World Gold Council Publishes Gold’s Q3 Summary

Commodities / Gold and Silver 2012 Oct 18, 2012 - 10:05 AM GMTBy: GoldCore

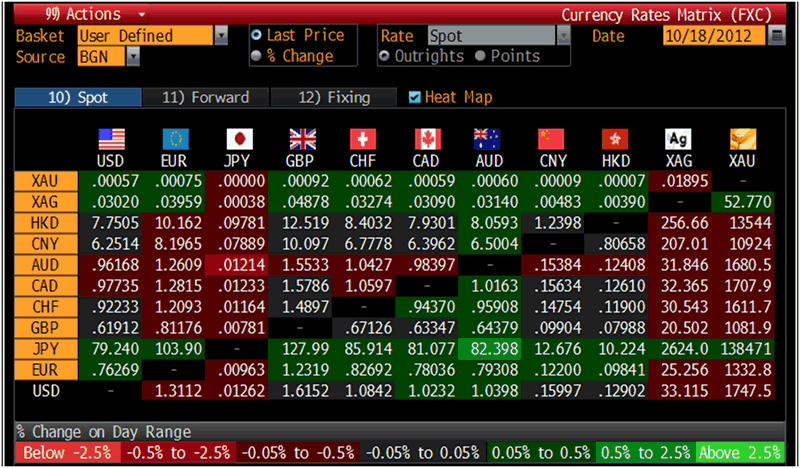

Today’s AM fix was USD 1,748.00, EUR 1,331.71, and GBP 1,081.42 per ounce. Yesterday’s AM fix was USD 1,747.75, EUR 1,333.86 and GBP 1,082.33 per ounce.

Today’s AM fix was USD 1,748.00, EUR 1,331.71, and GBP 1,081.42 per ounce. Yesterday’s AM fix was USD 1,747.75, EUR 1,333.86 and GBP 1,082.33 per ounce.

Silver is trading at $32.96/oz, €25.26/oz and £20.52/oz. Platinum is trading at $1,657.50/oz, palladium at $648.40/oz and rhodium at $1,200/oz.

Gold inched up $1.05 or 0.6% in New York yesterday and closed at $1,748.70. Silver climbed up & down and hit a session high of $33.255 and finished trading with a gain of 0.61%.

Gold hovered on Thursday, maintaining gains from the last two days and watching for new stimulus from a European Union summit after little reaction to news from China that showed the economy’s seventh quarter of GDP contraction.

The 27 member states of the EU will meet in Brussels today and tomorrow. The agenda includes, Greece’s progress in debt talks with creditors, organizing a common eurozone budget and initial discussions for the proposed EU banking union.

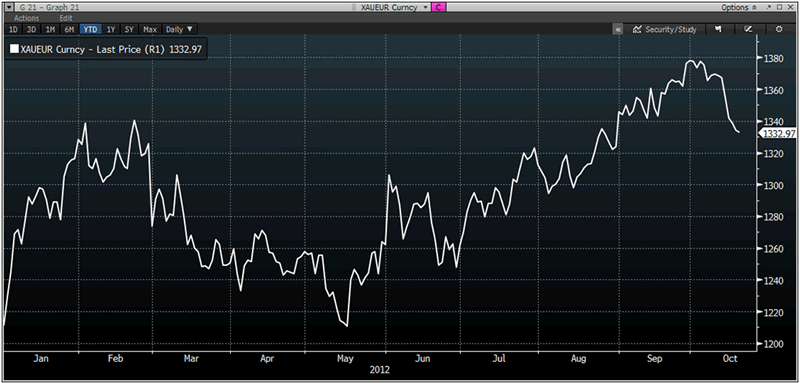

XAU/EUR Currency YTD – (Bloomberg)

The proposed ECB Bank as a single banking supervisor similar to the US Fed was received well by markets but is met with resistance from some of the bloc’s members- the strongest being Germany.

Greece is set to run out of money by the end of November without the €31.5 billion in external funding on offer and in the Sunday edition of Greece's Kathimerini newspaper, Greek Prime Minister Antonis Samaras said that he expected to reach a deal before the summit.

Investors are still waiting for Spain to seek a formal request for a bailout next month.

China's economy dropping for its 7th quarter was as expected. However, investors desire more policy clarity from Beijing with the leadership change next month, and speculate that further quantitative easing will be announced.

Cross Currency Table – (Bloomberg)

HSBC trimmed their 2012 gold forecast to $1,700/oz but raised its 2013 to $1,850 and 2014 to $1,775/oz. The price targets were adjusted based on the views of the Fed's open-ended commitment to easing until U.S. labor markets improve, will continue support gold well into 2013.

The World Gold Council issued a summary on gold’s price performance in various currencies during the third quarter. The report looks at influences that monetary policies and central bank actions have on gold.

Gold’s 11.1% USD/oz return in 3Q was in response to central bank stimulus measures. Volatility decreased and generally correlated with other assets.

Central banks announced a continuation of their unconventional monetary policy1 programmes in Q3 which mainly are used to lower borrowing costs and supporting financial markets.

Financial assets have responded to central bank policy announcements, but gold's reaction has been the strongest.

There is a consensus that these policies drive investment into gold purely due to inflation-risk impact. The World Gold Council believes that there are not one but four principal factors that provide further support to the investment case for gold: Inflation risk, Medium-term tail-risk from imbalances, Currency debasement and uncertainty, and Low real rates and emerging market real rate differentials.

To read the full report on the World Gold Council website click here or access from GoldCore’s Research section.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.