Warren Buffet to the Rescue, Credit Crisis Creates Opportunities

Stock-Markets / Credit Crisis 2008 Feb 16, 2008 - 12:41 PM GMTBy: John_Mauldin

Warren Buffet to the Rescue?

Warren Buffet to the Rescue? - How to Earn 20% in Tax-Free Income

- What Would Warren Do?

- A Crisis Creates an Opportunity

- It's All About Valuations

- There Are Times to Be Grateful

It was only a few years ago that I use to sit down at this computer on Friday and wonder what I would write about. In today's environment, there is enough to write three e-letters and still leave interesting copy on the editing floor. Today we look at the rather disturbing developments in the municipal bond market, Warren Buffett's offer to "rescue" the tax-exempt insurers, and ponder what the resolution will be. We also look at corporate earnings, and note how they have been downgraded significantly over the last year. There is (or will be) a connection between stock market prices, valuation, the current credit crisis, and the economy. There is a lot of ground to cover.

But first a quick note about my 5th annual Strategic Investment Conference, to be held in La Jolla April 10-12 (co-hosted by my partners at Altegris Investments). Paul McCulley of Pimco, Don Coxe of BMO (two of my favorite economists anywhere, and simply brilliant speakers), Rob Arnott, George Friedman of Stratfor, as well as your humble analyst and a dozen hedge fund managers who will show you how they navigate in these troubled waters. By the way, George's new book should be at the conference ahead of the bookstores. He has been writing on how the geopolitical world will change over the coming century. I have read a rough copy, and it is fascinating.

Attendees at previous conferences generally rate them as the best conference they attend in any given year, and often the best conference they have ever been to. We do try to do it right. The conference is limited to those with a net worth of over $2,000,000, due to regulatory requirements. I simply hate to put limits like that, but rules are rules. You can register and learn more by clicking on the following link. https://hedge-fund-conference .com/invitation.aspx?ref =mauldin .

Warren Buffet to the Rescue?

You have got to hand it to Warren Buffett. He does have a sense of humor. This week Buffett offered to take the tax-exempt insurance business from the various monoline firms (Ambac, MBIA, FGIC) at a lowball price, and leave them with all the toxic waste from the various structured vehicles they insured. This would mean the investment banks who are counting on that insurance to hold down their losses from the subprime garbage they have on their books would see any hopes of getting anything from the monoline firms reduced to zero.

Why would the investment banks let that happen? Surely they should step in and recapitalize the firms, which while expensive, would be less than the losses they would be forced to immediately take should the monolines fail. Why let Warren get what is a very profitable business which could eventually allow the banks to get their money back?

I and a lot of people were scratching our heads, wondering "What was Warren thinking?" He is very savvy and shrewd, and even though he cultivates a down-home image, he is a world-class vulture capitalist (which by the way is a compliment in my book). So why would he make an offer that is seemingly a non-starter?

To be sure, if Buffett was allowed to take the tax-exempt business, the concern in that market would immediately vanish. It would be the equivalent of walking into a child's room in a crisis and saying, "Daddy's home. It's alright."

But to understand what I think is really going on, we have to step back and examine the crisis (and that is almost too understated a term for it) in the normally boring world of tax-exempt bonds.

How to Earn 20% in Tax-Free Income

Last summer we were repeatedly told subprime problems would not spread to other markets. "The problems will be contained," proclaimed one authority after another. Now of course we know that this is not the case. The subprime contagion has spread to all sorts of markets far and wide. Small towns in Norway have lost money to subprime borrowers in the US.

The most recent development has been in a rather obscure market called the auction-rate note market. Auction-rate securities are an unusual type of long-term bond that behaves like a short-term bond. While the terms vary, let me quickly try and describe a typical bond, for those who are not familiar with them. A tax-exempt authority like a school district, hospital district, or municipality will issue a long-term bond, but within the covenants of the bond is the stipulation that it will be auctioned every 7 or 30 days. The issuer does this because it allows them to pay a lower overall rate.

Buyers are short-term money market funds and investors who are looking for a slightly higher yield than they can get in a money market fund. These bonds are auctioned by the usual suspects: Lehman, Citigroup, UBS, Merrill, and their kin. In essence, these banks make a market in the bonds.

Let's say a buyer says to UBS, "I will buy Small City School District bonds if they will pay me 4% for the next 30 days." The bonds go to the person who is willing to take the lowest interest rate for any given period. At the end of 30 days, I can re-bid or tell UBS that I want them to take the bonds back. UBS will buy them back from me, and put them on the list to be sold to another bidder the next day.

Why would someone be willing to take a chance on the bonds of a school or hospital district they have no direct knowledge of? Because these various tax-exempt authorities buy insurance from the monoline insurance companies that will give them an investment-grade rating. An investor simply looks at the rating and makes a buy decision.

That was all well and good when you could trust the ratings. Now the creditworthiness of the monoline insurance companies is in serious doubt. Ambac, MBIA, GFIC and others have been downgraded by the rating agencies or are in imminent danger of having their ratings cut.

And without their ratings, they have nothing to sell. A rating cut is essentially a death knell for the company. But it is also a potential crisis for those who have bought the insurance.

And now, these auctions are "failing." By that it is meant that there are not enough buyers to take all the paper. The investment banks are being forced to take back that paper, and they don't want it. Much of the auction market is shut down.

Now, here is the unusual feature of most of these bonds. If for some reason the auction fails, the interest rate is automatically set higher, so that whoever is stuck with the bonds is compensated for the loss of liquidity. And often that rate is a severe blow to the issuer.

Take the Port Authority of New Jersey (PANJ). Their $100,000,000 auction-rate bond offering failed. Their interest rate went from about 4% to 20%! It is costing them an extra $300,000 a week. That is serious money. No one would seriously contend that the PANJ is a financial risk. But buyers simply do not want to take the risk for 4%.

I suspect that the PANJ will quickly put together a $100 million offering and buy back the expensive bonds, but in the meantime they are paying higher rates than they could get from the local Tony Soprano over by the docks.

Good friend and bond maven John Woolway sent me a list of auction-rate bonds. Last week bonds from Puerto Rico, rated AAA, were paying 4.3%. Today the bid is 8.75%, and if the auction fails the rate goes to 12%! The taxpayers of Puerto Rico will have to pay that extra cost. Does anyone seriously think Puerto Rico is not creditworthy? But this is a market that is simply frozen. Buyers are on strike.

There are bonds of many solid issuers that are bidding almost 10% and will reset to 15% if their auctions fail, up from 4-5% last week. Understand, less than 1% of tax-exempt bonds fail. These are good-quality tax-free credits we are talking about, yet the possible interest rate is higher than CCC junk bonds.

The increased cost of interest is a serious blow to some smaller issuers. One hospital district would lose 25% of the operating profits that allow it to purchase new equipment and maintain their facilities. School districts could have to make very ugly choices about where to make cuts in their budgets.

So, what are they doing? They are calling every politician on their rolodexes complaining about the problem. Fix the problem NOW. This week. So, what does Governor Elliot Spitzer of New York do yesterday? He threatens the monoline companies, telling them they have three to five days to find sufficient capital or the state will step in and take charge. And the state does in effect have that authority, as the states are the regulatory authorities.

One concept being floated is to break the monolines up into two banks, a good bank and a bad bank. The good bank would get the very profitable tax-exempt insurance business, and the bad bank would get all the bad subprime and structured vehicle debt. Another is that the monolines raise enough capital to get through the crisis. Some suggest the government step in, as it did with Chrysler.

But the negotiations for additional capital are going rather slowly, or so it seems to those sitting on the outside. (I am sure if you'r on the inside it seems like warp speed.) To get the US government to step in would take even more time. And as I said last week, the spearhead for solving the current credit crisis is fixing the monolines. Nothing is going to get resolved with the current credit crisis until their problems are fixed.

What Would Warren Do?

Which now makes Buffett's offer rather intriguing. Spitzer the very next day comes in and says you have 3-5 days to get something done. That may or may not be possible. The issues are exceedingly complex and the egos are huge. Careers are on the line.

The "easy button" for the regulators is "Let Warren Do It." Problem solved. Of course, investment banks and other investors (pension plans, insurance companies, hedge funds, and mutual funds) are out tens of billions of dollars. But they can just go get some more capital from Abu Dhabi or China. Why should we worry about large investment banks, who basically created the problem?

Well, gentle reader, it is not that simple. UBS estimates that investment banks from around the world could have to write off yet another $203 billion in debt if the monolines fail, in addition to the $152 billion they have already written down.

I am not so concerned about the stock prices of the investment banks taking a hit. That is just the cost of their greed. I am more concerned about the hit to the US and European economies. Those large investment banks are the source of loans to corporate America and Europe, and too much of the rest of the world. They finance our credit cards and auto loans. And when their capital base is impaired, it means that credit becomes harder to obtain. Interest rates go up. Deals don't get done.

I and my partners talk to people (mostly in hedge funds) in the credit markets a lot. I can tell you that the leveraged loan business is almost nonexistent. There has not been a new CLO created since May. SIVs are for all intents and purposes being shut down as fast as possible. Credit standards at banks are tightening and getting into territory that typically reflects recessionary conditions.

The good news is that the monolines will not have to come up with 100% of the capital of a failed subprime CDO, for example, all at once. The original CDO would have a theoretical life of 30 years. So the monoline would have 30 years to pay out the interest and principle. With enough initial capital, they could buy enough time to survive. The key is getting enough in a tough credit environment, with the main potential investors already suffering from capital problems.

It looks like we will know in a few weeks. And maybe Buffett's offer goes from being a joke to being gold for his investors. It would be interesting to know if he had any idea that Spitzer was going to hold a gun to the monolines' collective heads. Or maybe he is just the beneficiary of good timing. We will see.

A Crisis Creates an Opportunity

Senior bank loans are currently routinely trading below junk bonds from the same corporation. This is of course crazy. If there is a problem with a corporation, the bank loans get paid first, while the bonds wait in line. So why are they trading beneath the junk bonds? Because there are forced sellers in the marketplace. Many CLOs which own corporate debt have covenants that force them to liquidate under certain conditions. They are often selling medium-term high-quality bank loans for prices as low as $.80 to par value (or $1.00). This potential extra return is on top of rising credit spreads. This will eventually correct itself. The value of the bank loans will rise and/or the value of the junk bonds will fall. But the forced selling is creating some very interesting valuation opportunities.

There are some very attractive rates if you understand the credit markets. If you don't, it is too late to go to school on credit, but there will be some very interesting opportunities for those who do. And while most of us will not get a chance to play in this market, it is important that there are those who can, as it will help get things back to normal. And by normal, I mean risk premiums from the early part of the decade, not those of 2006-7.

It's All About Valuations

This week we saw consumer confidence in the US drop to the lowest level since 1992. Manufacturing is flat to down, depending on which survey you read. Ben Bernanke all but said we are in recession, or as nearly as a Fed Chairman can. But the stock market is not paying attention. Things are going to get better, we continually hear. The recession is already priced into the stock market. So now is the time to buy.

I might suggest a little caution. I was having dinner with good friend and savvy analyst Ed Easterling last Tuesday, and about halfway through dinner he slyly asked if I had looked lately at the estimates for 2008 earnings from S&P for the S&P 500. As I had not, he pulled out a few sheets of paper and showed me some rather interesting numbers.

For the record, I wrote in early 2007 that earnings estimates would be lowered as we moved into recession. So, now let's look at whether that has come to pass.

On January 18, 2007 S&P estimated that as-reported earnings for 2007 would be $89.10 per share. The index was at 1426, which gave a forward P/E (price to earnings) of 16.

And the real number for 2007? It was $71.56, so down about 20% from the estimates at the beginning of the year, and down 12% from 2006. Not a good year, as it turned out.

Now, S&P came out with an estimate for 2008 on March 30 of last year. They projected earnings of $92.30 for this year. By the end of the year that was down to $83.98, which would give a forward P/E of 17.48, which is starting to be pricey.

And what are they currently projecting for 2008? $71.20, which is roughly what the earnings were for 2007. That also puts us into a rather sporty P/E at current levels of 19.2 on a forward basis.

But wait. It gets worse. They project that for the four quarters ending in June the earnings will be down to $65.15, which yields a very high P/E of 21 at today's prices. Do you think the stock market could be at risk if we get into a full-blown recession and P/E ratios are at the top of historical valuations, except for the 2000 bubble valuations?

Further, earnings typically soften during a recession, so it is likely that actual earnings will go down from here. S&P estimates that earnings for the S&P 500 will rise 20% in the 3 rd and 4 th quarters of 2008, from 2007. That is a rather robust recovery in their projections. And one that is looking increasingly unlikely.

As I have written before, the research shows that the reason bear markets stretch out over time is that it takes several earnings disappointments to truly put the majority of investors in a bearish mood. Of course, the opposite is true, in that several earnings surprises in a row will make investors much more bullish.

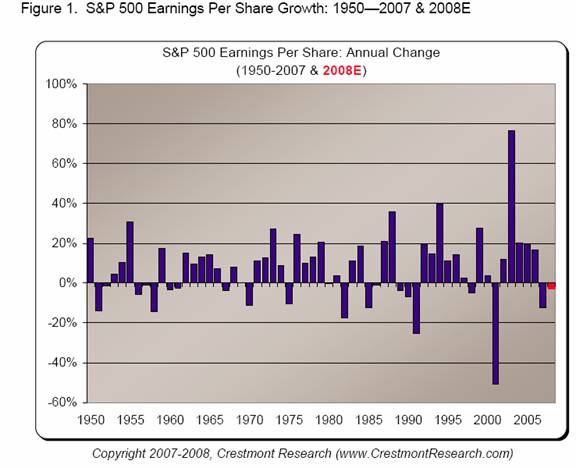

But should we expect earnings to fall for two years in a row? As it turns out, Ed has done some research that suggests we should. Look at the following graph. It shows earnings growth or decline since 1950 ( www.crestmontresearch.com )

"Over the past six decades, there was a fairly consistent pattern of three to five years of strong profit growth followed by a year or two of profit declines. Only one period in the 1990s extended into a sixth year of gains. The recent era of growth appeared to be destined to tie or exceed that record. Yet, economics and capitalism are powerful forces—the relatively high profit surge during the recent five year period likely led to the abrupt and unexpected reversal. It now appears that we're set for a pair of back-to-back earnings declines ... not at all uncommon, as history illustrates.

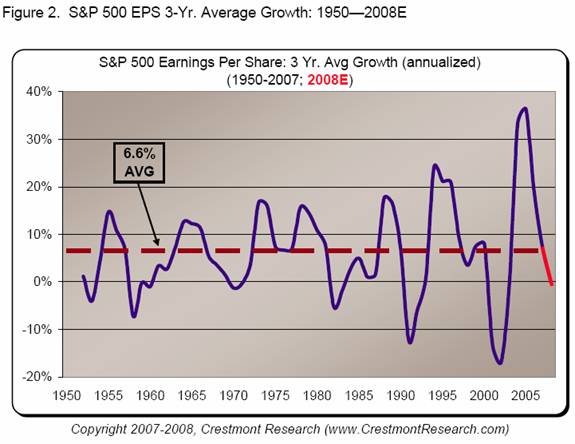

"To more accurately see the trends, we can combine a few years into a moving average. A multi-year average smooths the short-term swings and presents an insightful view into the earnings cycle.

"Given the historical duration of profit surges and retreats, three years is probably a reasonable period to use. Figure 2 presents the three-year average growth rate for earnings, where the earnings cycle begins to show its more cyclical nature."

Note that earnings swing a great deal around that 6.6% average growth. It would be very unusual for earnings in a recessionary year to not exhibit much lower growth. Note that in the last two recessions they dropped well below 10%. My bet is that earnings for the S&P 500 are going to be revised down again and again as the year goes on. A 10% drop in earnings will mean that the market has a P/E of 22, if the market stays where it is. That is hard to imagine.

The market goes in long cycles from high valuations to low valuations and back to high. These cycles are anywhere from 13 to 17 years. We are just in the 8 th year of this cycle, and we have not seen anything close to low valuations.

As Ed points out:

"In summary, EPS is likely to be near $90 per share in 2016. P/E is likely to be in the range of 20-25 if inflation remains low and stable. Higher inflation or deflation would drive P/E ratios back to the average of 15 or toward historical secular bear cycle lows below 10. If P/Es remain above 20, total returns over the next decade will be 4% to 6%.

If P/Es decline, investors could still see the current level of the stock market in 2016."

Maybe it will be different this time. But that is a dangerous assumption, as we watch the twin bubbles of housing and the credit markets implode all over the developed world. The bubbles may be even worse in England. I find it hard to get enthusiastic about overall stock market returns at today's valuations, and given the environment.

There Are Times to Be Grateful

The last two weeks have been emotionally tough on the Mauldin clan. My oldest daughter Tiffani (and the person who really runs the business, as all my partners will attest) reported a rather sizeable lump in her breast. The doctor decided not to biopsy it but simply go ahead and remove it. It took two weeks to schedule the operation, which was last Wednesday. You can imagine the emotions running through our minds.

When Tiff and I were in Santa Barbara with the management team from Altegris at Jon Sundt's ranch retreat last week, I had one of those moments that are forever seared into my mind. We were all finishing dinner, and had been talking about the future of our lives, business, and the world in general. Tiffani is getting married in August (08-08-08) and has actually been talking about having a kid for the last few months (good grief, me a grandfather?). Our business is good, and a lot of the stress is slowly getting to reasonable levels. Life is going so well. The guys left the table to begin clearing, and I looked over at Tiffani and could she was clearly distressed.

"What's wrong, baby?"

"Dad," she said with tears in her eyes, "I'm scared." This was my strong Tiffani, who I thought was dealing with the stress better than I was. All I could do was mutter some lame comment about things will be fine and hug her, and try not to cry myself. But I have to admit to being terrified. My mother had breast cancer (some 50 years ago now, and is still quite active at 90), and there was some on Tiffani's mother's side, so it was not something we could blithely dismiss.

There was really nothing we could do but wait for Wednesday. The surgey went fine. We knew we would get the results from the biopsy today. About mid-morning I got a long text from Tiffani on my cell phone, and the word "worst" immediately leaped out to my eye. My stomach felt as if it had been hit with an iron. Then I read the full message and saw that she was saying that the pain was the worst she had had for the last three days, and the pain medicines were not kicking in. You can imagine the sense of relief. But it made me realize how much this was affecting me.

Later this afternoon we got the text that said the biopsy was fine and the tumor was benign. So, I am going to hit the send button a little early tonight, pick up some of the kids, and go see Tiffani. She says she might be up for a movie, which sounds like a good thing.

Your happier than you can imagine analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.