Gold Falls as Draghi to Enter the Lion’s Den

Commodities / Gold and Silver 2012 Oct 24, 2012 - 10:48 AM GMTBy: GoldCore

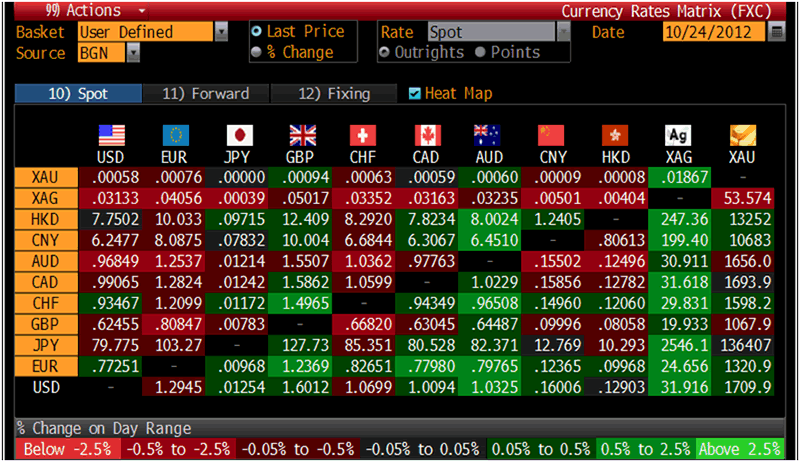

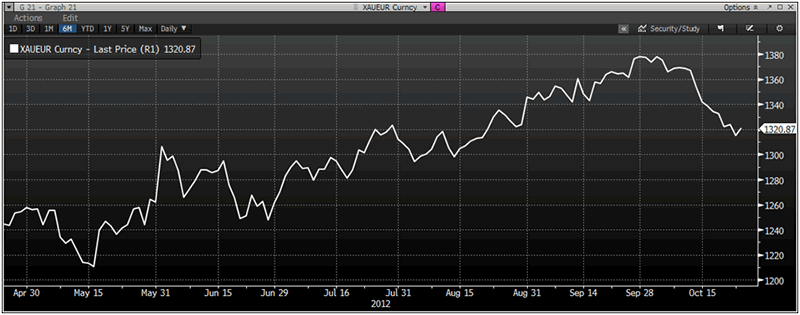

Today’s AM fix was USD 1,708.50, EUR 1,321.04, and GBP 1,069.28 per ounce. Yesterday’s AM fix was USD 1,717.00, EUR 1,317.22, and GBP 1,072.12 per ounce.

Today’s AM fix was USD 1,708.50, EUR 1,321.04, and GBP 1,069.28 per ounce. Yesterday’s AM fix was USD 1,717.00, EUR 1,317.22, and GBP 1,072.12 per ounce.

Silver is trading at $31.93/oz, €24.77/oz and £20.02/oz. Platinum is trading at $1,577.25/oz, palladium at $596.70/oz and rhodium at $1,100/oz.

Gold fell $21.60 or 1.25% in New York yesterday and closed at $1,706.90. Silver hit a low as $31.55 and ended finished with a loss of 2.35%.

Gold trimmed gains Wednesday amid worries about the global economy grew and demand from the world’s largest consumer, India helped support prices.

Cross Currency Table – (Bloomberg)

The China HSBC Flash Manufacturing Purchasing Managers Index (PMI) hit a three month high of 49.1 in October, and ramped up its largest order books since April, hinting at signs of a gradual economic recovery.

Investors await the US Fed’s policy statement today at 18:15 GMT but most economists expect no new policy initiatives before the US presidential elections on November 6th. Recent rumours released claim Bernanke has no interest in renewing his 4 year term as Chairman of the US Federal Reserve’s Federal Open Market Committee.

The festival season peak begins next month in India and physical demand is expected to increase.

Spanish government bond prices dropped on Tuesday after Moody's downgraded five Spanish regions. The news comes just days after more Spanish regions tapped the federal government's regional bailout fund, effectively depleting the remaining balance of the fund and increasing the need for Spain’s bailout.

Mario Draghi travels to Berlin today to meet with key German parliament members involved in the eurozone crisis policy. This private meeting is the ECB president’s effort to defend his new bond buying plan as a legitimate instrument in its monetary policy arsenal.

Germany’s legislative backing is critical for Draghi’s plan to buy up Spanish and other eurozone area government bonds.

The Bundesbank president, Jens Weidmann, says the program is tantamount to financing governments by printing money, which is prohibited by the ECB’s founding treaty.

ECB presidents normally give evidence to the European parliament but rarely if ever address national legislatures especially behind closed doors. This journey is highly unusual but a critical sell for Draghi. Today’s session will be followed by a press briefing at 4pm local time by Mr. Draghi and Bundestag leader Norbert Lammert.

XAU/EUR 6 Months – (Bloomberg)

The main goal will be to convince lawmakers that the ECB is committed to keeping inflation low.

Draghi’s plan outlines that the ECB will only buy a government’s bonds on the secondary market after it has agreed to economic reform measures set out by the single currency zone’s finance ministers and the IMF.

Although, Weidmann and other German politicians have been vocal in their objections, Chancellor Angela Merkel has backed the plan and asserted that it isn’t outside the central bank’s mandate.

German opposition lies deep in its history when under the Weiman Republic in the 1920’s massive bond buying is widely thought to have triggered hyperinflation.

The 2010 ECB bond buying program that initiated German adversity to ECB policies resulted in then-Bundesbank President Axel Weber and ECB chief economist Juergen Stark, a former Bundesbank vice president, to resign in protest.

In September, when Super Mario unveiled the new bond program, called Outright Monetary Transactions, to replace a prior facility the markets received the news favourably.

The ECB plans to buy bonds only if countries first seek assistance from Europe's bailout funds and agree to undertake fiscal overhauls or austerity.

The ECB (which wants the International Monetary Fund involved in overseeing compliance ) has said it would cease buying bonds if countries renege on their pledges.

Over the course of the eurozone debt crisis Germany's parliament has increased its powers requiring the government to seek its approval of any bailout.

German Parliament could throw a spanner into the works if Mario Draghi fails to convince lawmakers that he is operating within the ECB's mandate and increases speculation that the ECB is propping up state budgets.

"The decisive question is whether the ECB is conducting monetary policy or fiscal policy," said Carsten Schneider, a financial-policy expert for the main opposition Social Democrats. "If this is financing state budgets, then the Bundestag and the European Parliament will have to decide on it."

For breaking

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.