UK Royal Mint Plans To Offer Gold Bullion Storage Service

Commodities / Gold and Silver 2012 Nov 06, 2012 - 06:50 AM GMTBy: GoldCore

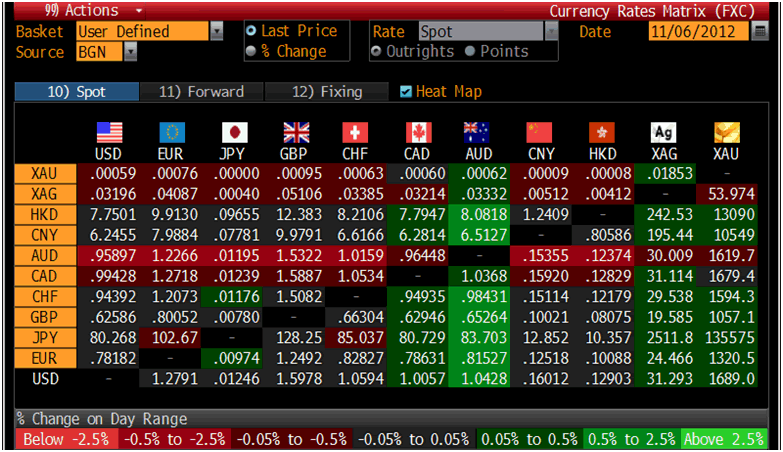

Today’s AM fix was USD 1,691.75, EUR 1,321.58, and GBP 1,058.80 per ounce.

Today’s AM fix was USD 1,691.75, EUR 1,321.58, and GBP 1,058.80 per ounce.

Yesterday’s AM fix was USD 1,679.00, EUR 1,313.05, and GBP 1,050.82 per ounce.

Silver is trading at $31.39/oz, €24.60/oz and £19.71/oz. Platinum is trading at $1,549.75/oz, palladium at $611.80/oz and rhodium at $1,070/oz.

Gold climbed $6.10 or 0.36% in New York yesterday and closed at $1,684.10. Silver hit a low of $30.64 in Asia, but it ran up to $31.24 in New York and finished with a gain of 0.78%.

Gold is relatively unchanged on Tuesday as investors await the US presidential election results, and remain cautious with news of Greece’s 2 day general strike against the new austerity package plus the upcoming Chinese leadership transition.

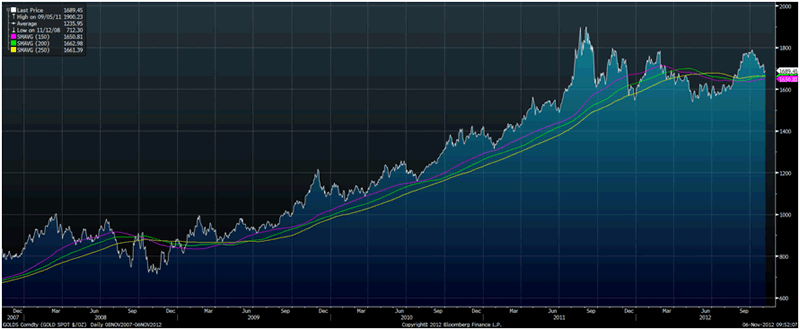

Gold $/oz Daily 2007-2012 – (Bloomberg)

A Romney victory would weigh on gold bullion with a potential for a tighter stance on monetary policy.

The Chinese 18th Communist Party Congress is set to open on Thursday.

The French government received a written warning from the International Monetary Fund to reform its economy or it may follow other crisis hit EU nations. The IMF’s economic growth figures for France were 0.4% which is half of what Paris is predicting for next year.

The Royal Mint of Britain is going to offer a vaulting service to high net worth clients.

“We will offer a vaulting service to our larger customers,” Shane Bissett, director of bullion and commemorative coin at the Royal Mint, said in a telephone interview today. “At some stage in the future we may look at offering that to individuals.”

Britain’s Royal Mint’s announcement is on the heels of Barclays Plc expansion into opening a precious metals vault for its customers in September and Deutsche Bank will follow suit in March.

In 1968, The Royal Mint of Britain relocated from London’s Tower Hill to Llantrisant, Wales. Here it makes and distributes The British Gold Britannia coins. Britannia coin sales doubled in Q1, and grew “slightly less” in the subsequent months, Bissett said. The mint plans to change gold Britannia coins from 92% pure gold to 99.99%, which will allow it to be more competitive in the international markets, including the Far East and Australasia, he said.

Silver $/oz, 2008-2012 – (Bloomberg)

Gold has seen 11 continuous years of annual gains as QE from the US Fed, Europe, China, and Japan have all committed to programmes to help their fledging economies. The World Gold Council estimates that central banks bought 254.2 tons of gold bullion in the first six months of 2012.

Metal held in bullion-backed exchange traded funds have soared to a record 2,589.516 metric tons on Nov. 2, notes Bloomberg.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.