What Is the Actual Book Value of Germany’s Gold Reserves

Commodities / Gold and Silver 2012 Oct 23, 2012 - 09:36 AM GMTBy: GoldCore

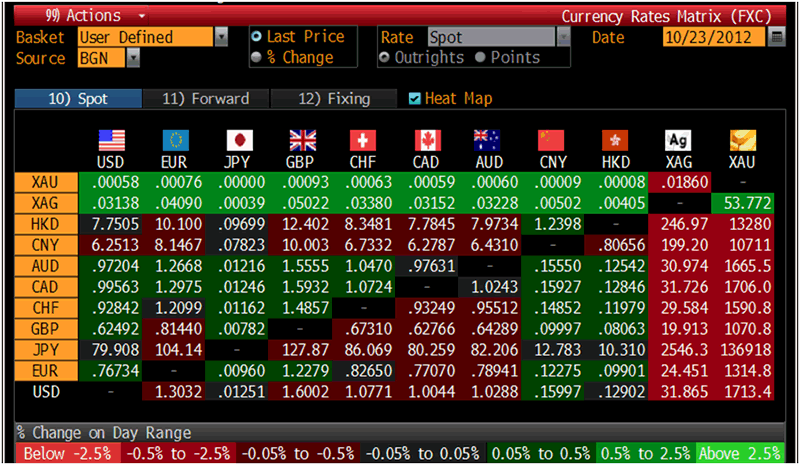

Today’s AM fix was USD 1,717.00, EUR 1,317.22, and GBP 1,072.12 per ounce. Yesterday’s AM fix was USD 1,725.00, EUR 1,321.03, and GBP 1,075.10 per ounce.

Today’s AM fix was USD 1,717.00, EUR 1,317.22, and GBP 1,072.12 per ounce. Yesterday’s AM fix was USD 1,725.00, EUR 1,321.03, and GBP 1,075.10 per ounce.

Silver is trading at $31.80/oz, €24.52/oz and £19.95/oz. Platinum is trading at $1,590.25/oz, palladium at $605.25/oz and rhodium at $1,125/oz.

Gold climbed $6.40 or 0.37% in New York yesterday and closed at $1,728.50. Silver hit a high of $32.434 and finished trading with a gain of 1%.

Gold edged down on Tuesday, in tandem with equities that relinquished gains, however demand from jewellers supported prices as investors await the policy statement from the US Federal Reserve meeting to be released on Wednesday at 18:15 GMT.

No major announcements are expected to come out of the meeting. Last month the Fed committed to hold rates low even after the economic recovery has strengthened. This was the signal that indicated it will continue intervening until the economy grows fast enough to decrease US unemployment sharply.

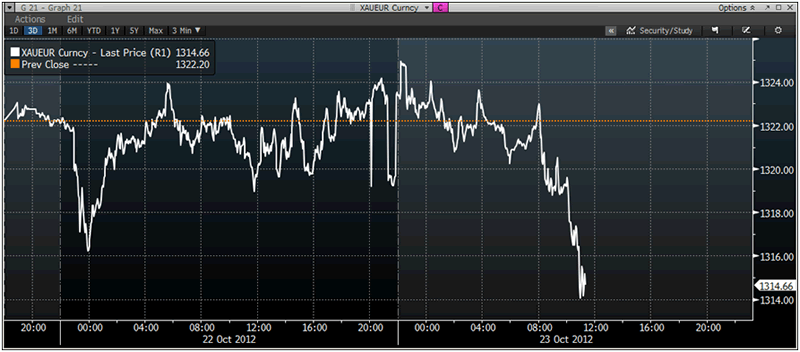

XAU/EUR Currency 3 Days – (Bloomberg)

The euro remained firm against the dollar as the market expects Spain to apply for a bailout within the next month. Now that Spain’s regional elections are complete and with Spain’s Prime Minister Rajoy’s People’s Party winning 41 out of 75 seats in the Galician assembly this affirmed the approval of financial austerity measures and paves the way for a formal bailout from the EU.

Spain's central bank announced this morning that the Spanish economy contracted at a faster pace in Q3 (1.7% vs. 1.3%) and that the country may miss its budget-deficit target because of tax-revenue shortfalls.

In India, demand for the yellow metal climbed overnight after a rebound in the rupee discounted prices by 1%.

German Federal auditors handed in a report slamming the Bundesbank for not inspecting their foreign held gold reserves to verify their book value.

The report says the gold bars "have never been physically checked by the Bundesbank itself or other independent auditors regarding their authenticity or weight." Instead, it relies on "written confirmations by the storage sites."

The lion’s share of Germany's gold reserves (nearly 3,400 tons estimated at $190 billion) are housed in vaults of the US Federal Reserve, the Bank of England and the Bank of France since the post-war days, when they were worried about a Cold War Soviet invasion.

The Bundesbank stated, “There is no doubt about the integrity of the foreign storage sites in this regard".

In contrast with best industry practices Germany’s gold reserves do not seem to be independently verified by a third party. GoldCore Gold Bullion Services offers clients secure storage accounts in Zurich, London, USA and Hong Kong, with independent verification of all client stored assets.

Philipp Missfelder, a politician from Merkel’s own party, has asked the Bundesbank for the right to view the gold bars in Paris and London, but the central bank has denied the request, citing the lack of visitor rooms in those facilities, German’s daily Bild reported.

The Bundesbank won't let German parliament members inspect the German gold vaulted abroad because the central bank vaulting facilities supposedly lack "visiting rooms." And yet one of those vaults, the Federal Reserve Bank of New York, offers the public tours that include "an exclusive visit to the gold vault".

Cross Currency Table – (Bloomberg)

With German elections around the corner (and this a politically sensitive issue) the central bank decided last month to repatriate about 50 tons of gold per year over the next 3 years from New York to its headquarters in Frankfurt for "thorough examinations" regarding weight and quality, the report revealed.

The auditor’s report stated that the German Central Bank’s gold in London has dropped "below 500 tons" due to recent sales and repatriations, but it did not specify how much gold was held in the U.S. and in France. German media have widely reported that some 1,500 tons — half of their total is stored in New York.

The lack of an announcement of the sale of the German gold in London suggests that the sale was actually part of a gold swap with another central bank -- like the New York Fed. The only question is the lack of transparency surrounding the fall in London. Was German gold sold at the behest of the US and in exchange Germany took title to US gold vaulted in the New York? Or was title to gold supposedly vaulted in the United States?

German economists have led a rally to “bring home our gold” and the news article listed below was circulated by the AP.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.