What Gold Analyst Consensuses is Telling Us

Commodities / Gold and Silver 2012 Sep 28, 2012 - 06:26 AM GMTBy: Clif_Droke

The big news in the commodities world lately is $10/barrel drop in the oil price in the last several days. The decline was initially blamed on Fed-Ex lowering its outlook for global growth and industrial production when it reported its latest quarterly earnings. The world's second biggest package delivery company forecast a continued slowdown in global trade. Reports that Saudi Arabia is keeping production high to drive oil prices lower were also blamed.

The big news in the commodities world lately is $10/barrel drop in the oil price in the last several days. The decline was initially blamed on Fed-Ex lowering its outlook for global growth and industrial production when it reported its latest quarterly earnings. The world's second biggest package delivery company forecast a continued slowdown in global trade. Reports that Saudi Arabia is keeping production high to drive oil prices lower were also blamed.

The actual reason for the drop in crude oil was likely political; with an upcoming election, the current administration is pulling as many strings as it can to keep voters happy and remain in office. Gasoline prices above $4/gallon and crude oil above $100/barrel isn't politically acceptable so close to a major election.

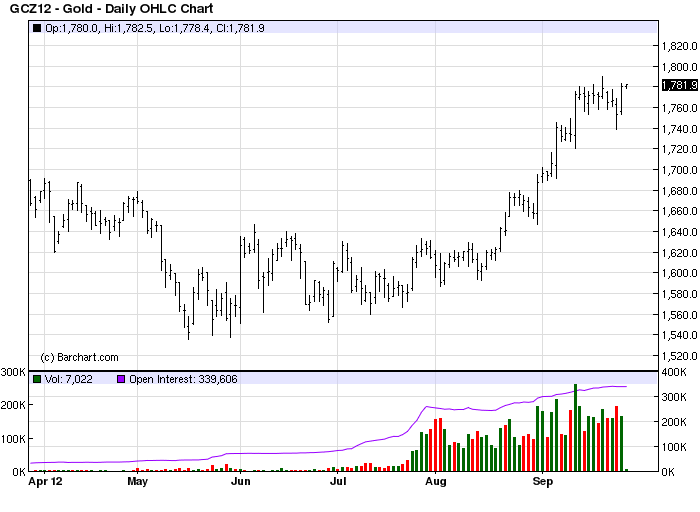

The real action meanwhile has been in gold, silver and the mining stocks. The precious metals group has been relatively unaffected by the latest drop in oil and other commodities and for good reason: gold is perhaps the best pure measure of inflationary pressures. The coordinated bond-buying program of the European and U.S. central banks has given gold all the excuse it needs to continue its march to higher price levels. Silver meanwhile is riding the back of the gold bull market as the "poor man's gold."

Gold's ascent has been a combination of a weak dollar, which has been pushed down in recent weeks in anticipation of the central bank actions of the ECB and the Fed. The German's court decision to ratify the European Stability Mechanism of Euro 500 billion also boosted gold prices. The pledge by the Chinese government to raise subway and railway projects spending by RMB 800 billion last week and Premier Wen's confidence in achieving 2012's growth target benefit both risky and gold markets, as Austin Kiddle of Sharps Pixley pointed out.

An analyst with a major U.S. investment bank has published an extremely bullish long-term forecast for gold in the wake of the Fed's QE3 and Operation Twist programs. What makes the prediction surprising is the fact that it comes from one of the more conservative financial institutions with an historically tepid gold outlook. Bank of America Merrill Lynch's Francisco Blanch predicted a gold price of $2,400 an ounce by the end of 2014 when the Fed says it will stop purchasing mortgages.

"Given the new open-ended nature of QE3, the upward pressure on gold prices should continue until employment is strong enough to require a change in policy," Blanch added. "In our view, this is unlikely to happen until the end of 2014."

This extremely bullish gold forecast contrasts with the median gold price forecast by financial analysts according to a recent Bloomberg report. The median forecast for gold in 2013 is $1,750; the range is from a low of $1,560 to $2,050 for next year. Clearly the analyst consensus is overly conservative. From a contrarian sentiment standpoint this is bullish for gold.

Meanwhile a Citibank analyst compared the gold price breakout in the week of 3 September, 2007 to that of the week of 27 August, 2012 and predicted gold price could reach $2,450 to $2,500 by Q1 2013.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.