Turkey Paying Iran for Oil With Gold Bullion

Commodities / Gold and Silver 2012 Nov 05, 2012 - 09:49 AM GMTBy: GoldCore

Today’s AM fix was USD 1,679.00, EUR 1,313.05, and GBP 1,050.82 per ounce.

Today’s AM fix was USD 1,679.00, EUR 1,313.05, and GBP 1,050.82 per ounce.

Friday’s AM fix was USD 1,708.25, EUR 1,325.77, and GBP 1,061.29 per ounce.

Silver is trading at $31.05/oz, €24.39/oz and £19.51/oz. Platinum is trading at $1,550.32/oz, palladium at $597.38/oz and rhodium at $1,070/oz.

Gold dropped $35.70 or 2.08% in New York on Friday and closed at $1,678.00. Silver hit a low of $30.789 and finished with a loss of 4.01%. Gold and silver were down nearly 2% and 3% on the week.

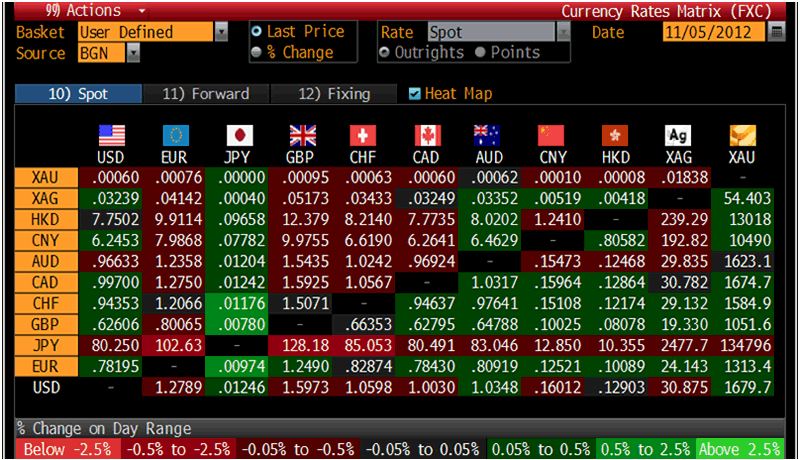

Cross Currency Table – (Bloomberg)

Gold edged up a bit on Monday, limiting the fall after the better than expected US jobs number sent the yellow metal downward to a two month low.

If the US Fed doesn’t need to embark on more stimulus measures this may limit the yellow metal’s appeal with investors who see continuous money printing by central banks as increasing inflation and debasing currencies.

The US dollar limited gold’s rebound as it hit its highest in 2 months as investors parked money there before the US election.

This week there is an ECB policy meeting on November 8th and also a key gathering of the Chinese Communist Party.

US Economic highlights include ISM Services at 1500 GMT today. Wednesday’s data is Consumer Credit, Thursday Initial Jobless Claims and the Trade Balance and Friday Export & Import Prices, Michigan Sentiment, and Wholesale Inventories are published.

Turkey’s trade deficit has been shrinking and the country has enjoyed the best bond rally in the emerging markets this year due in part to the contributions of airline passengers transporting gold in their baggage.

Statistics from Istanbul’s 2 main airports show $1.4 billion of precious metals were registered for export in September.

XAU/USD Currency, 1 Year – (Bloomberg)

Iran is Turkey’s largest oil supplier and Turkey has been paying for the oil not only with liras but also with gold bullion. Turkey exported $11.7 billion of gold and precious metals since March, when Iran was barred from the Society for Worldwide Interbank Financial Telecommunication, (Swift) making it nearly impossible for Iran to complete large international fund transfers. Of the $11.7 billion, $10.2 billion or 90% was to Iran and the United Arab Emirates, according to data on Turkey’s state statistics agency’s website.

Turkey’s current account deficit is second in the world at $77.1 billion or 10% of GDP while the US currently holds the top spot.

The problem with Turkey switching from a net importer to a net exporter of gold bullion this year is that the foreign trade data is misrepresented. Turkey’s use of precious metals is a key factor to help turn around its nation’s current junk bond rating status.

We mentioned before the government’s efforts to move the $302 billion in privately held gold, into government banks to increase the money supply in the economy.

“October data will be very critical” as the US urged Turkey not to export gold to Iran or the UAE, “which means indirectly to Iran,” Ozgur Altug, chief economist at BGC Partners in Istanbul, said in an e-mailed report yesterday.

The increase in precious metal exports accounted for three quarters of the 14% one year gain in total exports in the first nine months, Gulay Girgin, chief economist at Oyak Securities in Istanbul, said in an e-mailed report yesterday.

“If you look at Turkey’s trade figures without gold, it doesn’t look that great,” Gizem Oztok Altinsac, an economist at Garanti Yatirim, the investment unit for Turkey’s biggest bank, said by phone yesterday. “I think the analysts are paying a lot of attention to this, but at the end of the day, the bottom line is the current-account deficit, and that’s getting better.”

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.