Gold And Silver Fall On Open In Asia As October Correction Continues

Commodities / Gold and Silver 2012 Oct 15, 2012 - 06:40 AM GMTBy: GoldCore

Today’s AM fix was USD 1,747.25, EUR 1,347.56, and GBP 1,086.87 per ounce. Friday’s AM fix was USD 1,767.00, EUR 1,362.80, and GBP 1,101.35 per ounce.

Silver is trading at $33.28/oz, €25.78/oz and £20.81/oz. Platinum is trading at $1,648.50/oz, palladium at $637.30/oz and rhodium at $1,175/oz.

Gold fell $13.10 or 1.49% in New York on Friday and closed at $1,754.40. Silver dropped to a low of $33.46 and ended trading with a loss of 1.47%. Friday’s falls resulted in gold falling 1.2% for the week, while silver fell 3% over the same period.

Gold USD 3 Days, October 11-15 – (Bloomberg)

Gold saw quick price falls at the open in Asia overnight and hit a two and a half week low, continuing the drop from the prior trading session. Stop loss selling was triggered that counteracted the news of China’s inflation data which hinted at a need for further QE.

The yellow metal had its largest daily drop in over two months on Friday. More speculative players may have taken profits and closed long positions after US consumer sentiment climbed to a five year high.

October is one of gold’s weaker months and a correction after recent gains was possible and has materialised. Further weakness is possible and indeed likely although physical demand from Asia has picked up and that should support gold at the $1,700/oz level.

UBS said this morning that it is important to point out that “volumes exiting are not overwhelming, the liquidation action is patchy rather than consistent, while outright shorts are in limited numbers.”

US gold futures and options net length climbed to 198,194 contracts for the week ended October 9th, the highest in nearly fourteen months.

This correction should be used to further accumulate physical bullion in anticipation for a rally in gold after the election in November.

The US Retail sales number is published at 1230 GMT.

Other economic data scheduled for release this week are:

Monday Empire Manufacturing & Business Inventories. Tuesday - CPI, Net Long Term TIC Flows, Industrial Production, Capacity Utilization, & the NAHB Housing Market Index. Wednesday - Housing Starts & Building Permits. Thursday - Initial Jobless Claims, the Philadelphia Fed, & Leading Economic Indicators. Friday - Existing Home Sales. China’s GDP numbers out this week.

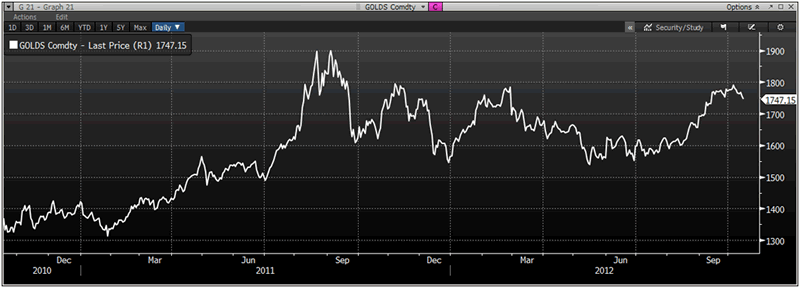

Gold USD Daily 2010-2012 – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.