What do White-Winged Doves have to do with Economics?

Economics / US Economy Oct 13, 2012 - 12:20 PM GMTBy: D_Sherman_Okst

Everything!

Everything!

This short, nonfiction, tragicomedy personifies what is wrong with our country, our economy and our totally inept and very dysfunctional legal system that has become a leech to taxpayers and a threat to humanity.

The Great Depression of the 1930s was brought upon by lawlessness. Documented, historical proof that a functioning economy is dependent on a basic legal framework. One that we no longer have.

It has been dismantled to allow a few megalomaniac psychopaths on Wall Street to become even richer.

‘A Wild Game’ is a byproduct of Corporatocracy which I wrote about in “Why We Are Totally Finished.” It correlates how idiotic laws threaten innocent Americans like Ryan Adams, a fellow blogger who writes about gourmet cooking. It clearly shows how common sense laws that protect innocent Americans were removed to enrich greedy psychopathic banksters and politicians.

Here is an excerpt from gourmet blogger Ryan Adam’s blog titled, ‘When life gives you wild game...’:

A few weeks ago, my wife and I were relaxing on the couch watching Project Runway—what?—when a loud “BAM” startled us and sent our pups into fits of barking. Initially we assumed that a stray baseball from a neighbor’s yard was the cause, but once outside we discovered this poor little guy. For whatever reason a White-winged Dove had gone kamikaze, breaking his neck in the process.

Coincidentally, dove season in Texas had started not twenty four hours earlier. Here in Texas, the dove hunting season is very popular. In 1999 alone an estimated 607,000 white-wings were harvested by hunters during the month of September. People travel long distances and pay big bucks to hunt these birds, and one had just been dropped into my hands.

A lot of people would either bury or throw away a dead animal under these circumstances.

I am not one of them.

Well, you know where this went...

Not only did he eat the bird that committed suicide-but he posted about a dozen instructional pictures of himself preparing the gourmet grilling—“La Mancha” style.

“Our” fine country holds less than 5 percent of the world’s populous but a quarter (25 percent) of the world’s entire prison population.

What does this have to do with our featherless friend above? You’re about to find out why.

Not one prisoner is a bankster that blew our economy to hell. The banksters decimated the housing market. A market responsible for one in six jobs. Put actual unemployment at 23.8%. Stole fortunes from every homeowner. Created massive amounts of fraudulent loans. Filled courthouses with fraudulent falsified forged documentation once called legal deeds of trust. They bundled these fraudulent loans and sold them as investments to pension funds, individual investors, cities and countries. Then sold them to anyone who would swallow anything marked Triple-A when Wall Street called them.

The banksters pressured the rating agencies to rate the investments without allowing underwriters to look at individual loan documentation. Where I was born they call this falsification, fraud, extortion and bribery.

Then they shorted the companies that were selling insurance policies on those very investments “should" they go bad because they knew they would go bad. While they were shorting AIG they cleared their books by selling “crap” (as they called it in their internal emails) to their own clients who they called Muppets or Dumb Money. And when things looked bad for AIG they bought insurance to protect their shorts that they had riding on AIG because they knew AIG would tank before AIG knew it was in trouble.

Another bank, UBS, created a new family of “feeder funds” to send their clients' assets to Madoff. Madoff paid them 4 percent per year for sending him clients so he could rip them off. All the while UBS explicitly instructed its employees to avoid Madoff. “Not To Do: Ever enter into a direct contact with Bernard Madoff!!!” They knew he was running a Ponzi scheme.

When a executive of UBS who was involved in creating the new funds received an inquiry on what he was doing he replied, “Business is business. We cannot permit ourselves to lose $300 million.” [Source: ‘Predator Nation’.] Read it!

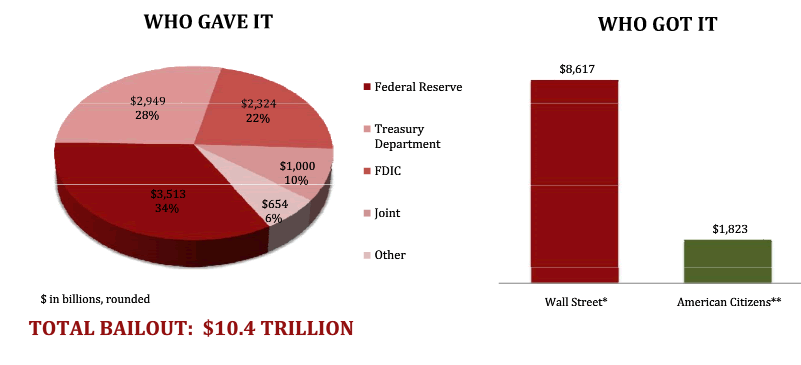

Then the criminals had their ex-CEO Hank Paulson hold a gun to our heads as he demanded a blank check, which to date has us paying out $10.4 trillion.

We pay for their criminal acts. Our kids pay for their crimes. Forty-five million Americans live in poverty as a result of absolute lawlessness. The Second Great Depression is a direct result of this.

And who does law enforcement go after? What does our legal system focus on?

You know where this it going...

The Texas Parks and Wildlife Department scoured the web and decided to investigate our gourmet cook and fellow blogger possessing wildlife resources that have “not been taken legally.”

The SEC has a massive budget and lawyers who spend their days looking at pornography, the Texas Parks and Wildlife Department surfs the web and wastes time on suicidal birds.

This is our economy. A Monopoly game of passing go and collecting $200 fake dollars printed by the "Fed". The banksters get rich on crime, you go to jail for no reason at all.

It is illegal to cook a bird that commits suicide by flying into the side of a house. Your house. On your property. All because the law says to acquire game you must have a hunting license and the correct ammunition.

Birdshot is acceptable ammo, vinyl siding is not.

Does the word “MORONS” come to mind?

Maybe the EPA will get in the act and outlaw houses to protect suicidal birds. Bright-light Linda Jackson headed up the Obama EPA. Like Bernanke—a Princeton educated appointee who couldn’t buy common sense if Amazon sold it online. Jackson’s resume is littered with criminal neglect and child endangerment on a massive scale. Her unit found out (during the Bush Administration) that a day-care facility was actually housed in a former thermometer factory and was exposing toddlers to mercury. Jackson failed to alert the parents for over 90 days.

Leadership material. Serious Princeton leadership material.

Cheney held secret energy meetings with CEOs in the energy sector. The EPA later excluded fracking-juice lakes from the Clean Water Act. Frack a well, dump 8 million gallons of water that has been mixed with 597 carcinogenic chemicals in a manmade lake and let it seep into wells and evaporate and rain down on us—that is okay. Let kids play in mercury and don’t tell parents, also okay.

Toxic bankster derivatives—also okay. Not wasting suicidal delicacies—not okay.

Do you understand how America works?

Greenspan, Phil Gramm and Rubin led the charge to repeal the Glass-Steagall Act. The Great Depression era fix created to prevent another depression. The firewall separating investment banks and commercial banks. Rubin’s reward? Vice chairman of Citigroup where he made $120 million.

Larry Summers, Alan Greenspan, SEC Chairman Arthur Levitt and Senator Phil Gramm got a law banning any regulation of OTC derivatives. From 2003-2007 $3 trillion in often fraudulent MBS were cranked out by America’s financial sector. [Source: ‘Predator Nation’]

If the banksters can get rich off changing a law, they get it changed. As a reward for changing the law the politicians like Rubin get paid off via a revolving door. Or, in other cases, the politicians write laws that allow them to make millions while in office. For instance: Spencer Bachus was chairman of the House Financial Services Committee and he shorted the DOW when it was above 11,000 on September 18, 2008 after Ben Bernanke and Hank Paulson gave him insider information during emergency economic briefings.

It is legal for Congress to trade on insider information. It is not legal for you to trade on insider information.

Nor is it legal for gourmet food connoisseurs to eat birds who commit suicide on their land.

"We've" created an economy based on manufacturing moronic laws that permit the criminals to pray on us.

Suicide by corporatocracy is not painless.

For the first time I've been alive: More Americans committed suicide than died in car crashes. Deaths from suicides rose 15 percent and deaths from poisoning rose 128 percent, the latter are often when intentional overdoses get classified as.

The only thing economically I've been wrong on so far is this: Celente said, "when people lose everything—they lose it." I optimistically thought he meant pitchforks and torches and not suicide.By D. Sherman Okst,

Bernardston MA USA

davos @ psychopathiceconomics.com

I'm an ex-airline captain with about 15,000 hours and am amazed at all the BS we are taught. Most of my friends still in the business were also taught the wrong aerodynamic principles with respect to what makes planes fly. Aviation or economics, Keynes to Austrian - Bernulli to Newton we've been sold bad goods. It's amazing anything works as backwards as we do things.

© 2011 Copyright D. Sherman Okst - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.