Gold Stage Three Volatility

Commodities / Gold and Silver 2013 Oct 23, 2012 - 03:00 AM GMTBy: Darryl_R_Schoon

STAGE 3: The price of gold is subject to increasing highs and lows and large investment funds move in and out of gold as global uncertainties wax and wane, a sign that gold is increasingly a haven in uncertain times.

STAGE 3: The price of gold is subject to increasing highs and lows and large investment funds move in and out of gold as global uncertainties wax and wane, a sign that gold is increasingly a haven in uncertain times.

pp. 151-152, Time of the Vulture: How to Survive the Crisis and Prosper in the Process, DRS, 3rd ed., 2012

In How to Survive the Crisis and Prosper in the Process (3rd ed., 2012) I describe the five stages of gold. When I began writing the book in 2006, gold was in Stage 2. In 2007, gold entered Stage 3 where speculators and investment funds become a factor the increasingly volatile price of gold.

On October 19th, Commerzbank attributed the day’s 1.3 % fall in the price of gold to speculative financial investors: “The Dollar Gold Price fell to $1732 per ounce Friday …We hold selling by speculative financial investors responsible for the price slide…In recent weeks they had strongly built up their positions and may now be seeing themselves forced to take profits given the faltering upswing."

http://goldnews.bullionvault.com/gold-price-101920121#DC-20121019

![Live New York Gold Chart [Kitco Inc.]](/images/2012/Oct/gold_23_image002_0000.jpg)

While speculators and investment funds may have indeed driven last week’s sell-off, they had sufficient incentive to do so. The paper-money cartel, concerned a two-month rise in the price of gold was evidence of growing momentum, had moved on September 27th to force the price of gold lower.

WHAT YOU DON’T KNOW EXPLAINS WHAT YOU DON’T UNDERSTAND

Gold had begun moving up August 2012. Beginning at $1600, it finished August at $1650; but gold’s August advance would more than double in September with gold ending at $1780. Gold was on the move and the paper-money cartel had noticed.

On September 27, the cartel acted against gold by sharply lowering one-month gold lease rates, incentivizing bullion banks to borrow then sell gold on the open market; increasing the supply and thereby driving down the price of gold.

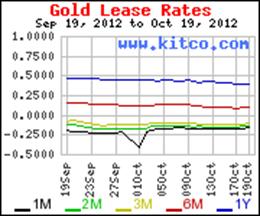

Chart 1

It worked. In October gold fell from a high of $1790, culminating in the $22 drop on October 19th, a drop Commerzbank attributed to financial speculators. The attribution is only partially correct.

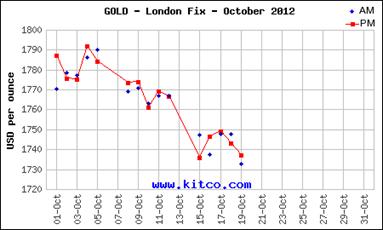

Chart 2

The selling had been earlier set in motion by increased gold supplies from the bullion banks. The banks had taken advantage of now lower one-month gold lease rates already at negative levels to borrow gold then sell it on the open market and reinvest the funds elsewhere.

TIME AND TIME AGAIN

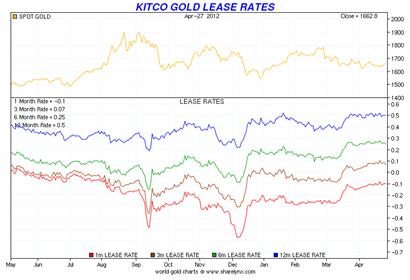

Last year, the paper-money cartel had also lowered gold lease rates for the same reasons. In Gold’s Coming Rise, I noted how the paper-money cartel capped gold’s rise in the summer of 2011 by manipulating gold-lease rates that September.

When gold rose from $1500 to $1900 between July and September, the bullion banks cut the one-month, two-month, three-month, six-month and one-year lease rates for gold; flooding the markets with enough gold to reverse gold’s then powerful upward trend.

As a consequence, during September gold dropped from an intraday high of $1920 on September 3rd down to $1620 on September 30th and when gold began moving higher again in October and November, the paper-money cartel again responded with even lower lease rates in December.

Chart 3

Chart 4

Lowering the gold lease rates in September and December 2011 forced the gold bear back into his cave to lick his wounds until August 2012 when gold began to move upwards; and then, on September 27th, the paper-money cartel attacked gold again.

WHAT A DIFFERENCE A YEAR MAKES

No one knows how long gold will remain in Stage 3. What is certain is that we are closer to Stage 4 by a year than in September 2011 when gold-lease rates were lowered; and there is a critically important difference between this year and 2011.

In September 2011, the paper-money cartel attacked gold by collectively lowering the one-month, two-month, three-month, six-month and one-year lease rates (see Chart 4). This year the cartel only lowered the one-month lease rate (see Chart 1).

In 2011, the paper-money cartel believed their attack on gold would keep gold prices low for up to a year and were willing to offer and take 12-month bets on that possibility. Today, in 2012, the paper-money cartel is willing to risk only 30 days on that very same bet; and, someday—and perhaps soon—even 30 days will be too long.

GOLD: STAGE 4 – WHEN GOLD EXPLODES UPWARDS

An explosive ascent in the price of gold. A crisis results in a monetary breakdown which drives the price of gold to never-before-seen highs. Investment capital floods towards the safety of gold. Central banks capitulate.

p. 152, Time of the Vulture: How to Survive the Crisis and Prosper in the Process, DRS, 3rd ed., 2012

Stage 4 is what the paper-money cartel fears most of all. This is the stage when panic-stricken investors realize too late that the bankers’ game of leveraged debt is over. Stage 1 began with the bankers’ suppression of the price of gold and the current stage, Stage 3, will end in Stage 4 when the bankers’ decades-long suppression of market forces explodes in a cataclysmic rendering of credit and debt-based paper instruments and the collapse of financial markets.

There’s a bull in the bear’s cave

In the end, only gold and silver will be left standing on a field littered with the piles of now worthless paper coupons that once passed for money. My current youtube video, Why Gold? Why Debt?, is now available on my website at www.drschoon.com.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.