ECB Confidence Game, Gold Stocks Roller Coaster

Commodities / Gold & Silver Stocks Oct 04, 2012 - 03:36 AM GMTBy: HRA_Advisory

Did we tell you or did we tell you? It’s a bit premature to claim bragging rights but the Junior market has been trading exactly how we hoped it would. Ben Bernanke delivered the early Christmas presents gold bugs were dreaming of and the market tenor looks better than it has for a year.

Did we tell you or did we tell you? It’s a bit premature to claim bragging rights but the Junior market has been trading exactly how we hoped it would. Ben Bernanke delivered the early Christmas presents gold bugs were dreaming of and the market tenor looks better than it has for a year.

The operative word is still “better”, not “great”. The increase in volume in the Juniors is gratifying but still not enough. It will take higher volumes still to keep a rally alive through to year end.

In keeping with that note of cautious optimism we are sticking with discovery stories that are already working and later stage stories that were under loved until the gold price took off. A number of these are trading impressively well. So far discoveries and undervalued developers/small producers represent most all of the positive volume. They are riding the wave but the tide has not come in for the rest of the companies in the sector.

We still think the market may strengthen further in October but until that happens we decided to add a company to the list with built in protection in the form of a healthy back account. This company is not beholden to the market and should have news flow going forward. Like many companies, it still needs discovery news as a spark for a bigger move however.

After months of nothing but ugly, the market for resource stocks finally took a meaningful turn for the better. We all know the reason for that. US Fed chief Bernanke delivered on QE3 and the gold market responded.

The chart below shows how impressive the rally that kicked off in August has been. Bernanke telegraphed his move and the markets were already cheering a push by the ECB for its own money printing. By the time the Fed announcement of $40 billion a month in mortgage backed bond purchases was announced a lot of the gain was in. Since the announcement there has been another up-leg in price but that move appears to be stalled out in the $1770-1780 range. Where do we go from here?

The Fed’s actions have weakened the Dollar but for the trend to continue there needs to be more “risk on” trading. Even better would be progress by Europe or other currency blocks that leads to traders exiting the greenback to go long Euros or other currencies.

QE3 has certainly taken care of the risk-on part of the equation. That was probably the Fed’s main aim, in fact. Yes the buying will lower long term yields a little more but it also goosed the major market indices which we suspect was the major reason for doing it.

Notwithstanding anemic economic stats consumer confidence has been rising steadily in the US. This has much to do with gains in the stock market. Equities are a bigger part of the personal balance sheet for Americans than others. Seeing their 401Ks growing (those with jobs, that is) is making Americans more confident. So too is increasing evidence that the housing market is finally bottoming after five years of pain.

This confidence is not showing up in spending numbers yet. Other concerns like the Fiscal Cliff have been holding back hiring. The US economy needs to see some follow through for consumers to start spending. It will be tough to maintain momentum unless that happens.

In Europe, the ECB has a more complicated monetary equation to solve. Announcements of “unlimited” bond buying have helped European bourses but shareholdings are less widespread and those gains don’t impact confidence the way they do in the US.

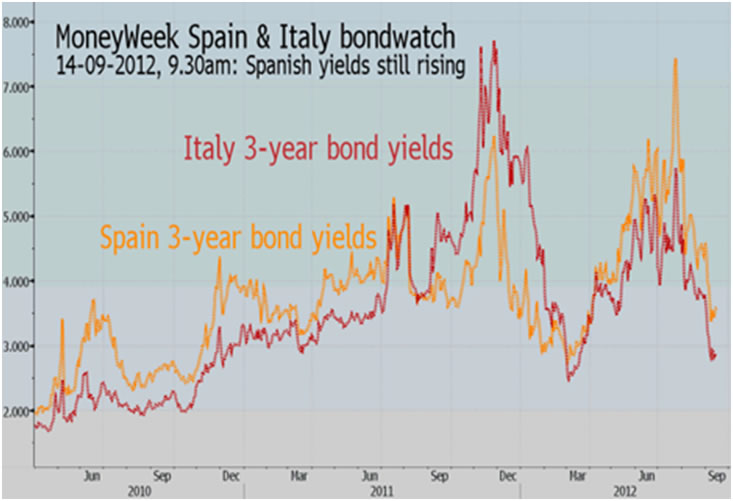

In the case of ECB head Draghi, it’s the bond market’s confidence levels that are the main concern. As the 3 year yield chart above for Spanish and Italian bonds shows Draghi too has had some success.

Rates started falling as soon as Draghi decided to call the bluff of Euro area politicians in August. They fell farther as the plan to buy bonds was outlined early this month but doubts have begun to creep in. “Unlimited buying” made for good headlines but the latest European plan is as opaque as its many predecessors.

In order to appease creditor countries the ECB plan calls for countries that need ECB backstopping their sovereign bonds to ask for help and to be willing to submit to further conditions. Three is no indication what those conditions would be.

That was enough to spook both Spain and Italy which insist they don’t need the help. Until debtor countries ask for help ECB bond purchases will be extremely limited. Most traders think Spain at least will have no choice. Spain recently published bank stress test results that indicate its major banks need to raise $60 billion in capital, $40 billion less than the amount expected and offered by the ECB during the summer.

Even so, Spain needs to issue about €300 billion in debt this year to cover its budget shortfall and maturing debt. The odds of Draghi turning on the printing press still look good.

In Japan, the government seems powerless to defend the Yen from buyers, even though its export economy desperately needs a cheaper currency. The Bank of Japan has added $200 billion to its liquidity funds. Japan can least afford to pile up debt but its cornered in a classis liquidity trap and here too the printing press will hum.

With both risk-on trades and a known minimum amount of new money getting printed the path of least resistance for the Dollar is down. Even if the ECB starts printing too that might not change. ECB bond buying could actually strengthen the Euro in the short term as it would be considered a positive development in their debt crisis. Either way, the Dollar should be capped and gold and silver should see more gains in coming weeks and months.

Base metals and materials need stronger economic stats. Most major economies published manufacturing indices in the past few days. While most readings improved marginally all of them except the US are still showing contraction.

If Europe can complete negotiations on banking oversight and the US consumer continues to cheer up the Euro zone may also move out of contraction. China’s leadership starts its party congress on November 9th. Beijing hasn’t added any stimulus since early summer. If that is going to happen it will probably start in about a month.

The chart below shows the turn around to date in the Venture Index. It’s still at depressing levels but the rally, such as it is, is the longest we’ve seen since the market turned down in March. Here too, confidence is needed. There have been early adopters buying (like HRA) but most are still on the sidelines. Higher volumes are the clearest sign more are joining the party so watch those. We expect the rally to run to year end. How far it climbs depends on who wins the confidence game.

Ω

2012 hasn’t been an easy year for explorers but HRA has been calling for a fall rally since early in the summer. Thanks to a surging gold price that rally appears to have arrived. It’s not a broad rally yet. Traders are looking for companies with discoveries and management that knows how to add shareholder value. HRA is your key to uncovering and profiting from extraordinary resource shares by getting ahead of the crowd. At HRA, we look for companies with the potential to at least double over one or two years based on asset growth and development of metals deposits for production or take over by larger companies.

To download our latest HRA Journal for free--which includes a recent new recommendation that is making gains--click here now!

By Eric Coffin

http://www.hraadvisory.com

The HRA – Journal, HRA-Dispatch and HRA- Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ , 85071 Toll Free 1-877-528-3958

hra@publishers-mgmt.com

©2012 Stockwork Consulting Ltd. All Rights Reserved.

HRA Advisory Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.