Correction in Gold and Silver Stocks Nearing End

Commodities / Gold & Silver Stocks Oct 18, 2012 - 12:48 PM GMTBy: Jordan_Roy_Byrne

We expected a correction after the gold and silver shares ran into predictable resistance that coincided with October seasonal resistance. That was predictable. Now we are 19 days into the correction and we see some stealth signs of strength and signs of the correction nearing its end.

We expected a correction after the gold and silver shares ran into predictable resistance that coincided with October seasonal resistance. That was predictable. Now we are 19 days into the correction and we see some stealth signs of strength and signs of the correction nearing its end.

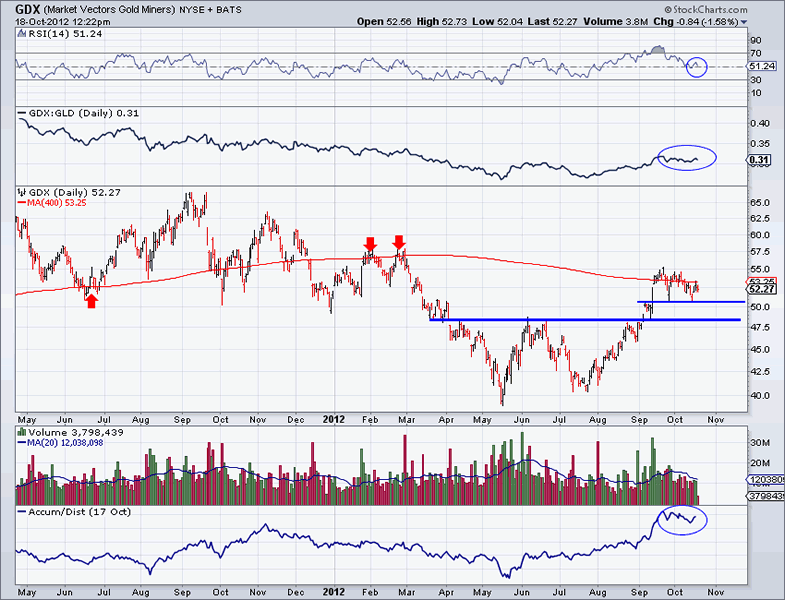

Let's take a quick look at GDX before we get to the analysis.

There are numerous positive elements to the current technical makeup of GDX. First, is the price action. The market has very strong support at $48 to $49. It first bottomed at $50.90 and then at $50.81 on Monday. Since then, GDX pushed higher to $53. Secondly, note that the RSI bottomed at 50. In a bull trend the RSI will bottom at 40 and not the typical 30. However, in a very strong bull trend the RSI can bottom at 50. Third, the GDX vs. GLD ratio has shown strength in the past few days and has shown little to no weakness during this correction. Finally, note the accumulation line at the bottom of the chart. It barely dipped after surging for several months.

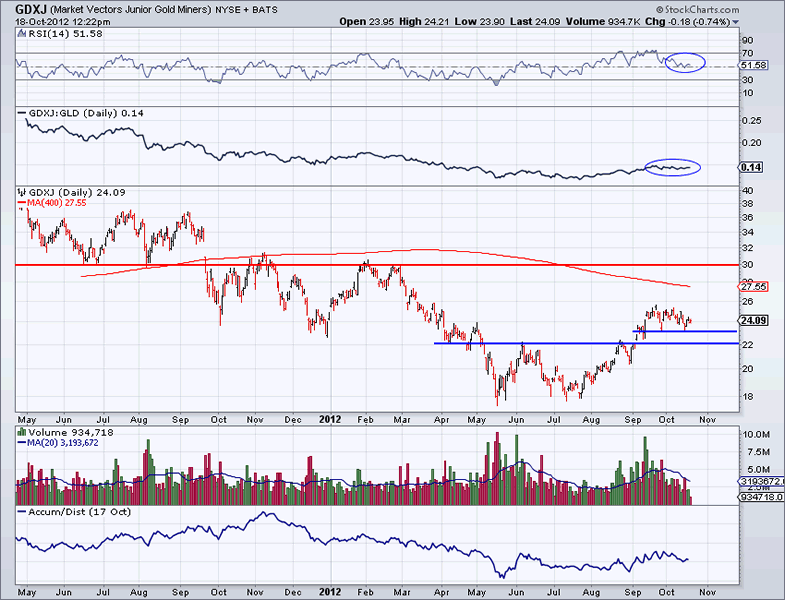

Next, let's take a look at GDXJ. Do you notice the similarities to GDX?

GDXJ has strong support at $23 but managed to bottom twice at $23. Meanwhile, the RSI indicator has remained above 50 and the GDXJ vs. GLD ratio has remained steady during the correction. Once we have confirmation that the correction is complete, we'd target $30 in the near term. A close below $23 would indicate that the correction has further to go.

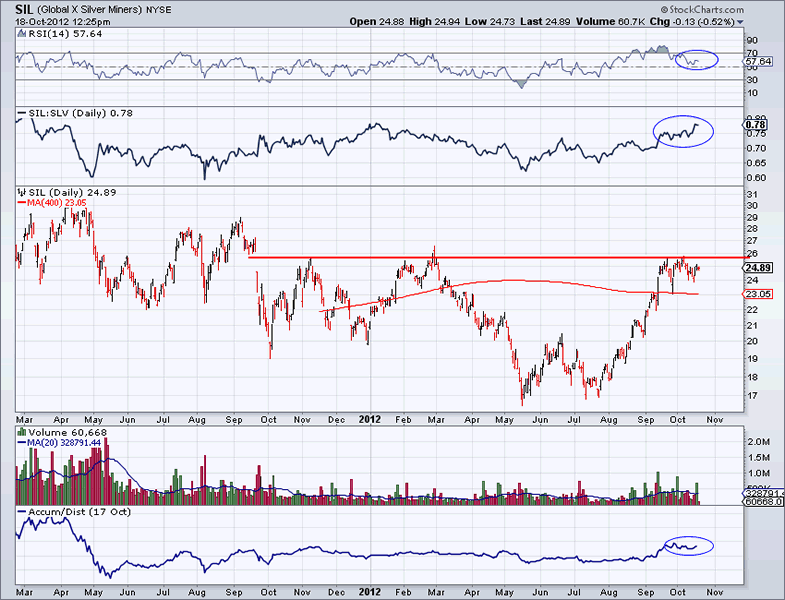

Moving to the silver shares, we see the same things we see in the previous charts. The market has maintained support at $23, RSI is holding above 50, there has been little distribution during the consolidation, and the silver stocks are trending higher against SLV.

Precious metals shares enjoyed a strong summer rebound after forming a double bottom. Their overbought condition has been worked off in a consolidation more so than a correction. As we noted, the shares are quietly showing signs of strength that hint at another leg higher in the not too distant future. The shares could remain in consolidation for a few more weeks but it would not impact the bullish prognosis for the medium term. As long as recent lows hold, this bullish analysis applies going forward.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.