Sell Your Gold, Q4 Defence, Hedge Your Bets and Up Your Stops

Commodities / Gold and Silver 2012 Oct 25, 2012 - 10:37 AM GMTBy: Money_Morning

Keith Fitz-Gerald writes:

So far fourth quarter earnings have made a mockery of things.

Keith Fitz-Gerald writes:

So far fourth quarter earnings have made a mockery of things.

Of the 20 S&P 500 companies that have provided Q4 guidance so far, 18 of them have guided lower, "slashing" their forecasts, according to Goldman Sachs and CNBC (as of Monday afternoon).

What's more, roughly one quarter of the reported earnings have come in flat to middling. According to Capital IQ, overall revenues are up only slightly at 0.34%.

Yet, for some reason the S&P 500 is only 3.89% off of its highs and is up 12.01% year-to-date through Wednesday afternoon.

Under the circumstances this suggests two things to me:

•There's a lot of volatility waiting in the wings; and,

•The near-term risk is to the downside.

First, let's tackle the volatility that's still in store; then we'll move on to what you can do to prepare for it.

The Q4 Earnings Story

So far this earnings season, roughly one quarter of the S&P 500 has already reported. That leaves the market with nearly 375 companies that have yet to spit out their numbers, roughly 150 alone this week.

Assuming the balance follows the pattern set so far, companies like Caterpillar Inc. (NYSE: CAT), Philip Morris International (NYSE: PM), and 3M Co. (NYSE: MMM) are going to show "respectable" (under the circumstances) numbers while talking about the "challenges" they see ahead.

Meanwhile, a few others, like DuPont (NYSE: DD) and United Technologies (NYSE: UTX), are going to reflect weakening earnings and revenue pressures leading to further cost-cutting as a means of protecting profits. These will include job cuts.

I also expect the bulk of the remaining companies will take the opportunity to lower their expectations -- especially when you consider that 61% of the companies as of Monday afternoon missed revenue expectations.

The irony here is that 61% of the companies that have reported over the same period have also exceeded analysts' expectations.

Naturally the markets will punish those who missed even when what they should recognize is that the analysts were wrong yet again. But that's another story for another time.

What's important to understand is that top-tier company management is using this earnings season to accomplish three things.

First, they're telegraphing real worries from the C-suite. Despite what the Fed wants us to believe, executives remain cautious and uncertain. So they are hoarding cash, hiring only when necessary and trimming things to the bone.

Second, they're lowering the expectations bar to the point where any hint of prowess in the future will likely induce an earnings "surprise" and engender additional support for their share prices.

Three, they hope investors will respond to both situations favorably and they're banking on Fed policy as the primer. There's no question the Fed has run out of bullets given the near-complete lack of response in the markets to QE infinity. And with the fiscal cliff approaching, they'd like to appear protective rather than aggressive, figuring it's the easier position to defend.

Now let's talk about the downside.

If you look at a chart below of the S&P 500, the range-bound conditions we've seen since this crisis began are evident. So are the much broader ranges since 2000, which is really where this mess started from a technical standpoint.

Chart: Fitz-Gerald Research Publications, Yahoo Finance

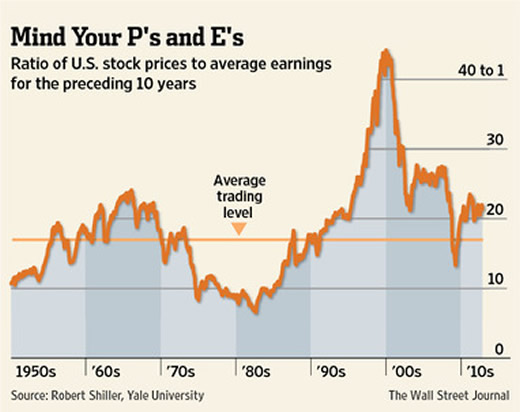

Put that against Professor Robert Shiller's work, and you can see the Fed is clearly trying to engineer a rally even when the natural proclivity is to guide lower to the norms established since the end of WWII.

At 17.7 times earnings, the S&P 500 is still expensive in the big scheme of things.

Figure 1: Wall Street Journal, Robert Shiller - Yale University

This isn't a surprise. Or, at least it shouldn't be.

As my good friend Barry Ritholtz, CEO of Fusion IQ, recently pointed out so eloquently in his blog, The Big Picture, the "Fed's liquidity fire hose has forced managers into equities beyond what is normally prudent."

That's the key: normally prudent. There's nothing normally prudent about anything the Fed is doing at the moment.

Sell Your Gold??

And that brings me to what you can do about all of this brewing volatility...prudently...and ahead of time:

•Hedge your bets by either shorting stocks or picking up shares of my favorite inverse fund, the Rydex Inverse S&P 500 Fund (RYURX), or tapping into an inverse ETF like ProShares Short S&P500 (NYSEArca: SH). Michael Purves, who is the Chief Global Strategist for Weeden & Co, made the case for shorting small caps as an alternative on CNBC, recently noting that the higher financial leverage and lower yields offer better opportunity. I agree, but only if you can stomach the additional risk.

•Be ready to sell your gold then buy it back again at a lower price. Don't I mean buy gold then get ready to sell it? Nope. Not this time. Many hedge funds and institutions are using gold to collateralize their marginable assets right now so one of the first things they're going to sell to raise cash when faced with a margin call is gold. They're also sitting on large profits that they'll immediately begin to take off the table in a sell-off. This will end up catching a lot of investors by surprise because they expect gold to take off when the stuff hits the fan. It will...but only after it takes an initial hit.

•Ratchet up your trailing stops. The markets have risen significantly since the beginning of the year. If you're using your trailing stops properly (and I hope you are given how frequently we've talked about them), that means you should be moving up your stops in near lock step. Or, consider buying put options as an alternative. The last thing you want to do is let a big gainer turn into a loser if things roll over.

And as always, remember that buy-and-hold is a marketing gimmick, not an investment strategy.

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.