The Iran Hyperinflation Fact Sheet

Economics / HyperInflation Oct 07, 2012 - 09:11 AM GMTBy: Submissions

Steve H. Hanke writes: For months, I have been following the collapse of the Iranian rial, tracking black-market (free-market) exchange-rate data from foreign-exchange bazaars in Tehran. Using the most recent data, I now estimate that Iran is experiencing hyperinflation – a price-level increase of over 50%, per month.

Steve H. Hanke writes: For months, I have been following the collapse of the Iranian rial, tracking black-market (free-market) exchange-rate data from foreign-exchange bazaars in Tehran. Using the most recent data, I now estimate that Iran is experiencing hyperinflation – a price-level increase of over 50%, per month.

In recent days, Iranians have taken to the streets in protest over the collapse of the rial. In response, the Iranian government has cracked down on the protestors and shuttered Tehran’s foreign-exchange black market. Moreover, it has effectively cut off the supply of reliable economic information. Indeed, the signal-to-noise ratio in the Iranian economic sphere, which is normally quite low, is now even lower than usual.

To address this, I have prepared a fact sheet of the top 10 things you should know about Iran’s hyperinflation.

- Iran is experiencing an implied monthly inflation rate of 69.6%.

- For comparison, in the month before the sanctions took effect (June 2010), the monthly inflation rate was 0.698%.

- Iran is experiencing an implied annual inflation rate of 196%.

- For comparison, in June 2010, the annual (year-over-year) inflation rate was 8.25%.

- The current monthly inflation rate implies a price-doubling time of 39.8 days.

- For certain goods, such as chicken, prices may be doubling at an even faster rate.

- The current inflation rate implies an equivalent daily inflation rate of 1.78%.

- Compare that to the United States, whose annual inflation rate is 1.69%.

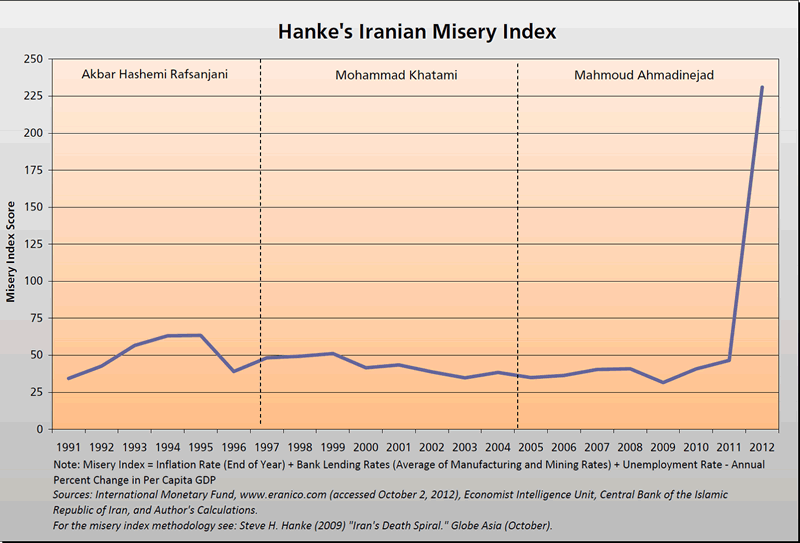

- Since hyperinflation broke out, Iran’s estimated Hanke Misery Index score has skyrocketed from 106 (September 10th) to 231 (October 2nd).

- See the accompanying chart.

- Iran is the first country in the Middle East to experience hyperinflation.

- Iran’s Hyperinflation is the third hyperinflation episode of the 21st century.

- The first was Zimbabwe, in 2008. The second was North Korea, whose episode lasted from 2009-11.

- Since the sanctions first took effect, in July 2010, the rial has depreciated by 71.4%.

- In July 2010, the black-market IRR/USD rate was very close to the official rate of 10,000 IRR/USD. The last reported black-market exchange rate was 35,000 IRR/USD (October 2nd).

- At the current monthly inflation rate, Iran’s hyperinflation ranks as the 48th worst case of hyperinflation in history.

- Iran currently comes in just behind Armenia, which experienced a peak monthly inflation rate of 73.1%, in January 1992.

- The Iranian Rial is now the least-valued currency in the world (in nominal terms).

- In September 2012, the rial passed the Vietnamese dong, which currently has an exchange rate of 20,845 VND/US

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2012 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.