The Monetary Times They Are a Changin’, Time for Gold Stock Mania?

Currencies / Fiat Currency Sep 27, 2012 - 06:52 AM GMTBy: Jeff_Berwick

Bob Dylan’s iconic, “The Times They Are A Changin’” starts off with the following lyrics:

Bob Dylan’s iconic, “The Times They Are A Changin’” starts off with the following lyrics:

Come gather 'round people

Wherever you roam

And admit that the waters

Around you have grown

And accept it that soon

You'll be drenched to the bone

Nothing could better symbolize the monetary state of affairs going on in the world today. We will all soon be drenched to the bone.

But, before I go into detail on what is currently happening, let’s briefly look back at the last year to examine the massive changes afoot (Thanks to friend, Michael Pollaro, of The Contrarian Take for reminding us of these events).

LOW TIDE MONETARILY FOR THE LAST YEAR

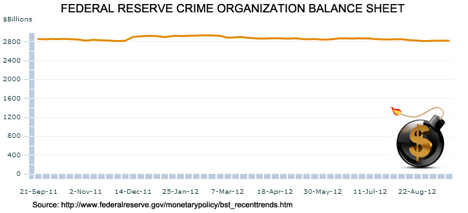

First, note that the Federal Reserve crime organization’s balance sheet was flat over the last year.

That’s a marked difference from the last five years.

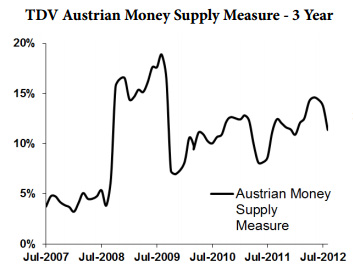

But notice that the YoY monetary base increase has still continued to stay above 10%.

This means that the commercial banks have been pulling the monetary inflation weight for the last year. But notice, the increase in the monetary supply has begun to slow of late.

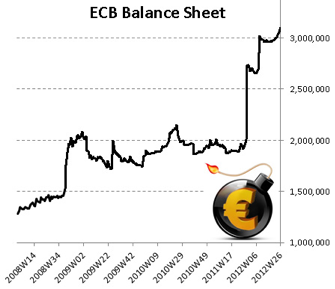

Meanwhile in Europe the European Central Bank’s (ECB) balance sheet has erupted 50% in the last year.

But 70% of that total increase is owing to LTRO which, while blowing up total balance sheet footings, has ZERO direct impact on the Euro money supply.

This means that as far as QE is concerned, neither the US nor Europe have had their foot on the gas for the last 12 months.

Even the Bank of Japan (BoJ) has only increased its balance sheet by 8% YoY. Only the Bank of England (BOE) has been printing like mad, up over 50% YoY.

In other words, up until lately, excluding the Bank of England, most of the Western world’s central banks have been on a one-year vacation.

FAST FORWARD TO TODAY

In the last month alone, and in eerie synchronization, the Fed, BOE, and Japan have all announced massive new QE programs.

The ECB's unlimited QE program has been announced and is about ready to go.

Even the Chinese central banksters have jumped aboard and just injected a record 290 billion yuan into the banking system via open market operations with much more likely to come.

And in this mercantilist, nation-state, democratic and fasco-socialist Western world of today, no one can ever resist devaluing their currencies along with the big players, which will likely mean almost every major country in the world will have to step things up or they risk the chance that their currencies won’t get to zero as quickly as the others, which will anger their exporters.

In other words, this could be the final stages of the crackup boom, as Ludwig von Mises predicted. Now that Ben Bernanke and others have committed to QE to infinity, it certainly looks that way. But, exactly how long it will take is the main question.

TIME FOR A GOLD STOCK MANIA?

We here at TDV believe we should still have at least another 3-5 years before the total collapse. Could we be wrong? Absolutely! No one can predict the future. That’s just our best guess. Could it be faster? Certainly. Could it take longer? Doubtful, but possibly.

As with all things in life, the key is in the timing. If the system all out collapses in the next year then there will not be enough time for a gold stock mania to foment, and enough time to sell and get into another hard asset before the collapse.

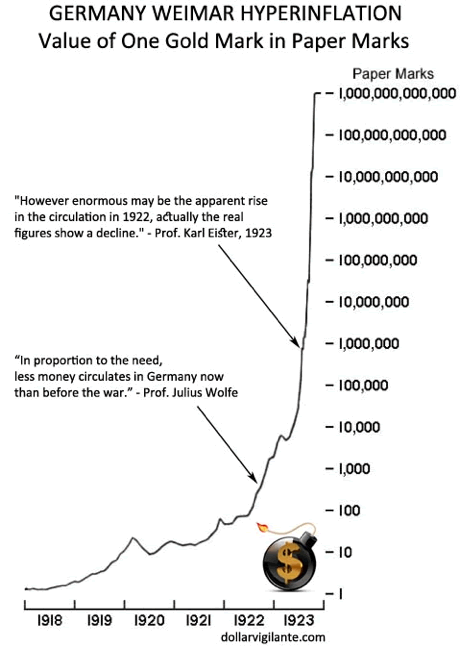

But if the system can last another few years I am now pegging the possibility of a gold stock mania at “near certainty”. Ben Bernanke and the like have all but guaranteed it. Their bizarre mental affliction, a not-so rare disease called Keynesianism, has consumed them and they will go into the final stages of hyperinflation printing more money, just like they did in Weimar.

Just look at some of the quotes of the Bernanke’s of the day as the value of the Mark was well into hyperinflation.

In the end, junior gold stock investors may make John Maynard Keynes their god, solely for making them so rich. Many of these stocks went up thousands of percent during the last stagflationary crisis in the late 1970s. And this crisis is set to make the last one look like a non-event.

Bob Dylan’s lyrics again are very apt:

The line it is drawn

The curse it is cast

The slow one now

Will later be fast

As the present now

Will later be past

The order is

Rapidly fadin'

And the first one now

Will later be last

For the [monetary] times they are a-changin'

Thanks to Ben Bernanke and all the other Keyniacs the line is drawn and the die is cast. Where all this new funny money goes is anyone’s guess, but we are gambling a small part of our portfolio on the junior gold stocks that we cover at TDV Premium and at the TDV Golden Trader.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2012 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.