Think of Gold as Anti-Fed, for a Golden Future

Commodities / Gold and Silver 2012 Oct 16, 2012 - 12:48 PM GMT Now that gold has declined for a couple of sessions, I can sense worry creeping back into the market place. Personally I think that’s healthy because too many people who know too little about gold have had too much to say about it. These corrections are the market’s way of telling them to shut up! I am fascinated by investors who can watch stock prices go nowhere for years, and yet they sat on stocks all that time and never complained. Gold on the other hand takes a breather for a week and these same investors will throw out the baby with the bath water. So far the spot price for gold has fallen from the October 4th closing high of 1,791.80 to yesterday’s close of 1,738.50; just enough to get the Chicken Little’s out and cackling.

Now that gold has declined for a couple of sessions, I can sense worry creeping back into the market place. Personally I think that’s healthy because too many people who know too little about gold have had too much to say about it. These corrections are the market’s way of telling them to shut up! I am fascinated by investors who can watch stock prices go nowhere for years, and yet they sat on stocks all that time and never complained. Gold on the other hand takes a breather for a week and these same investors will throw out the baby with the bath water. So far the spot price for gold has fallen from the October 4th closing high of 1,791.80 to yesterday’s close of 1,738.50; just enough to get the Chicken Little’s out and cackling.

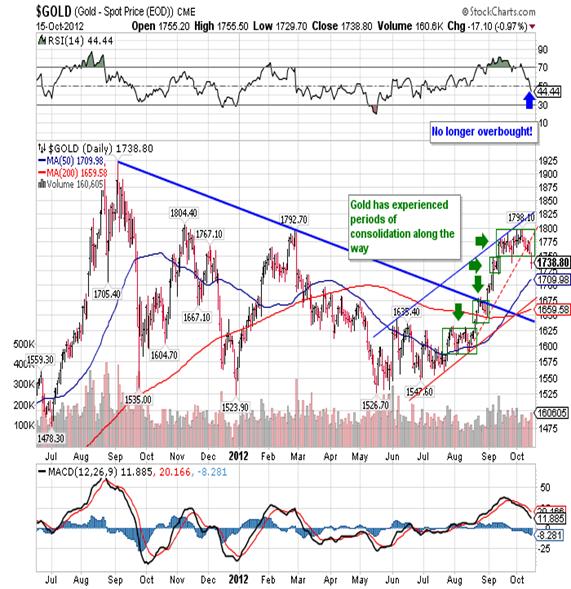

The yellow metal has a way of getting under people’s skin unlike anything else you’ll see in the market place. We love to see it move higher and that’s been the case as it rallied off of the June 1,547.60 low:

The correction so far stands at 3% and that is mild to say the least. In the process of correcting the RSI has moved from an extremely overbought level of 81.00 to yesterday’s close at 44.44 and is approaching oversold. Also, the histogram is at a negative 8.28 and that’s as low as it’s been in almost four months!

Yesterday’s 17.10 decline was the seventh day down from the October 4th top and really shouldn’t shock anyone. Markets correct and it’s healthy. Unfortunately we have unreal expectations when it comes to gold that we would never impose on another index or commodity. As declines go, I have

been looking for a seven to nine day reaction and I still think that’s what we’ll get here. You have good Fibonacci support at 1,723.50, strong support at the 50-dma, and both can easily be reached in a day or so. Right now the spot gold is up 4.50 at 1,741.90 in what I would describe as quiet trading.

I believe gold has potential to break all time high of $1,921 an ounce by the end of this year. I also believe gold should be purchased right now and told my clients just that yesterday. I am not alone in thinking gold is going higher. According to figures published by Saxobank (Denmark), gold investments through Exchange Traded Funds reached a new record during the week with more than 200 tons added since the rally resumed in mid-August once the price moved above $1,625an ounce. Hedge funds and other leveraged investors only joined in following the break above that level, but have since then added 380 tons. Physical demand from China and India, the two major buyers, had been subdued but is now picking up. Also, there are new reports of central bank buying, especially from emerging economies, and is expected to reach a new record in 2012.

All in all I continue to see a lot more upside potential for gold over the next four to six months, and the same can be said for silver as reduced demand from industrial users increases the pressure on financial investors to keep an already stressed supply surplus down. According to the Copenhagen based bank, “With the open ended nature of quantitative easing, part three, we see the potential for gold reaching the 2011 high at $1,921/oz. during December following an initial period of consolidating as $1,800 offers strong resistance. As most of you already know, I see gold at $2,400.00 by March 2013. The bank thinks the rally may eventually take us up and above the physiological barrier of $2,000 in early 2013 before reaching a technical target of $2,075.”

CONTRACT SUPPORT RESISTANCE

SPOT GOLD 1,709.60 1,770.60

1,632.30 1,820.90

1,899.90

1,971.40

Nothing is without risk and that goes for gold as well. There is always downside risk and an investor has to be aware of that risk. If you measure the last leg up, as I have in the following chart, you can see that gold has retraced 25% and touched support at 1,731.75 in the process:

If this is a strong trend, and it has been so far, this could be the low. In spite of that I am still looking at 1,723.50 as a possible bottom, and a worst-case scenario of 1,698.70 to 1,709.60. Why such a broad brush stroke? Simply put gold and silver are manipulated markets and you always have to take that into consideration. Fortunately for us, manipulation is only effective over the short run and that’s why the “smart money” goes in for the long haul. Always keep in mind that no amount of market manipulation can overcome “general market conditions,” a lesson that Mr. Bernanke is going to learn the hard way.

CONCLUSION

Slowly but surely the public is becoming aware of the Fed’s blatant mismanagement. Even the mainstream media will be forced to report the truth; only they give it to you with an eyedropper. This weekend there was a good article in Forbes entitled, "Gold Can Save Us From Disaster." This is the title of the editorial in the October 22 issue of Forbes magazine. The article insists that gold must be freed from the onerous taxes placed on it by the US government. On the opposite side of the fence we have the Fed who wants its fiat currency to be the only legal tender, and therefore it does not want gold to be legal tender. If gold is actually currency, or the dollar is pegged to gold, then the Fed cannot act without first increasing the supply of gold! As it stands now, the US government is forcing Americans (and going against the US Constitution in the process) to use the Fed's fiat currency as our legal tender

Forbes is asking for change saying that Americans must be allowed to use gold and silver as legal tender for the payment of all debts. Of course there are lobbyists and PAC’s that will fight to the death in order to see that that doesn’t happen. Think of gold as the anti-Feb, the more gold in circulation, the less power the Fed has. If gold is allowed to become money, the Fed will be powerless. Gold is our only protection against the wild printing of junk currency by the Federal Reserve. Forbes says that gold can save us from disaster, but I disagree. All the distortions from decades of fiat abuse are already upon us and must be allowed to play out. All that fiat-generated debt must be discounted down to its true value of pennies on the dollar, and only then should gold be introduced. That is still way off in the future.

Giuseppe L. Borrelli

www.theprimarytrend.com

analyst@theprimarytrend.com

Copyright © 2012 Giuseppe L. Borrelli

- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.