Economic Reforms in India Likely To Stick This Time

Economics / India Oct 04, 2012 - 01:28 PM GMT

India has always taken a protectionist approach to managing its economy, initially out of a certain necessity and more recently as a result of populist politics.

India has always taken a protectionist approach to managing its economy, initially out of a certain necessity and more recently as a result of populist politics.

The initial necessity arose out of a desire to develop a stronger internal economy by fostering small businesses that cater to indigenous tastes and demands. That’s no surprise, given the huge cultural disparities within the country’s regions, especially between the more cosmopolitan and richer south and the poorer north.

In India, a regional business that understands its local markets enjoys a competitive edge. As a result, a huge class of mom-and-pop storeowners and entrepreneurs exists within the country and they’re not keen on the idea of foreign competition. Western companies such as Wal-Mart (NYSE: WMT) have historically met with stiff resistance when they’ve tried to enter the Indian market.

Indian politicians have liked it that way for the better part of two decades, implementing tough restrictions on foreign investment in everything from the retail trade and railroads to investment houses and soda makers. Over the intervening years, whenever loosening of those restrictions is proposed, Indian politicians with a more populist bent have managed to squash it.

Now, that’s all changing. Recently, India’s technocratic Prime Minister Dr. Manmohan Singh, an Oxford-trained economist, implemented several economic liberalization measures that threaten this regional paradigm. In a sweeping and unexpected program of reform, he and his Indian National Congress (INC) party hiked the price of diesel fuel and capped a national subsidy on cooking gas and eased restrictions on foreign direct investment in the retail, media and airline sectors. Plans to sell stakes in four government-owned companies were also pushed through.

In response, politicians immediately began calling for street protests. In years past, such dissent would have prompted politicians to quickly backpedal on the unpopular moves. This time around, the measures appear likely to stick because business now knows that liberalization is in its broader self-interest.

Earlier this year, both Fitch and Standard & Poor’s issued negative outlooks on India’s sovereign debt, noting concerns over the country’s deficit and the stifling economic effect of the country’s protectionist policies. If India were to lose its investment-grade rating, it would be the first of the BRIC nations (Brazil, Russia, India, and China) to be downgraded. That’s a dubious honor that Dr. Singh does not want on his resume and it would be a blow to his party’s prospects in forthcoming elections.

As shown in the chart below, India has also suffered from a sharp drop off in foreign direct investment (FDI). The decline in FDI inflows can be partially attributed to the global financial crisis of 2008-2009, but the real driving force has been the increasing pace of economic liberalization in other emerging market countries. As investment barriers have fallen throughout South America and much of Asia, investors have been quick to follow the resulting opportunities.

Source: Organisation for Economic Co-operation and Development

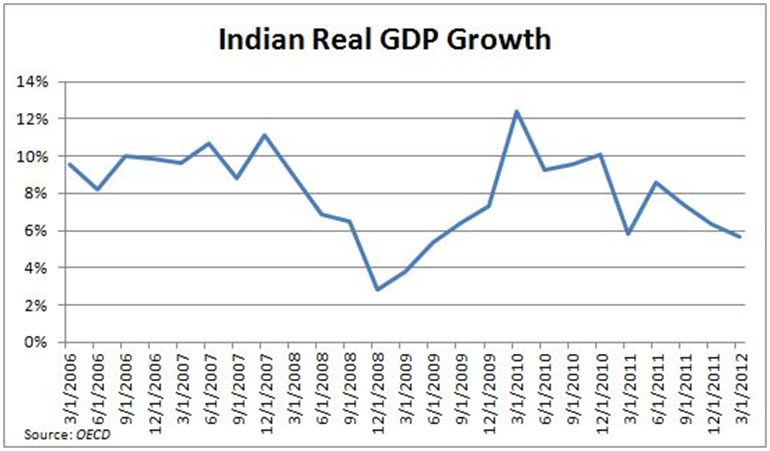

In turn, this trend has put a serious dent in India’s once-explosive economic growth, halving gross domestic product (GDP) growth from its 2010 peak of more than 12 percent to less than 6 percent now.

Source: OECD

Given those headwinds, Dr. Singh and the INC are likely to stand by their reforms. Moreover, these recent measures are just the starting point. If the INC maintains control of the government for the next few years, as appears likely, the shield of economic protectionism will be gradually disassembled.

HDFC Bank is positioned to be the biggest winner. Growth in FDI will mean more jobs and increase demand for banking services, particularly since India is an “under-banked” country with less than a third of Indians holding bank accounts. Greater FDI also will create demand for project financing, in which HDFC is already a leader.

While HDFC’s own credit rating isn’t in any danger, it could suffer collateral damage from a downgrade of India’s sovereign rating. When Standard & Poor’s downgraded America’s credit rating just over a year ago, the biggest US banks saw their own ratings reviewed. If India ultimately avoids a similar downgrade, all the better for HDFC. For a more extensive list of stocks set to benefit from India’s growth, check out my free report, The Best Asian Stocks to Buy Now.

© 2012 Copyright Benjamin Shepherd - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.