Gold Being Remonetised As Banks In Turkey Target Gold Worth $302 Billion

Commodities / Gold and Silver 2012 Oct 30, 2012 - 05:53 AM GMTBy: GoldCore

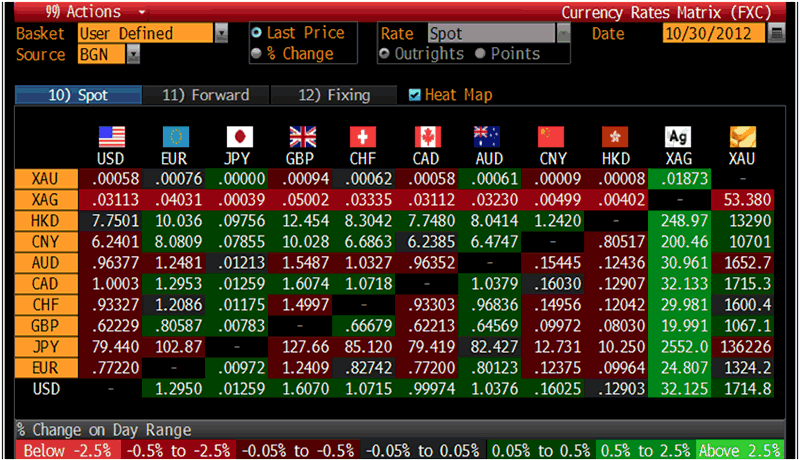

Today’s AM fix was USD 1,713.50, EUR 1,322.66, and GBP 1,067.07 per ounce.

Today’s AM fix was USD 1,713.50, EUR 1,322.66, and GBP 1,067.07 per ounce.

Yesterday’s AM fix was USD 1,712.00, EUR 1,326.72, and GBP 1,066.00 per ounce.

Silver is trading at $32.01/oz, €24.80/oz and £19.99/oz. Platinum is trading at $1,551.50/oz, palladium at $593.25/oz and rhodium at $1,075/oz.

U.S. stock and bond markets were closed Monday due to Hurricane Sandy. Futures markets remained open. Stock and bond Markets will be closed today as well. The worst storms to have ever hit the East coast of the U.S. are estimated to have cost some $200 billion in damages and for the first time in more than a century, weather has stopped U.S. equity trading for two straight days.

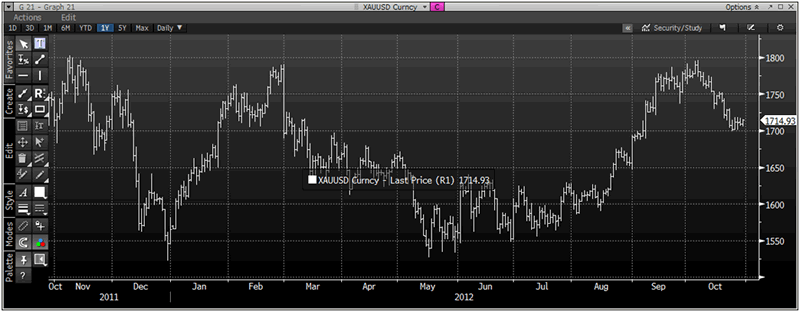

Despite the huge uncertainty caused by the storm, gold fell $3.00 or 0.18% yesterday and closed at $1,709.00. Silver slipped to as low as $31.65 and rebounded higher at times, but finished with a loss of 0.97%.

Cross Currency Table – (Bloomberg)

Gold is moving higher on Tuesday as the dollar has weakened possibly on concerns that Sandy may derail an already fragile economic recovery.

October is on track for its largest monthly loss (-3.3%) since May, after many more speculative players were forced to cash in their gold positions to cover losses in other markets hurt by the global economic insecurity. The S&P is down 2% and the Nasdaq has fallen by 4.8%.

The highlight of this week’s economic data is Friday’s US non-farm payrolls report which will give market watchers a glimpse as to how the labour market is doing.

Hurricane Sandy is affecting the bullion market by lowering trading volumes.

The peak in Indian gold consumption will begin in November with Diwali, the Hindu Festival of

Lights. This is also a large wedding season where gold jewellery is a key component in the dowry that the bride receives from her parents.

The US election campaign has taken a back seat to Hurricane Sandy and with just a week to polling day, a move to Romney might impact markets. A Barclay’s poll highlighting that “an Obama win is good for bonds and a Romney win is good for stocks”. Romney is not a fan of the Fed’s QE program and favours more of a tight money stance.

This uncertainty may be contributing to lack lustre range bound trading in the precious metals and most other markets.

Some Turkish banks are now offering customers the ability to use their gold based deposits for collateral on gold backed loans according others are allowing access to Turkish Lira or for access to credit cards.

Isbank and Turkiye Garanti Bankasi AS, the country’s biggest lender by market value, offer gold-backed loans, where customers can bring jewellery or coins to the bank and take out loans against their value. Garanti also has a credit card linked to gold deposit accounts.

Government efforts to help ease the nation’s current account deficit are encouraging householders to bring their gold coins which it is estimated that there are $302 billion of hidden gold stashed in homes.

This hidden gold is second only to the US, and Turkish gold based deposit accounts have grew 15% this year calculated until the end of July, which is a 3 fold increase in standard savings accounts according to the Turkish Central Bank.

The gold accounts give customers an amount in Turkish lira equivalent to the weight of the precious metal they deposit in the bank. Bank customers can then withdraw cash or take out loans, while the bank is able to sell or hold onto the gold.

Yapi Kredi Bankasi AS (YKBNK), owned by UniCredit SpA (UCG) and Koc Holding AS (KCHOL), deposits in gold-based mutual funds, which invest at least 51% of their moneyin precious metals and offer a guaranteed return on capital, increased 62% in 2012.

Turkiye Is Bankasi AS (ISCTR), Turkey’s largest bank by assets, said gold deposits increased 10 times in the two years through June.

The campaign by Turkey’s banks, featuring ads for “golden age” accounts and products such as gold gift checks, is targeted at Turks who traditionally give gold coins or jewellery as presents at weddings, births and circumcision ceremonies. The custom gained popularity a decade ago as Turkey’s inflation rate topped 70%, making gold an attractive store of wealth.

The World Gold Council estimates that by bringing 5,000 metric tons (5,512 tons) of treasure into the banking system -- an amount greater in value than Ireland’s GDP, Turkey aims to reduce gold imports and external borrowing, according to Erdal Aral, deputy chief executive officer of Isbank.

“We have to get the gold that’s out there into the financial system,”Aral said in an interview in Istanbul this month. “This is going to be an important step toward solving our current-account problem.”

Government statistics cite Turkey’s current-account deficit, has narrowed its gap 23% from $77 billion (2011) to $59 billion (ending August). Record gold sales from Turkish companies to the United Arab Emirates and Iran increased its exports. Exports of precious metals to the UAE and Iran, climbed to $9.2 billion (ending August 2012) from $645 million last year driven by western sanctions on Iran.

Many of the gold exported is coming from the population that are shifting their gold stash from their homes to the banks since Turkish gold production is only 25 metric tons.

Turkish women began holding “golden days” when a gift of either jewellery or coins was brought to the hostess of a party.

Turkey’s household savings rate is only 12.7% compared to China’s 53% according to a World Bank Report.

XAU/USD Currency 1 Year – (Bloomberg)

The Turkish Government endeavours include the August 16th central bank decision to raise the proportion of reserves lenders can keep in gold to 30% from 25%, have increased its efforts to get more bullion out of the homes and into the monetary system. Central bank Governor Erdem Basci has said he may make adjusting the ratio his main monetary policy tool.

Banks will attempt to increase its diversification of gold related services.

Turkey’s regulators have been discussing planned legislation to enable customers to buy or sell gold at bank branches or transfer gold into other accounts, according to an Aug. 29 report in Milliyet, a daily newspaper. Bank Asya has said it will soon start purchasing and selling bullion at its branches.

Jewellers in Istanbul’s Grand Bazaar, one of the world’s largest covered markets, have opposed the move. They say banks buying and selling gold would cut their revenue and push them into underground trading, according to Bloomberg.

The 6th century-old Grand Bazaar houses 4,000 jewellers, and about 1.5 metric tons of scrap gold is processed into bullion there every day, according to Istanbul Gold Exchange data. Transaction volume totalled 8.5 billion liras ($4.7 billion) last year.

The move by the Turkish banks may soon be followed by desperate banks in other emerging and developed markets.

Gold is gradually being remonetised again and with gold soon to become a Tier 1 asset, banks will attempt to get a significant amount of gold onto their balance sheets.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.