US Housing Indexes Bounce From Key Support, Bottom of the Housing Bust?

Housing-Market / US Housing Feb 12, 2008 - 03:22 PM GMTBy: Donald_W_Dony

After 30 months of plunging lower, several leading indicators of the U.S housing sector have finally found a narrow ledge to support their falling prices. Now the most important question is; can these past support levels be broad enough to hold the frail U.S. housing market indexes or is this just a short-term stop on the way down?

After 30 months of plunging lower, several leading indicators of the U.S housing sector have finally found a narrow ledge to support their falling prices. Now the most important question is; can these past support levels be broad enough to hold the frail U.S. housing market indexes or is this just a short-term stop on the way down?

Two of the key leading indiators on the housing market are the Housing Index, a combination of 20 suppliers, builders and leaders (the symbol is HGX) and the Dow Jones Home Construction sector.

Both of these groups have staged a waterfall drop down to a price level not seen in over four years. The Housing Index (Chart 1) has sunk to the October 2002 line of 118 and the Dow Jones Home Builders sector (Chart 2) has spiraled downward to 250. Both indexes have wiped out all of their growth for the past four years.

Technically, these two indexes should remain at current levels for several months. Fundamentally, do not expect a resurgence in prices for awhile. According to Warren Buffet during a recent visit to Canada, the outlook is still very grim.

He stated that he was not optimistic that the housing bust would work its way quickly through the financial system.

"It's going to take a while, because there's all these secondary and tertiary effects. It isn't just subprime. When housing prices go down, it affects the prime stuff too."

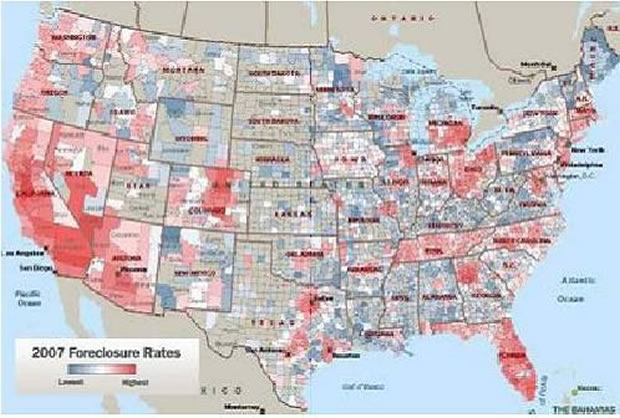

The increasing mortgage foreclosures (Chart 3) certainly would suggest this financial crises is not over. Over 2/3rds of the U.S. are battling with runaway housing defaults in all price ranges. Only the narrow band of states in the centre appear untouched for the moment.

Another area of potential damage that is lurking for the U.S. housing market is the mortgage strategy called the option ARMS. This concept offers home owners the ability to pay no principal and only pay part of the monthly interest. The mortgage over time increases as the unpaid interest is loaded back on to the mortgage total. These types of mortgages have dramatically grown in popularity over the past few years. According to the Mortgage Bankers Association, Option ARMs made up 7.2% of all mortgages in 2005 and have increased to over 20% in 2007, giving a total of around $250 billion for those three years alone.

Bottom line: Fundamental evidence strongly suggests the on going the crisis within the U.S. housing market is not over. The toxic combination of interest only mortgages, tightening credit and rising unemployment will take several years to unfold and stabilize. Sector prices are expected to remain depressed throughout 2008.

Additional research on the U.S. economy and equity markets can be found in the February newsletter.

Your comments are alway welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.