Gold To Rally Strongly In November After October Correction

Commodities / Gold and Silver 2012 Oct 26, 2012 - 07:11 AM GMTBy: GoldCore

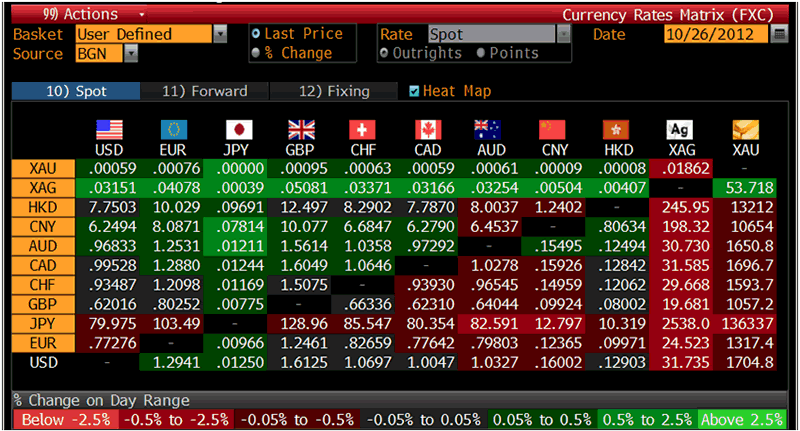

Today’s AM fix was USD 1,704.00, EUR 1,316.44, and GBP 1,057.01 per ounce. Yesterday’s AM fix was USD 1,715.00, EUR 1,317.71, and GBP 1,063.24 per ounce.

Today’s AM fix was USD 1,704.00, EUR 1,316.44, and GBP 1,057.01 per ounce. Yesterday’s AM fix was USD 1,715.00, EUR 1,317.71, and GBP 1,063.24 per ounce.

Silver is trading at $31.76/oz, €24.72/oz and £19.80/oz. Platinum is trading at $1,552.80/oz, palladium at $594.20/oz and rhodium at $1,045/oz.

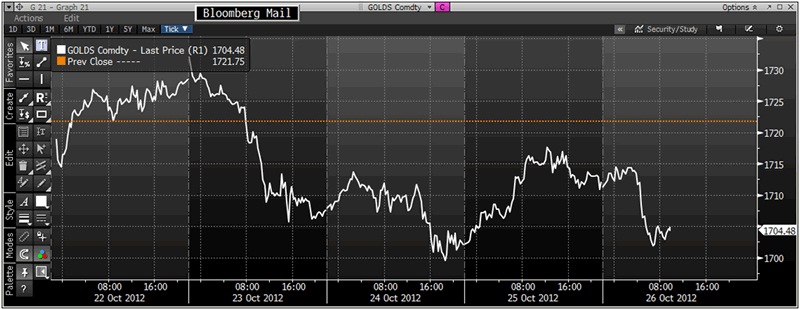

Gold climbed $11.80 or 0.69% in New York yesterday and closed at $1,712.70. Silver surged to a high of $32.232 and finished with a gain of 1.36%.

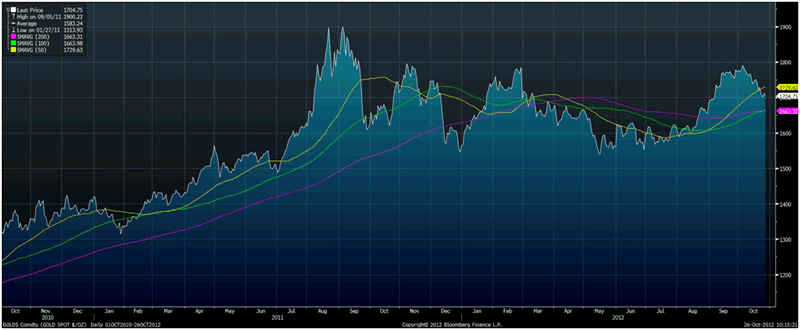

Gold in USD (2 Year) With Support At 100 and 200 Day Moving Averages - (Bloomberg)

Gold edged down early Friday, on track for its third week of declines as the US dollar strengthened and momentum traders continued to exit positions or go short.

Investors and dealers await the US CFTC commitment of traders figures due at 1930 GMT, after last week's data showed hedge funds and other big speculators decreased their long positions in gold to their lowest since the end of August. This is bullish from a contrarian perspective and shows that much of the short term speculative froth has been removed from the market.

Gold in USD, 5 Day – (Bloomberg)

The US GDP figures are released later today and they are expected at 1.9%. A weaker than expected number would benefit safe haven gold.

Gold corrected in October as we anticipated and has fallen by 5.5% (in USD terms) from over $1,795.55/oz to a low of $1,699.65/oz It is too early to tell yet if the October correction is over. There would appear to be strong support at $1,700/oz and Asian physical demand is very robust down at these levels.

The physical bullion market was subdued in Asia overnight although there was some buying out of Japan. Trade was muted because of a public holiday in Indonesia, Malaysia and Singapore, but Reuters noted that dealers saw gold buying from Thailand.

Importantly, Chinese buying of gold, official and public, on dips is likely to be continuing.

Physical demand for gold bullion coins and bars in western markets remains subdued but smart money buyers continue to add to allocations. Gold and silver 1oz bullion coins from the Australian Lunar – 2013 Year of the Snake Coin Series are officially sold out at The Perth Mint. The sell out of the full mintages of 300,000 pure silver 1oz coins and 30,000 pure gold 1oz coins was achieved in just two months, ranking this release as one of the fastest selling behind the phenomenally successful Year of Dragon coins in 2012.

With gold having pierced slightly below $1,700/oz there is a risk that gold could fall to test the 200 and 100 day moving averages which are now at $1,663.30/oz and $1,664/oz respectively (see chart above).

Cross Currency Table – (Bloomberg)

A rise of over 1% today (from the current price of $1,705/oz) would result in a higher close this week, above $1,721.75/oz. This would be a good indicator that the recent dip is over and it is time to get into position for November, which is one of gold’s strongest months and the November to March rally which is one of gold's strongest periods. A lower close this week could see further falls next week and in early November.

As ever it will be nigh impossible to pinpoint the exact price lows.

The low of $1,699.65/oz seen two days ago on Wednesday may mark the intermediate low however gold could continue falling until October 31st (next Wednesday) as month ends often mark intermediate lows or could even continue falling until the US election or soon after.

There are now 6 trading days left until the US Presidential election on November 6th. The US election has many investors on the sidelines.

Gold will be supported by and likely see gains into yearend due to the coming uncertainty surrounding the US “fiscal cliff.” Tax increases and spending cuts are expected which would sink the US economy into a deep recession or Depression. If US Congress cannot agree on a deal by the end of the year it could have deleterious effects on the dollar and on capital markets.

The US elections themselves are unlikely to have a significant impact on currencies and wider markets in the short term but we expect the recent calm may recede and the stormy volatility of recent years may again be seen soon after the election when the reality of the appalling US fiscal and monetary situation is realised.

November is traditionally one of gold's strongest months (see gold seasonal charts).

Given the extremely bullish fundamentals due to negative fiscal outlooks, ultra loose monetary policies, negative real interest rates and global currency debasement, we expect this November and year end to be very positive for gold and particularly still undervalued silver.

Prudent buyers should now be buying this dip by cost averaging or getting into a position to do so. While gold may correct by another 2% or 3% from here, there is a greater likelihood of gold beginning to rise sharply and quickly recovering the 5.5% loss seen this month in November.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.