ETF “Costs and Liabilities” Sees Investors Migrating to Physical Gold

Commodities / Gold and Silver 2012 Oct 16, 2012 - 06:51 AM GMTBy: GoldCore

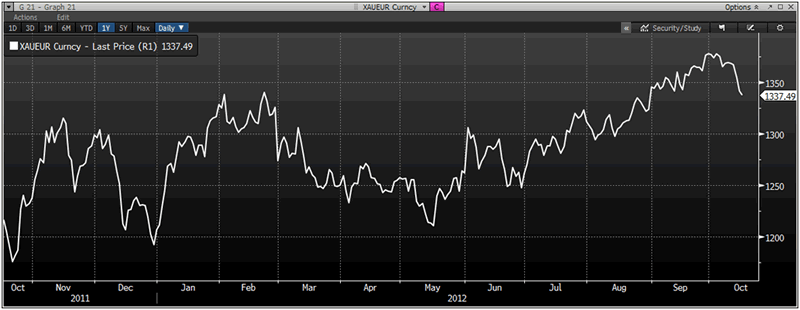

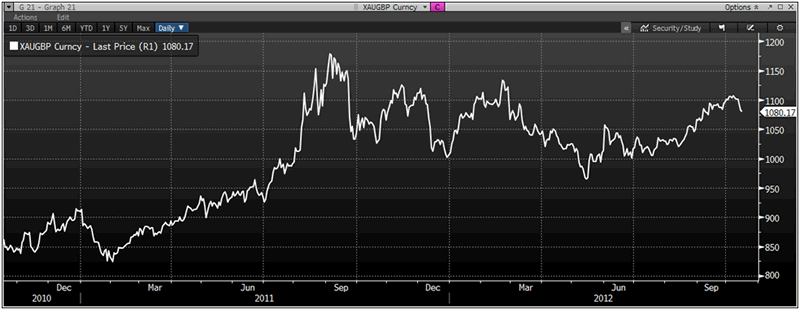

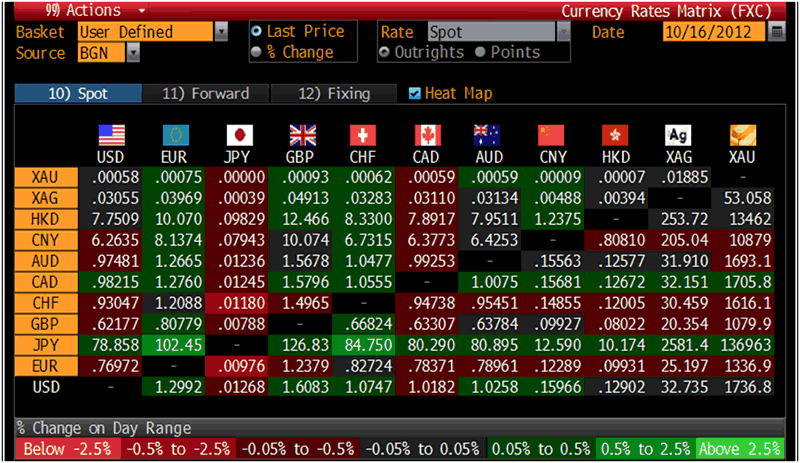

Today’s AM fix was USD 1,737.50, EUR 1,337.36, and GBP 1,080.40 per ounce. Yesterday’s AM fix was USD 1,747.25, EUR 1,347.56 and GBP 1,086.87 per ounce.

Today’s AM fix was USD 1,737.50, EUR 1,337.36, and GBP 1,080.40 per ounce. Yesterday’s AM fix was USD 1,747.25, EUR 1,347.56 and GBP 1,086.87 per ounce.

Silver is trading at $32.86/oz, €25.35/oz and £20.50/oz. Platinum is trading at $1,644.50/oz, palladium at $636.50/oz and rhodium at $1,160/oz.

XAU/EUR Currency 1 Year – (Bloomberg)

Gold dropped $18.00 or 1.03% in New York yesterday and closed at $1,736.40. Silver fell to a low of $32.62 and finished with a loss of 2.36%.

Gold edged up on Tuesday, but its appeal was diminished by positive US retail sales data.

In September, The US Federal Reserve committed to buying $40 billion of mortgage-backed securities on a monthly basis only as long as it is needed to improve the labour market.

The markets are also waiting on a firm commitment from Spain as to when and how much financial aid it requires as the eurozone crisis lingers on.

Physical buying in Singapore saw premiums jump 80 cent per oz above London prices for high quality gold bars.

XAU/GBP Currency Daily – (Bloomberg)

The head of industrial and precious metals trading at Barclays, Cengiz Belentepe, has told Bloomberg that investors are selling their investments in gold ETFs and opting for the safety of allocated physical gold.

According to Barclays, gold holdings in ETF products are growing at a slower pace than in 2004-2009 because some investors may be moving to physical bullion after initial purchases of an ETF.

Gold holdings in ETPs have increased 9.6% this year to a record 2,582.98 metric tons, data compiled by Bloomberg show. They rose 7.9% last year and 19% in 2010. Growth in gold ETP holdings has exceeded 35% from 2004 to 2009, the data show.

Barlcay’s Belentepe said “the question is whether the pace of buying has slowed, or whether the people have become a bit more sophisticated in recognizing the costs and liabilities.”

‘‘We’ve seen instances of people coming in, whose first step is to buy an ETF, second step is to get educated on how the market works, third step -- I’m going to shift this in direct gold purchase and storage, fourth step -- let me allocate this metal into these locations. It’s the early step they are all migrating through, expressing the same view but in different ways.”

One would have to be cautious here as Barclays have been aggressively marketing their new precious metal storage solution. Barclays may be attempting to capture some of the large capital flows that have flowed into the ETFs in recent months and continue to do so.

Gold ETFs have a very significant degree of counter party risk to the many counter parties such as the trustees and the many custodians and sub custodians. The ETF is a second rate form of paper gold in which one becomes an unsecured creditor of a trust rather than the outright, beneficial owner of allocated and segregated coins and bars.

Some of the largest hedge funds managers and most respected investors in the world such as Marc Faber, David Einhorn and Kyle Bass have all warned regarding the ETF and spoke of how they favour physical bullion.

Indeed, Bass has warned of the risk of a COMEX default due to the exchange not being able to fulfil its delivery commitments should even a small fraction of futures buyers decide to take delivery,

More sophisticated, knowledgeable and risk averse investors will continue to opt for taking delivery or storing allocated gold coins and bars.

Cross Currency Table – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.