Uranium Could Now be the Best Investment

Commodities / Uranium Oct 25, 2012 - 10:51 AM GMTBy: Richard_Mills

Under the terms of the 1993 government-to-government nuclear non-proliferation agreement (Megatons to Megawatts program), the United States and Russia agreed to commercially implement a 20 year program to convert 500 metric tons of HEU (uranium 235 enriched to 90 percent) taken from Soviet era warheads, into LEU, low enriched uranium (less than 5 percent uranium 235).

Under the terms of the 1993 government-to-government nuclear non-proliferation agreement (Megatons to Megawatts program), the United States and Russia agreed to commercially implement a 20 year program to convert 500 metric tons of HEU (uranium 235 enriched to 90 percent) taken from Soviet era warheads, into LEU, low enriched uranium (less than 5 percent uranium 235).

To date 463.5 metric tons of bomb-grade HEU have been recycled into 13,345 metric tons of LEU - enough material to produce fuel to power the entire United States for about two years.

Overall, the blending down of 500 tonnes of Russian weapons HEU will result in about 15,000 tonnes of LEU over the 20 year lifespan of the program. This is equivalent to about 152,000 tonnes of natural U, or just over one year's global demand.

The Megatons to Megawatts Program was supplying roughly 50% of the US's LEU demand. Mining accounted for eight percent with the rest coming from other sources (rapidly depleting utility and government stockpiles).

Currently, the electricity for 1 in 10 American homes, businesses, schools and hospitals is generated by Megatons to Megawatts fuel.

The U.S. has 104 nuclear reactors operating, this is the largest fleet of nuclear reactors in the world making the U.S. the world's largest uranium market. In 2011 the US nuclear reactor fleet required 55 million pounds of uranium.

The mined supply of uranium in the U.S., in 2011, was about four million pounds.

US Uranium Facts & Figures as published May 2012:

'2011 Domestic Uranium Production Report' by the U.S. Energy Information Administration(EIA):

- Total uranium drilling in 2011 was 10,597 holes covering 6.3 million feet, 47 percent more holes than in 2010

- Expenditures for uranium drilling in the United States for 2011 were $54 million in 2011, an increase of 20 percent compared with 2010

- U.S. uranium mines produced 4.1 million pounds U3O8 in 2011, 3 percent less than in 2010

- Total production of U.S. uranium concentrate in 2011 was 4.0 million pounds U3O8, 6 percent less than in 2010

- Total shipments of uranium concentrate from U.S. mill and ISL plants were 4.0 million pounds U3O8 in 2011, 22 percent less than in 2010

- U.S. producers sold 2.9 million pounds U3O8 of uranium concentrate in 2011 at a weighted-average price of $52.36 per pound U3O8

World Uranium Market

According to a recent report from the International Atomic Energy Agency (IAEA) and the Organization for Economic Cooperation and Development (OECD), by the year 2035:

"World nuclear electricity generating capacity is projected to grow from 375 GWe net (at the end of 2010) to between 540 GWe net in the low demand case and 746 GWe net in the high demand case, increases of 44% and 99% respectively.

Accordingly, world annual reactor-related uranium requirements are projected to rise from 63,875 tonnes of uranium metal (tU) at the end of 2010 to between 98,000 tU and 136,000 tU by 2035. The currently defined uranium resource base is more than adequate to meet high-case requirements through 2035 and well into the foreseeable future.

Although ample resources are available, meeting projected demand will require timely investments in uranium production facilities. This is because of the long lead times (typically in the order of ten years or more in most producing countries) required to develop production facilities that can turn resources into refined uranium ready for nuclear fuel production."

Wyoming and In-Situ Recovery Mining

Wyoming has roll-front uranium deposits in its sandstones and the largest known uranium reserves of any US state. There is no doubt in this author's mind the state will be a key player in supplying the fuel nuclear power plants in the US need to become independent of foreign supplies.

A pro-mining state, prolific numbers of roll-front uranium deposits, and a rising spot uranium price in a resurgent uranium bull market will all combine to make Wyoming the U.S. center for in situ recovery mining (ISR), also known as solution mining.

ISR uranium mines were the only ones that were able to continue operating economically in the US during the 1980s and 1990s when the downturn in uranium prices happened.

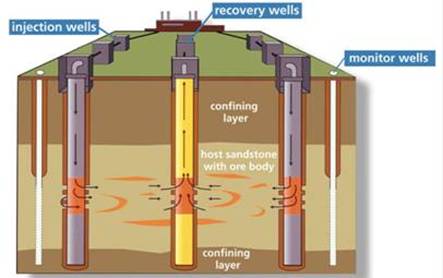

The in-situ recovery mining process uses a 'leaching' solution to extract uranium from underground ore bodies. The 'leaching' agent, which contains an oxidant such as oxygen with sodium bicarbonate (commonly known as baking soda), is added to the native groundwater and injected through wells into the ore body in a confined aquifer to dissolve the uranium. This solution is then pumped via other wells to the surface for processing -- resulting in a cost-efficient and environmentally friendly mining process.

Advantages:

- Low Capital Costs for Mine Development

- Low Operating Costs

- Environmentally Friendly, No Waste Rock, No Tailings Pond

- Profitable on Lower Grade Uranium Deposits

- Small Work Force (low labor costs)

Uranerz Energy Corp. TSX & NYSE MKT - URZ

Uranerz is a U.S. mining company focused on near-term commercial in-situ recovery ("ISR") uranium production, and is currently constructing its first ISR mine in Wyoming. Uranerz Energy Corporation has significant expertise in the in-situ recovery mining method - they have licensed, designed, constructed or operated no less than seven separate in-situ recovery uranium mines located in Wyoming, Texas, Nebraska, and Kazakhstan.

The Company controls a large strategic land position in the Pumpkin Buttes Uranium Mining District of the central Powder River Basin of Wyoming. In August 2011, Uranerz commenced construction of its first in-situ recovery ("ISR") uranium mine - the Nichols Ranch ISR Uranium Project.

The Wyoming Department of Environmental Quality has just issued the Class I underground injection control (deep disposal well) permit. This deep disposal well authorization is the last permit required to begin operations and commercial uranium production.

The Nichols Ranch ISR Uranium Project is expected to become the first new uranium mine built in Wyoming since 1996. The project is licensed for a production level of up to two million pounds of uranium per year with initial annual production targeted for 600,000 to 800,000 pounds after ramp-up.

The Nichols Ranch project will also serve as a platform to develop the Company's other Powder River Basin properties with enhanced economics for adjacent and satellite projects.

Conclusion

Make no mistake; there is no shortage of uranium in the ground. What is in short supply is mined uranium.

It's obvious, that starting very soon, and continuing for at least a decade (the time needed to develop, permit and construct a uranium mine), there is going to be a significant shortfall of uranium supply. Where is the US, and the rest of the world, going to source its needed uranium from?

Perhaps the most relevant question for investors in the junior resource space is WHO is going to, in the very short term, commence production, WHO is perfectly positioned to help fill the looming supply gap?

A looming uranium supply squeeze, and how to potentially profit from it, should be on all our radar screens. Have you got a near term uranium producer on your screen?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.