The Conundrum of Malaysia's proposed Minimum Wage

Economics / Economic Theory Nov 01, 2012 - 03:45 AM GMTBy: Sam_Chee_Kong

Due to the scarcity of resources such as labor it is common for the government at times intervenes into the markets with the objective to prevent prices from rising and dropping too much from the equilibrium price. The Government can influence the market supply and demand through setting the price floors and price ceilings in the market.

Due to the scarcity of resources such as labor it is common for the government at times intervenes into the markets with the objective to prevent prices from rising and dropping too much from the equilibrium price. The Government can influence the market supply and demand through setting the price floors and price ceilings in the market.

An example of price ceiling will be the rent controls on housing. By imposition of the rent control, the government hope to provide affordable housing for the lower income group. Similarly the imposition of minimum wage is another form of setting the price floor. This will help prevent wages from going below a certain level set by the government. The Government hope that such a move will help alleviate the income and also ease the burden of the lower income group.

The Malaysian Government’s recent proposal to raise the minimum wage to RM900 per month starting on Jan 1st 2013 was received with mixed blessing. For many years Malaysia had difficulty in raising its wage level because of the influx of foreign labour into the country. Unskilled foreign labour had been a source of cheap labor and it is a boon to its labour intensive industries and hence hamper any attempt by the authorities to uplift the wage level.

This is why Malaysia’s unequal income distribution between the rich and poor remains high and its Gini coefficient remains above 0.4 for the past 17 years. The higher the reading of the Gini numbers the more unequal the income distribution. The following is the Gini coefficient for Malaysia.

Since the country’s poverty level is hovering at RM760, by raising the minimum wage above this level the authorities hope to reduce the poverty level in the country or in other words redistribute its income. This is important as this will help keep Malaysia on course in achieving its developed nation status by the year 2020 because poverty eradication is one of the criteria in the evaluation process. But economic policies tends to have causes and effects or put it simply, in any policies implemented there will be both intended and unintended consequences.

So the question is whether such a move is of good intent ot just a political move to garner votes since the General Election is around the corner.

Another problem feared by the authorities is whether such a move is ill timed since the Global Economic scene does not look encouraging with the impending ‘fiscal cliff’ facing the U.S economy by the end of December 2012 and also the contraction of the Chinese economy for the past few months. The fiscal cliff refers the the problems the U.S government going to face comes 1st Jan 2013. By that time some of the policies that are designed to boost the economy such as payroll tax cut, tax break for businesses, end of tax cuts from 2001-2003 and etc will have to come to an end. In order to balance the situation the Government will have to increase taxes on certain items and also cut its spending. The plus side will be a reduction in the deficits while the negative will be the slow down in growth which might cause a double dip in the economy.

Before we proceed to analysing whether the minimum wage set by the government is justifiable and implemented at the right time, it is best to take a look at both the Global and our Domestic Macroeconomic Development space. To seek the answer we shall employ the following forward and backward looking economic indicators.

Forward and Backward looking Indicators

To help us gauge the health and performance of the Global economy for the next 1-2 years, we will employ one backward looking economic indicator (PMI – Purchasing Manager Index) and another forward looking economic indicator (BDI – Baltic Dry Index) to help us formulate our view on the global economic performance space.

The BDI index is one of the leading indicators for measuring the Global economic activity. BDI is one of the more accurate ‘Forward Looking’ economic indicators, meaning it acts as a precursor of economic activity that are yet to begin. Whereas consumer spending and other economic indicators are ‘Backward Looking’ such as the PMI, meaning they are the result of what had already happened. By analyzing the BDI, you are able to gauge the level of economic activity that is going on around the world through the global demand for raw materials and infrastructures.

Baltic Dry Index (BDI)

Below is the Chart of the Baltic Dry Index for the past 10 years. As you can see the index peak during the early part of 2008 it hit an all time high of about 11,400 points just before the Global Financial Crisis struck. After that it went off the cliff and dropped more than 10,000 points to less than 1000 by December 2008. This represents a drop of more than 90% from its peak. After that it only managed to recover to about 4643 points which is only 35% from its peak.

The three year Baltic Dry Index (BDI) as shown below seems to be loosing ground again. Since the 2008 crisis the highest point recorded is at 4643 on 18 Nov 2009 and the lowest point recorded was in Feb 3rd 2012 at 648 points. That represents a drop of 3995 points or roughly 85% retracement. It managed to rebound in February to a high of 1157 and it is now again closed below the 1000 psychological level again at 798 as of 03/10/12.

However the bad news is that it remained below the MA50 line (blue) which is an indicator of consumer sentiment. With the current economic contraction that persists in most part of the world, more importantly the economies of BRIC nations, we do not expect the BDI index to rebound to above the 1000 points level at anytime soon. In fact we fear that the worse is yet to be seen and probably it will test the new low of 648 which was set in February this year.

Global PMI readings

PMI or Purchasing Manager Index is an indicator that is developed by the Markit Group and the Institute for Supply Management to measure the activity of purchasing manager’s buying of good and services. PMI is a lagged indicator because its measurement is a result of what already happened. We present below the August Global PMI for selected countries. Those coloured in red are countries with their PMI readings less than 50. A reading of less than 50 means there is a contraction in the economy. Hence from the table below, it shows that the Global economy is still weak as most countries registered below 50 readings.

Source : Markit

As evident from the above the main concern that we worried about is the PMI contraction in China, Russia and India. These are some of the biggest economies in the world and they are expected to help pull the world economy out of the current contraction as they did back in 2008. China with its second month of contraction worries everybody because it might manifest into a hard landing which nobody wants.

With both BDI and PMI indicating not very encouraging results in the near future, we can conclude that the Global economy has yet to find its footing and more contraction in global economic activity will be in place in the next 6-12 months. Further to this given the projected negative global economic development we also present below some of the negative effects as a result of the implementation of a minimum wage policy.

Negative effects of Minimum Wage

Increased in Unemployment

Before we proceed to answering the question on what will be the optimal demand for labor based on a certain wage rate. We need to understand the dynamics of wages and the allocation of labour. The wage rate is dependent on the demand of labour by the industries. If the demand of labour is increased due to the additional capacity then naturally it will push the wage rate upwards and hence employers will have no objection to it. However, if it were to forced upon the employers by the authorities to increase their wage rate through the implementation of minimum wage then it will be a different ball game.

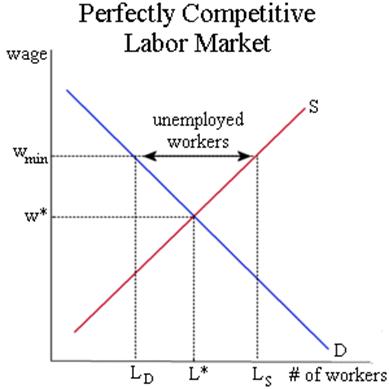

One result due to the artificially increase in wage is the supply of labor will be increase due to the fact that more people are willing to offer their labor. Hence the supply of labor will move upward along the supply curve to Ls. However at the same time employers will be reducing their demand for unskilled labor because of the increased cost and hence will move leftward of the demand curve to Ld.

Since the increase in wage rate is not brought about by the need to employ more workers then employers will have to recalibrate his cost of production. Everything being equal, an increase in the wage rate through the minimum wage represents an increase in cost which will not be tolerated by the employers. In order to maintain the cost of production employers will have to cut the amount of workers and hence a new equilibrium will need to be defined.

As can be shown by the Chart below, the original equilibrium is at the intersection between the Supply and Demand curves where the wage rate is W* and the number of workers is at L*. Due to the authorities imposition of the minimum rate to Wmin a new equilibrium is established. The new demand will be Ld and the supply of labour is at Ls. This difference between Ls and Ld represents the unemployment due to the cost cutting by employers or Ls – Ld.

Legend

W* - Equilibrium wage

L* - Equilibrium Labor

Wmin - Minimum wage

Ls - Minimum wage Labor Supply

Ld - Minimum wage Labor demand

Ls-Ld - Labor surplus due to Minimum wage

Benefits the foreign workers

Due to the influx of large foreign workers in Malaysia either through the legal or illegal channels with most of them are unskilled and mainly employed in labor intensive industries such as manufacturing, plantation, agriculture and etc. Needless to say their wages are at the lower end of the spectrum and tend to be less than RM900. According to the Chinese Chamber of Commerce 43% of the workforce in the manufacturing sector and 70% in the plantation sector are foreign workers. We present Malaysia’s labour market and its composition in different industries.

Source : Department of Statistics Malaysia 2010

As can be seen from the above the top 5 sector in the economy employs 6,990,300 workers which accounts for 62.8% (6,990,300/11,129,400) of the work force. Most of the workers from these sectors are unskilled and will benefit from the minimum wage. It is estimated that the bulk (about 55%) of the unskilled workers in the country are foreign workers who hailed from Indonesia, Bangladesh, Nepal, Vietnam, India and etc.

Reduced benefits for workers

If reduced head count is out of the question then employers will have to pass on the higher wage cost forward to consumer in the form of higher prices or backward to the workers or suppliers in the form of reduced prices of raw materials or parts. Higher prices mean higher inflation which is bad for the economy. As for the workers their overtime will have to be reduced, working hours will be cut if they are hourly paid, job training will also have to be reduced, more selective hiring – better skilled workers to less skilled workers. If the increased in wages takes its toll on the bottom line then employers will have to take cost reduction measures such as reduce production cost, automating production lines and etc.

Uncompetitive labor cost

If the minimum wage is implemented then Malaysia’s labor cost in general will go up and it has to be prepared to lose some Foreign Direct Investments to some of its lower cost neighbors. Not only foreign owned but also local manufacturers will be shifting some of their operations to some neighboring countries that offer more competitive wages.

Even now rubber glove manufactures like Safeskin and Top Glove are moving some of their operation to Southern Thailand not only due to their cheap labor but also raw materials like latex. Similarly palm oil plantation companies like TSH and KL Kepong are also establishing their presence in Indonesia due to their cheap labor and fertile land which requires less fertilizer.

Another avenue employers will take in order to reduce labor cost is to hire more foreign workers whether they are legal or illegal.

Conclusion

In conclusion, no doubt some might argue that minimum wage help to increase the income for those that are already in employment and hence a fairer income distribution. Employers are also better off because higher wages attract better skilled workers. But at the end of the day the cost and benefit generated from such a policy depends on the timing of implementation.

If both the global and domestic macroeconomic outlook is promising then such a move will be beneficial to everybody but from our analysis above the risk of a Global slowdown in the coming months remains high and moreover Malaysia external sector will be deteriorating in the coming months due to the softening of the commodity market.

Palm oil prices for October 2012 is at RM 2089 down from RM 3820 last year and similarly rubber prices remain low at less than RM 5.63 down from RM 11 a kg in April last year. Since palm oil is the second largest component in the export sector we fear Malaysia’s balance of trade will be in jeopardy. The Government should be prepared for another round of expansionary monetary and fiscal policy to boost the economy.

by Sam Chee Kong

cheekongsam@yahoo.com

© 2012 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.