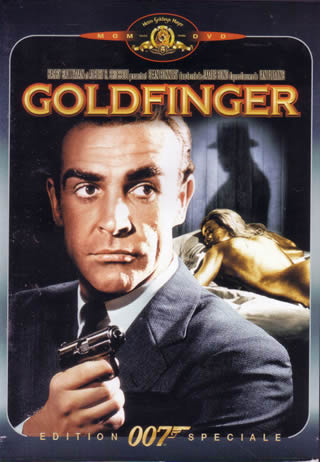

Gold James Bond, and Europe's New Gold Standard

Commodities / Gold and Silver 2012 Oct 25, 2012 - 02:41 AM GMTBy: Adrian_Ash

Europe's huge gold reserves are currently more useless than Bond-villain Auric Goldfinger could wish...

Europe's huge gold reserves are currently more useless than Bond-villain Auric Goldfinger could wish...

LET'S SAY you owe the world €2 trillion, but you also hold the world's 4th largest hoard of physical gold.

Sounds like a no-brainer, right? Use Italy's gold to pay Italy's debt.

Trouble is, Rome's gold would be worth only a drop in the bucket – a mere 10% of its outstanding debt. The gold isn't Rome's to sell either. It belongs to the central bank, the Banca d'Italia. And under the terms of the Eurozone treaty, as well as domestic law, that puts it beyond the reach of grabbing politicians, as Silvio Berlusconi learnt in 2009.

Two solutions are being bounced around regardless. First, says the Council of Economic Experts in Germany, every Eurozone country with public debt of more than 60% of its annual GDP should put up assets – like gold – to join a big "redemption fund". That fund would be secured by those assets, which members would then get back as they paid down their excess debt, over and above that 60% ceiling, over a period of 20 years.

With it so far? Berlin isn't. Chancellor Angela Merkel rejected this idea a year ago, perhaps because Germany – like France, the Netherlands and pretty much everyone else – would have to join the scheme. The Eurozone's biggest gold-owner as well as its biggest economy, Germany now has public debt equal to 83% of GDP. But the crisis hasn't improved since November 2011. And it is a German idea.

Second however, and because the Eurozone crisis is due to some nation's facing steeply higher borrowing costs than other member states, why not let them use their gold to raise cheaper finance in the market? That's what friends of BullionVault the World Gold Council propose.

Italy and Portugal for instance could issue new government debt which is part-backed by gold. Both have sizeable gold reserves compared to their immediate financing needs. Both could very likely get lower interest rates from private lenders if those lenders got the promise of a part-gold payment in the event of default. So both would be highly incentivized to avoid defaulting, thereby losing all or part of their gold reserves. And as the World Gold Council's director for government affairs, Natalie Dempster, put it to me last week reducing their role in the problem – especially Italy's – would let the Eurozone focus its tax-funded resources on the other troubled states, most notably Greece and Spain.

What coverage this idea has got so far has been mixed. The Financial Times was broadly positive in late summer; last week's coverage by the Wall Street Journal was less so. There's still the legal problem of using gold to help fund government debt. There's also the problem of leaving each Eurozone nation to sink or swim by itself, rather than splashing about together in the big happy pool of the German Experts' scheme.

For now then, the gold stays "Gold gets dug out of the ground in Africa, or someplace," as Warren Buffett told Harvard students in 1988. "Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head."

But maybe Buffett, like his Martian and the grandees of Europe, isn't thinking hard enough. But the idea of offering gold as collateral to get cheaper loans is common practice in Asia. It has revolutionized consumer credit in India for example, where private households own more gold bullion than even the Eurozone states added together. And as a positive study submitted to the European Parliament by University of Duisburg-Essen professor Ansgar Belke shows, using gold collateral to raise cheaper loans is hardly new to sovereign governments either.

"In the 1970s, for instance, Italy and Portugal employed their gold reserves as collateral to loans from the Bundesbank, the Bank for International Settlements (BIS) and other institutions like the Swiss National Bank. Italy, for instance, received a $2 billion bail-out from the Bundesbank in 1974 and put up its gold as collateral. More recently, in 1991, India applied its gold as collateral for a loan with the Bank of Japan and others. And in 2008, Sweden's Riksbank used its gold to raise some cash and provide additional liquidity to the Scandinavian banking system."

Yes, contrary to common wisdom and current Eurozone practice, governments can and have put gold to good use. And they've done it long after the demise of the classical Gold Standard seemed to mean Auric Goldfinger had beaten James Bond, effectively irradiating the world's official gold reserves, putting them beyond use (his plan in the movie, not the book). Nor do governments need to sell and so lose their gold, as they did a decade ago – back when history had ended, and the risk of crisis seemed as remote as, say, a Greek Eurozone exit.

Yes, contrary to common wisdom and current Eurozone practice, governments can and have put gold to good use. And they've done it long after the demise of the classical Gold Standard seemed to mean Auric Goldfinger had beaten James Bond, effectively irradiating the world's official gold reserves, putting them beyond use (his plan in the movie, not the book). Nor do governments need to sell and so lose their gold, as they did a decade ago – back when history had ended, and the risk of crisis seemed as remote as, say, a Greek Eurozone exit.

Part-backing debt with a chunk of gold has a much longer history than the 1970s too. Under the high Victorian Gold Standard, the Bank of England was allowed to issue banknotes over and above the actual gold-backing held in its vaults. Over the next 80 years – the zenith of international trade enabled by that London clearing house – the Bank of England's requirement was safely cut to just one ounce of gold for every 3 ounces' worth of paper Pounds Sterling. So two thirds of Great Britain's gold-backed money was unbacked, in short, with the "promise to pay" still stamped on all banknotes regardless.

To anyone watching from Mars, part-backing a debt issue today would look awfully similar.

By Adrian Ash

BullionVault.com

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and a regular contributor to MoneyWeek magazine, Adrian Ash is the editor of Gold News and head of research at www.BullionVault.com , giving you direct access to investment gold, vaulted in Zurich , on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2012

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.