Obama Election Wins Sends Gold And Silver 2 and 3 Percent Higher

Commodities / Gold and Silver 2013 Nov 07, 2012 - 08:50 AM GMTBy: GoldCore

Today’s AM fix was USD 1,730.50, EUR 1,345.86, and GBP 1,080.75 per ounce. Yesterday’s AM fix was USD 1,691.75, EUR 1,321.58, and GBP 1,058.80 per ounce.

Today’s AM fix was USD 1,730.50, EUR 1,345.86, and GBP 1,080.75 per ounce. Yesterday’s AM fix was USD 1,691.75, EUR 1,321.58, and GBP 1,058.80 per ounce.

Silver is trading at $32.01/oz, €25.18/oz and £20.12/oz. Platinum is trading at $1,559.50/oz, palladium at $614.00/oz and rhodium at $1,120/oz.

Gold soared $32.10 or 1.91% in New York yesterday and closed at $1,716.20. Silver surged to a high of $32.25 and finished with a gain of 2.76%.

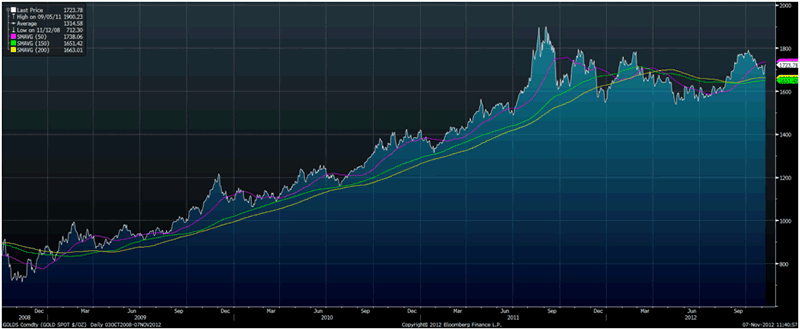

Gold in USD – Gold’s Performance in the First 4 Years of Obama’s Presidency

Gold fell slightly in Asia prior to eking out further gains and rising above $1,730/oz in early European trading after President Obama was confirmed as the next President of the U.S.A.

Obama’s election means that quantitative easing, ultra loose monetary policies and currency debasement are set to continue in the world’s number one economy which is bullish for gold – and indeed silver.

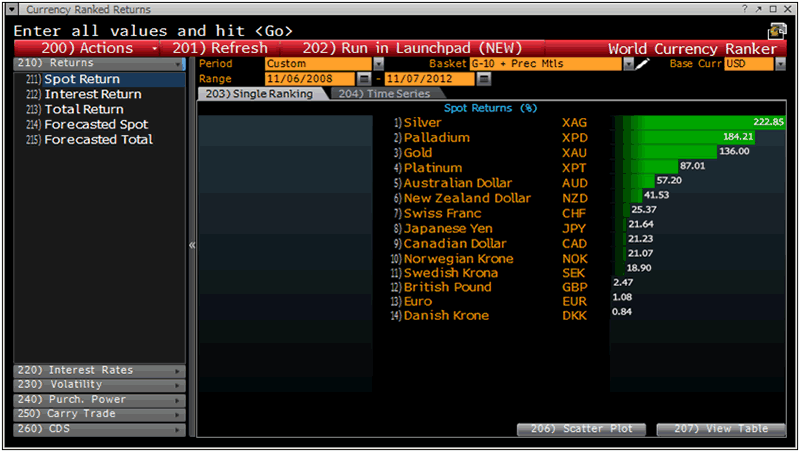

Precious Metals Performance in USD in the First 4 Years of Obama’s Presidency

The scale of the economic, fiscal and monetary challenges in the U.S. are so great that whether Obama or Romney was elected, gold and silver were set to continue in their bull markets.

However, some market participants believe that Romney would have been more conservative - fiscally and monetarily.

Romney may have talked a good game rhetorically but there may not have been a whole lot of difference in the fiscal and monetary approaches of both men and any differences would likely be a matter of degree.

U.S. and global economic data suggests that we are on the brink of a severe global recession and or Depression and there is a real sense of rearranging the chairs on the Titanic about the U.S. election.

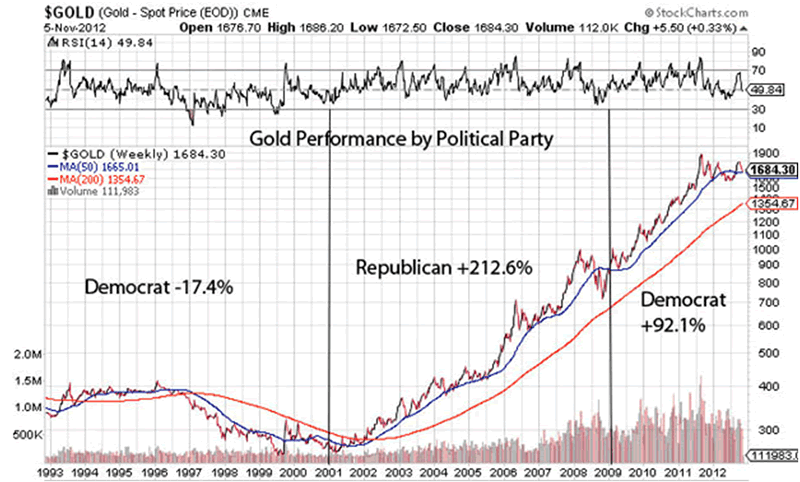

Chart via SmartKnowledgeU via Gold Seek (see Commentary)

US Consumer Credit numbers for September are released at 2000 GMT and expected at $10.6 billion.

Eurozone contagion risk remains real as seen in both Spain and Greece. The general strike continues in Greece as MP’s debate and are set to vote this evening on the 13.5 billion euro austerity plan.

November ushers in the festival season in India with Diwali and during this time many weddings are planned. Physical buying in Asia is expected to pick up due to the consumer demand in India and as China again begins to stock up for Christmas and the Chinese New Year.

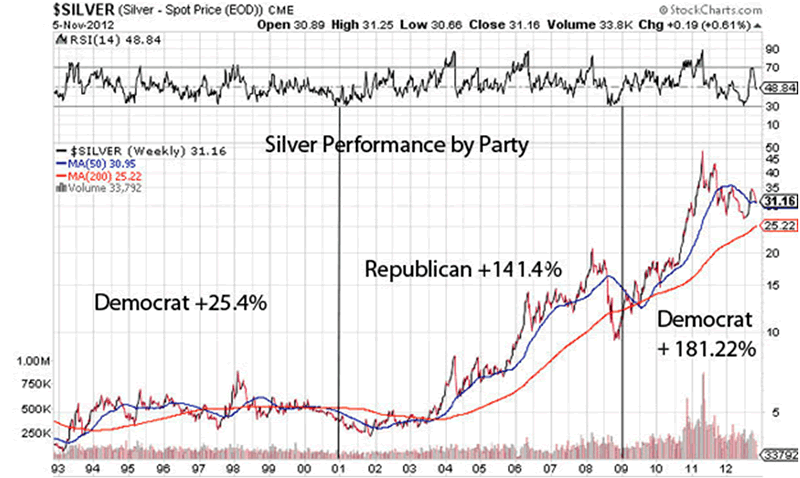

Chart via SmartKnowledgeU via Gold Seek (see Commentary)

Investors should prepare for rising prices and more expansionary monetary policy now that President Barack Obama has won re-election, investor Jim Rogers told CNBC on news of the election.

The co-founder with George Soros of the Quantum Fund said he expected Obama’s policies to drive up commodities and drive down the U.S. dollar.

As the Federal Reserve moves to ‘stimulate’ a stalled economy through debt purchases, Rogers says markets should expect the status quo to remain the same.

“If Obama wins, it’s going to be more inflation, more money printing, more debt, more spending.” Rogers told CNBC, saying he expected to sell U.S. government debt and buy precious metals, such as silver and gold.

“It’s not going to be good for you me or anybody else.”

“It looks to me like the money printing is going to run amok now, and spending is going to run amok now,” Rogers stated. “I have to invest based on what’s happening and not what I would like.”

Rogers said that he didn’t vote for either Romney or Obama, saying that “they’re both evil as far as I’m concerned.”

With the re-election of Obama absolutely nothing has changed and we are likely to see precious metals perform as they did in Obama’s first term – gold rose 136% and silver 223% (see chart and table). Much of those gains were seen in the first 2 months, November and December 2008, after Obama was elected and prior to him taking office and we may see that again given the strong seasonal factors and very strong fundamentals today.

With regard to the economy, Obama is strong on hope which he has yet to deliver.

As ever we believe it is best to hope for the best but be prepared for less benign scenarios.

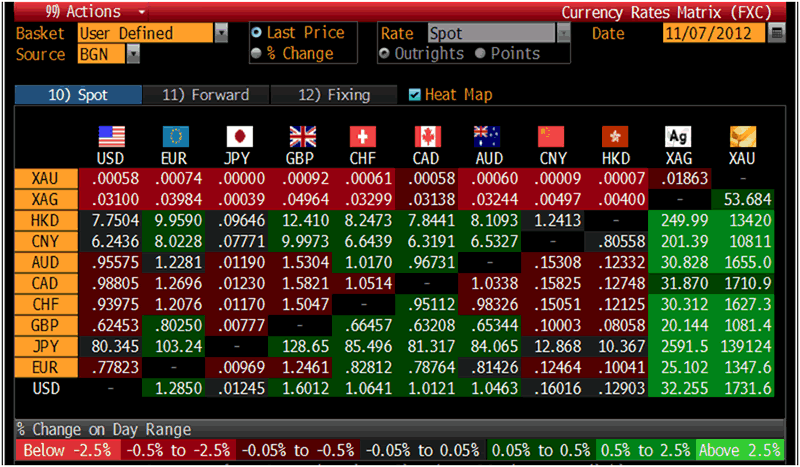

Cross Currency Table – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.