What is the Dry Bulk Shipping Industry BDI Index Saying?

Stock-Markets / Global Economy Sep 28, 2012 - 02:38 AM GMTBy: Tony_Caldaro

During the past decade or so nearly every sector of the transporation industry has run into serious Secular cycle problems. First it was the Airlines, then Trucking, then the Autos, and now Shipping. While the first three sectors appear to be in some early stages of recovery. The Shipping sector has yet to find the bottom. During the 2000′s demand-driven commodity boom, shipping rates skyrocketed and new ships were coming online every month. After the 2008 collapse in demand and commodity prices, the shipping industry found itself dealing with much lower rates and huge excess shipping capacity. During the past four years some shipping companies have been forced into bankruptcy, some are facing bankruptcy, and others a struggling along with high long term debt. To reverse this downward cycle, demand has to rise along with shipping rates while industry consolidation continues.

During the past decade or so nearly every sector of the transporation industry has run into serious Secular cycle problems. First it was the Airlines, then Trucking, then the Autos, and now Shipping. While the first three sectors appear to be in some early stages of recovery. The Shipping sector has yet to find the bottom. During the 2000′s demand-driven commodity boom, shipping rates skyrocketed and new ships were coming online every month. After the 2008 collapse in demand and commodity prices, the shipping industry found itself dealing with much lower rates and huge excess shipping capacity. During the past four years some shipping companies have been forced into bankruptcy, some are facing bankruptcy, and others a struggling along with high long term debt. To reverse this downward cycle, demand has to rise along with shipping rates while industry consolidation continues.

Since the middle of the last decade we have been tracking the Baltic Dry Index (BDI). This is a weighted index of international shipping rates. Its three components are the Capesize, Panamax, and Super Panamax (Handy) dry bulk cargo ships. For the past few months we have been examining this index, looking for signs of a potential upcoming bottom in this industry. We have concluded that is likely to occur this year.

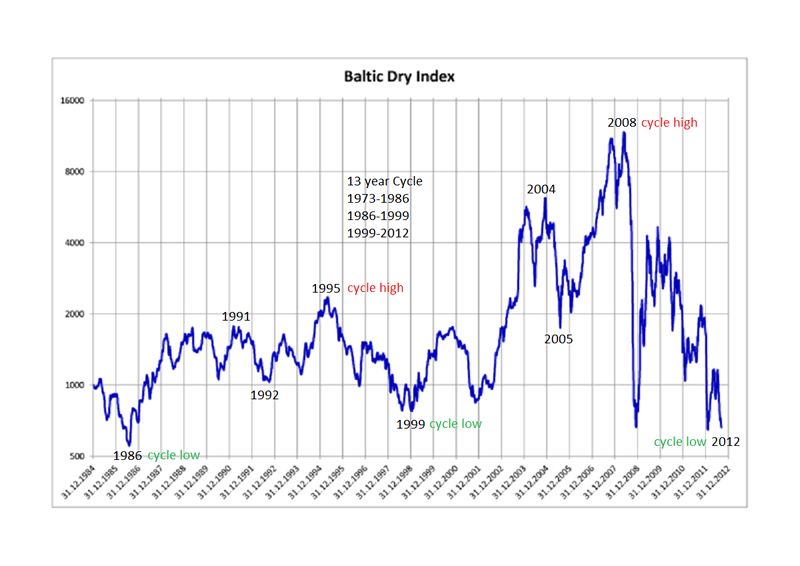

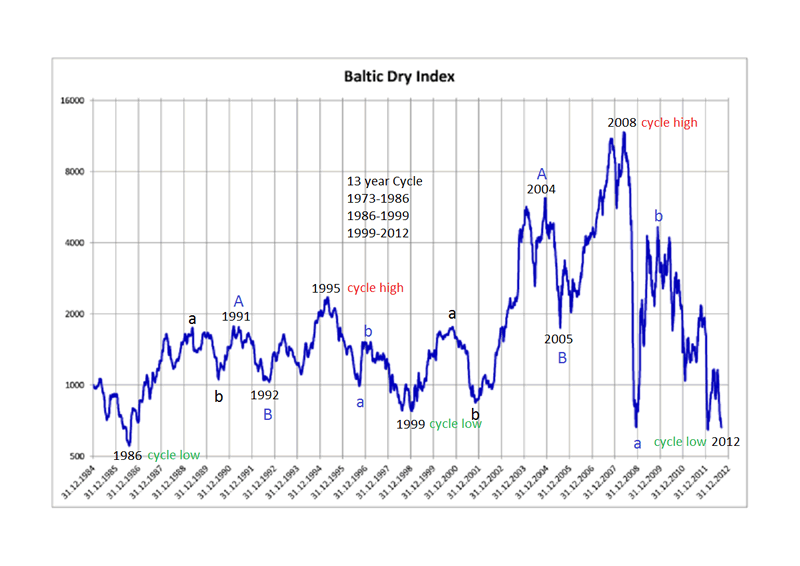

When reviewing the BDI from 1985, and using written reports on the shipping industry as far back as the early 1970′s, we believe we have uncovered a regular 13 year cycle. It appears every 13 years shipping rates make a cyclical low: 1973-1986-1999-2012. After the low is in place rates generally rise for the next 9 years, then decline 4 years into the next cyclical low. During the 9 year bull market, rates rise for 5 years, decline for 1 year, and then rise for another 3 years into the cyclical peak. In addition, in the early stages after the cyclical low, rates typically triple during the first 2-3 years. This is the recovery stage for the shipping industry.

From an OEW perspective. We count the 9 year rising Cycle as an Primary ABC wave advance. With each of the rising Primary waves dividing into three Major waves. The four year declining Cycle is a simple Primary ABC wave decline.

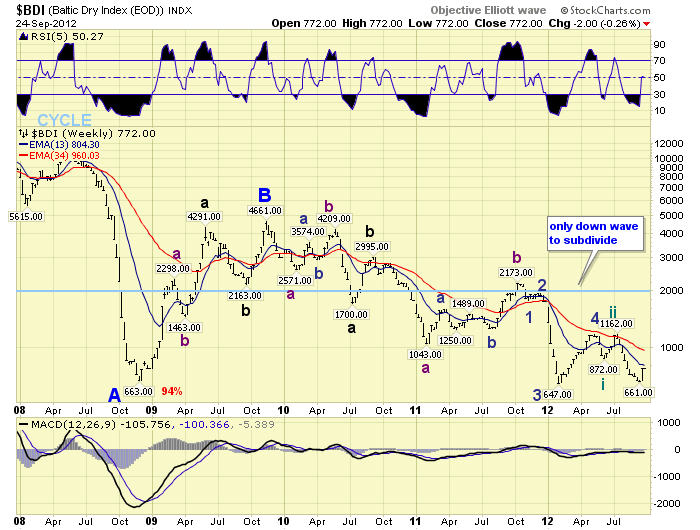

When we examine Primary wave C of this declining Cycle we observe a nearly completed pattern. Primary B topped in late 2009 at BDI 4661. Over the next several months there was an abc Major wave A decline into mid-2010 at BDI 1700. Then after a quick Major B wave advance to BDI 2995, a complex Major wave C was underway. Intermediate wave A, of Major C, bottomed in early 2011 at BDI 1043. Then Intermediate wave B topped in late 2011 at BDI 2173. After that, the only subdividing Intermediate wave decline of this down Cycle began. At the Feb12 BDI 647 low Minor waves 1, 2 and 3 had completed. Then after a Minor wave 4 rally into May12 at BDI 1165, a subdividing Minor wave 5 began. Currently, we can count three Minute waves into the recent BDI 661 low, with possibly Minute wave iv underway now. We will know for sure once we get an OEW uptrend confirmation.

Should this occur, all that will be required is one more downtrend to complete the entire 4 year down Cycle from 2008. That downtrend should end the bear market is dry bulk shipping rates. With three months left in the year, it appears the 4 year down Cycle should bottom before year end. When it does we would expect shipping rates to triple over the next two to three years.

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2012 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.