-quality powerful business that is being more ridiculously undervalued than Apple currently is. Stock price is clearly illogically disconnected from the business fundamentals of this technology powerhouse.

Moreover, in order to conduct your own research and get a clearer perspective on Apple's valuation, click on the picture below that links you to a fully functioning sample F.A.S.T. Graphs™ on Apple Inc and research this high-quality dividend growth stock deeper and faster.

Run this "tool to think with" through its paces. Use the tan navigation bar to the left of the graphs and draw multiple graphs ranging from 2 to 21 years of history. Discover how this tool instantly provides a clear picture of the business behind the stock and dynamically re-evaluates valuation and reveals the clear correlation between the company's earnings and price.

Note: This link will be live for 90 days beginning November 8, 2012. For more advanced instructions on how to utilize the live graph follow this link.

Apple’s Valuation in Comparison to Similar Success Stories

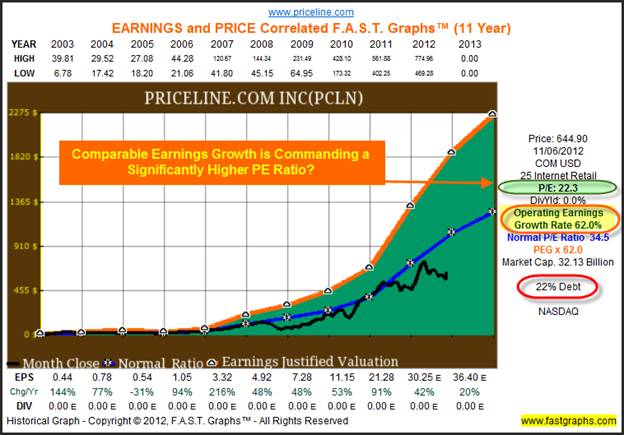

To illustrate just how bizarre we believe that Apple’s current market valuation really is, let’s compare it to a couple of other Wall Street favorites with similar fundamental stories, but entirely different valuations. Our first example looks at Priceline.Com Inc (PCLN). Here we see a company with very similar earnings growth as compared to Apple, but it is being awarded a PE ratio of 22 versus Apple’s 12.9. As an aside, a case could be made that the stock is also being undervalued by Mr. Market based on historical operating results, but not nearly as much as Apple is.

The real question, of which we can find no logical or justifiable answer to is: Why is a dollar’s worth of Priceline.Com’s earnings worth almost twice as much as are a dollar’s worth of Apple’s earnings? Both companies have strong growth, but Priceline has debt, although modest, and doesn’t pay a dividend. But perhaps more importantly, both companies are expected to grow between 20% to 25% per annum over the next five years. If one were to really weigh the differences, it would seem logical that the edge should go to Apple.

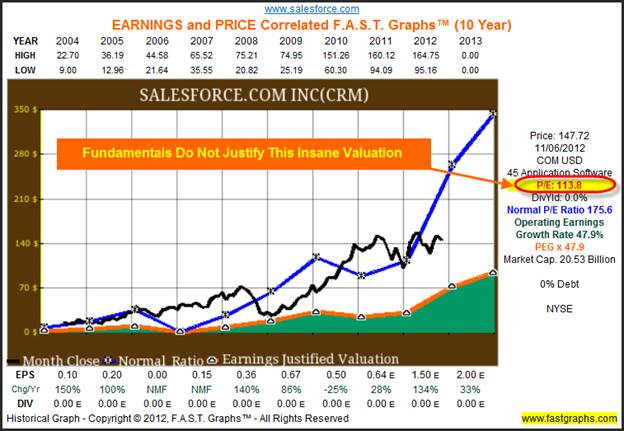

Our next example looks at Salesforce.Com Inc. (CRM) which like Priceline.Com Inc. and our featured company Apple Inc., has produced a powerful record of historical earnings growth averaging 47% per annum. However, it should also be pointed out that Salesforce.Com Inc. has a lower record of growth than either Priceline.Com Inc. or Apple, Inc. Yet inexplicably, the often crazy Mr. Market is valuing their shares at an unbelievably high PE ratio of 113.8.

We do not believe there is any logic, or even a reasonable rationale, that can justify the significant variances with how Mr. Market is valuing these three enterprises. How can you justify that a dollar’s worth of Salesforce.Com’s earnings could possibly be worth almost 12 times more than are Apple’s earnings? From our point of view, and even though we would also consider Salesforce.Com a strong business with a great record, we would further argue that it is nowhere near the quality enterprise that Apple is. If someone believes they can make sense out of this, then we would love to hear it, because it makes absolutely no sense to us at all.

Getting Real With The Apple Story

There’s no shortage of articles written on Apple Inc. expressing all sorts of opinions about their competitive situation. In fact, it may be one of the most written about companies on the entire planet. Furthermore, even the staunchest bears would probably accept that Apple will continue to grow its business into the foreseeable future. Because when you separate fact from fiction, it becomes crystal clear that Apple Inc. is a very strong and financially healthy business that is currently dominating its industry.

On the other hand, we feel it would also be naïve to believe that Apple can continue to grow in the intermediate future at the same rates as it has over the intermediate past. But most importantly, we are quite confident that Apple will continue to grow their business and its earnings, and yes, now its dividends, at rates exceeding 20% per annum over the next several years. Consequently, it is also our contention, that Apple’s growth potential deserves a much higher valuation than it is currently being awarded. In other words, we believe Apple is undervalued and represents a great long-term buy for both capital appreciation and a growing dividend income stream.

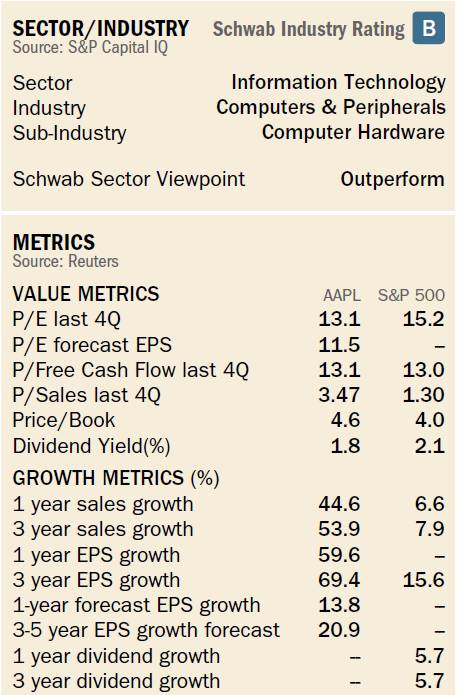

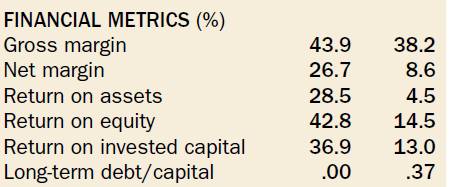

The following screenshots are taken courtesy of a research report from Charles Schwab & Co. Rather than go into a long dissertation, we will let the fundamental numbers speak for themselves. However, we will add that there are very few businesses in existence that possess the value, financial and growth metrics that Apple does. When you compare this company to the average company as the following slides depict, a compelling case that Apple is a superior business is undeniably made.

A Realistic and Achievable Look at Apple’s Future

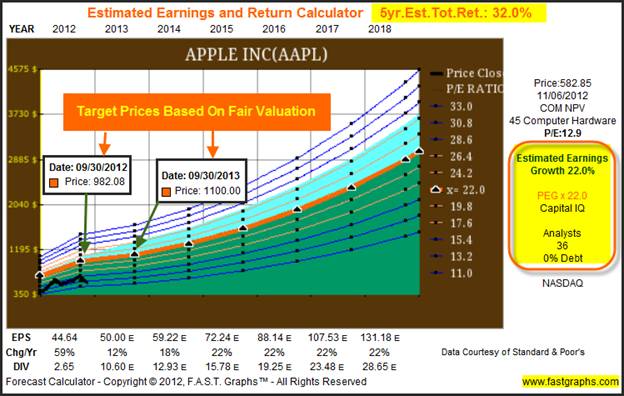

Although Apple has achieved incredible operational growth and success over the last decade or more, it’s only reasonable to expect that future growth should slow down some. On the other hand, we believe it’s also reasonable to expect that Apple is still positioned to generate significantly above-average future growth. The following graphics provide consensus estimated five-year future growth rates from two renowned earnings aggregators. The first is the estimated earnings and return calculator from F.A.S.T. Graphs™ that reports the consensus of 36 analysts reporting to Standard & Poor’s Corp.’s Capital IQ.

The consensus of these analysts expect Apple’s earnings to increase approximately 12% this year, followed by a 18% growth rate for fiscal year 2013 and then 22% per annum over the next 3 to 5 years. If Apple achieves these earnings growth rate targets we strongly argue that the company is cheap at today’s levels. By the way, and this is important, the price is not cheap based on the nominal dollar cost of over $580 a share, but it’s cheap relative to its current earnings yield of 8.6%, and especially so relative to its forecast future earnings yield of 22.5%. In other words, there are a lot of earnings associated with one share of Apple stock. Consequently, the PE ratio under 13 seems like a great buying opportunity to us.

Our next graphic from MSN Money shows the consensus of analysts reporting to Zacks, and is presented to offer a corroborating view. In this case, we have between 31 to 40 analysts who are forecasting this year and next year’s earnings per share in close approximation to what the analysts reporting to Capital IQ expect.

Furthermore, the five-year estimated earnings growth rate for Apple by these same analysts reporting to Zacks is 21.9%. This number is essentially the same as the 22% five-year growth rate forecast by the analysts reporting to Capital IQ. Even though we believe there is duplicity of forecasts here, our point is that there currently is a consensus for Apple to grow future earnings at over 20% per annum.

Summary and Conclusions

It is logical to assume that Apple cannot possibly grow in the future at the same rate that it has in the past. However, it is equally logical to assume that Apple is fully capable of growing their earnings and cash flows at rates of 20% to 25%, as many analysts currently forecast, for at least the next five years. There are numerous reasons for our optimism, but we will only highlight a few of the most compelling ones.

MorningStar reports that Gartner expects the Smartphone market to double from 2011 to 2014. They go on to say that despite the iPhone’s huge success so far, according to Gartner data, unit sales make up less than 25% of Smartphone shipments and less than 10% of total handsets. Consequently, MorningStar suggests that Apple has a huge opportunity to see continued strong iPhone growth.

Additionally, many researchers, including MorningStar, believe that China and other emerging markets will generate a larger proportion of future sales. The negative to this is that there may be a focus on budget iPhones which could affect average selling prices and margins. Additional margin pressure is expected due to the higher cost of producing many of Apple’s newest offerings. However, we believe that Apple has enough gross margin cushion to absorb any erosion, and still generate the above-average growth that we have described above as top-line growth should continue to be very strong.

Also, a surprising bright spot in Apple’s recent quarterly report was better-than-expected Mac sales, which were also significantly above other firms’ sales in the personal computer supply chain. We believe this is a sign that Apple has created a strong echo system for its iOS products. Therefore, many, including MorningStar, believe that Apple loyal customers will be reluctant to purchase a product that doesn’t sync with iCloud and the rest of the Apple iOS system. And finally, we continue to believe that Apple still possesses the culture and ability to offer innovative and easy to use product offerings in the future.

So in conclusion, Apple’s growth may slow a bit, and their margins may shrink a little, but the company has a lot of fat in these areas and therefore should continue to grow at above-average rates. And perhaps most importantly, Apple’s current valuation is indicative of a company with a lot less opportunity and a lot weaker fundamental profile. Although there are a lot of opinions pro and con about Apple’s future, we’ve attempted to provide evidence that the facts tell a powerful and compelling story. Therefore, we believe that long-term oriented investors seeking a combination of above-average growth at below-average risk with even a dividend kicker may regret not seizing on today’s opportunity to invest in Apple on sale.

Disclosure: Long AAPL, CSCO, HPQ, INTC, MSFT, ORCL at the time of writing.

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm.

Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2012 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.