If Obama Wins Gold Is Going To Go Through The Roof

Commodities / Gold and Silver 2012 Oct 31, 2012 - 07:35 AM GMTBy: GoldCore

Today’s AM fix was USD 1,718.00, EUR 1,321.54, and GBP 1,065.89 per ounce. Yesterday’s AM fix was USD 1,713.50, EUR 1,322.66, and GBP 1,067.07 per ounce.

Today’s AM fix was USD 1,718.00, EUR 1,321.54, and GBP 1,065.89 per ounce. Yesterday’s AM fix was USD 1,713.50, EUR 1,322.66, and GBP 1,067.07 per ounce.

Silver is trading at $32.78/oz, €24.93/oz and £20.12/oz. Platinum is trading at $1,578.75/oz, palladium at $604.75/oz and rhodium at $1,070/oz.

Gold edged up $0.50 or 0.06% yesterday and closed at $1,709.50. Silver hit a high of $32.118 and pulled back but still finished with a gain of 0.05%.

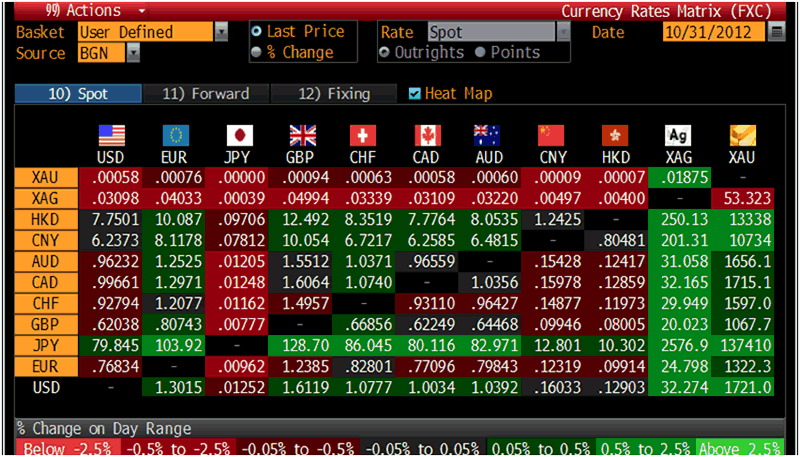

Cross Currency Table – (Bloomberg)

Gold inched up on Wednesday but traders remain cautious ahead of the nonfarm payrolls report and the imminent US presidential election.

The devastation of Hurricane Sandy will be a further blow to the already fragile U.S. economy. The destruction of property and vital infrastructure - two of the vital components in the wealth of a nation is negative for the economy. The last thing the over indebted families and close to default U.S. government needs are more very expensive reconstruction works. Reconstruction and 'stimulus' has to be paid for either by the tax payer in the form of taxes or a further increase in the money supply and inflation.

Event risk is high with the aforementioned issues including a change of power in China and multiple policy meetings at various central banks.

Today, the September eurozone unemployment figures released were 11.6% up from 11.5% in August.

The US fiscal cliff involving steep government spending cuts and tax hikes looms in January and is likely to support gold at these levels and lead to higher gold prices in the coming weeks.

Violence in South Africa’s mining industry continues. The police fired tear gas and rubber bullets on strikers and protesters at top platinum producer Amplats today.

The Financial Times had an interesting article that suggested that Mitt Romney is a "threat to the gold price" (see news) and quoted an executive in a jewellery group who said that “if Obama gets re-elected gold is going to go through the roof.”

The truth is that, gold is likely to go much higher in the course of the 45th President's 4 year term - whether there is a President Obama or a President Romney.

The article suggested that gold investors would vote for Mitt Romney due to concerns about "potential" currency debasement and the US government’s indebtedness and that the Republican Party’s rhetoric of deficit reduction appeals to them:

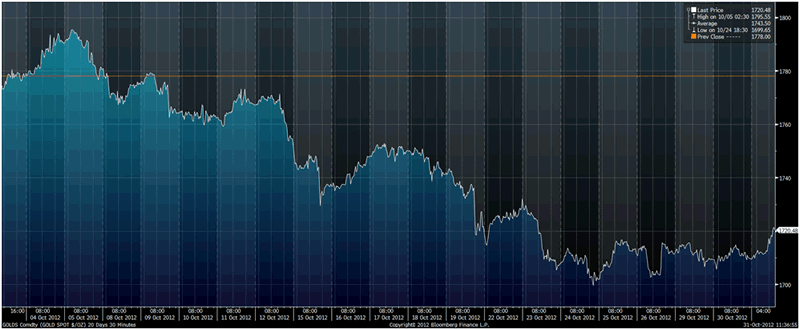

Gold Spot $/oz, 20 Days – 30 Minutes – (Bloomberg)

“It is therefore ironic that the single greatest risk to gold at the moment is probably a Romney victory in next Tuesday’s presidential elections.

“A win by Romney is generally seen by investors as a downside risk for gold,” says Joni Teves of UBS. “Nobody wants to do anything until the elections are out of the way.”

A surprise win by Romney could lead to very short term gold weakness but the scale of the fiscal and monetary challenges facing the White House and Federal Reserve mean that the down side risk is short term and limited and investors should continue to fade the noise and focus on the long term diversification benefits of gold.

The FT continues

“History supports the case. As James Steel of HSBC notes, gold’s most dramatic rallies – in 1980 and 2011 – have occurred with Democrats in the White House (Jimmy Carter and Barack Obama). And if Mr Romney can succeed in bringing down the deficit, that could lead to a stronger dollar and therefore weaker gold.”

History supports the case somewhat. It is important to point out that gold rose for the 8 years of George Bush’s Republican Presidency. Many gold buyers would be concerned that Republican rhetoric regarding deficits is just that - rhetoric.

“But the real “Romney risk” for the yellow metal has nothing to do with fiscal policy. Instead, traders and investors are focusing on the likelihood that if Mr Romney wins the November 6 election, he would replace Ben Bernanke with a more hawkish chairman of the Federal Reserve when the latter’s term expires in January 2014.

If that means a change in direction from the Fed’s current experimental and super-accommodative monetary policy, gold could suffer. Recall the sharp sell-offs earlier this year when expectations of quantitative easing were deferred.”

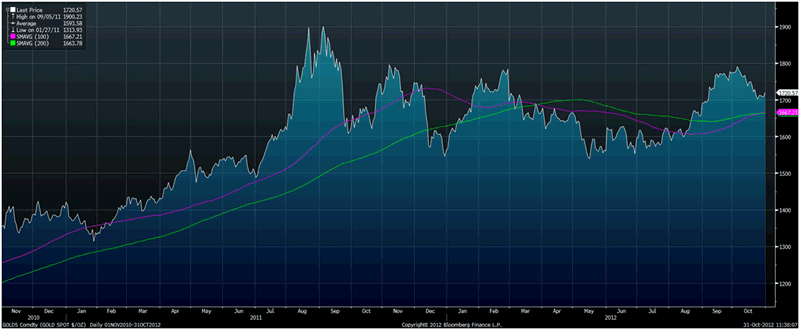

Gold Spot $/oz, 01 November 2010-31 October 2012 – (Bloomberg)

Gold will not suffer when there is a change and a move away from ultra, ultra loose monetary policies. As was seen in 1980, gold’s secular bull market is likely to end if the Federal Reserve again achieves positive real interest rates.

As was seen in 1980, gold will only fall towards the end of the interest rate tightening cycle - this could take many years.

“Likewise, an Obama victory may be the green flag gold bulls have been waiting for.”

The 45th U.S. President is less relevant to the gold price than the wider global monetary, macroeconomic, systemic and geopolitical fundamentals - all of which remain extremely positive for gold.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.