China Buys North Korea Gold Reserves

Commodities / Gold and Silver 2012 Sep 26, 2012 - 09:27 AM GMTBy: GoldCore

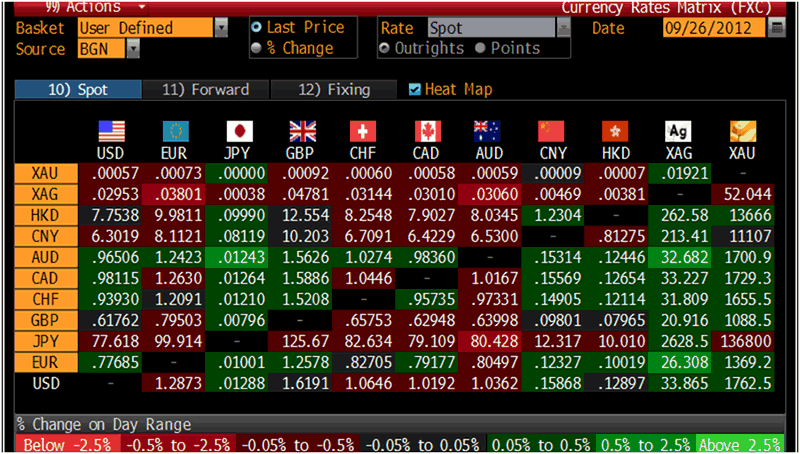

Today’s AM fix was USD 1,763.75, EUR 1,369.80, and GBP 1,089.07 per ounce.

Today’s AM fix was USD 1,763.75, EUR 1,369.80, and GBP 1,089.07 per ounce.

Yesterday’s AM fix was USD 1,766.75, EUR 1,369.36 and GBP 1,088.37 per ounce.

Silver is trading at $33.79/oz, €26.41/oz and £20.99/oz. Platinum is trading at $1,630.00/oz, palladium at $627.10/oz and rhodium at $1,075/oz.

Gold fell $3.10 or 0.18% in New York yesterday and closed at $1,761.40. Silver rose to $34.47 in early New York trade then fell off and finished with a loss of 0.71%.

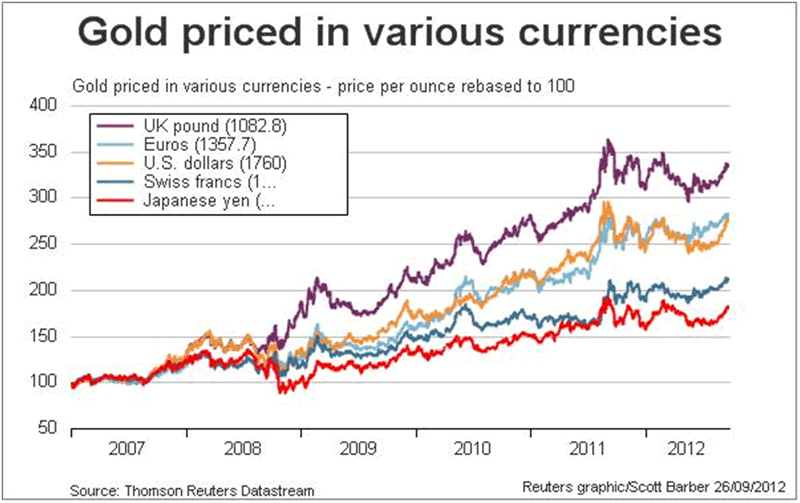

Gold continues to eke out gradual gains in all currencies. It looks set for the best quarterly gain in more than two years, as central banks and investors diversify into gold to hedge against the prospect of weaker currencies and slowing growth.

Euro gold hovering near record highs at €1,375/oz shows the eurozone crisis is far from over and is indeed set to deepen in coming months.

The overnight joint declaration of Germany, the Netherlands and Finland appears to unravel much of what was agreed at the last European summit in June, when EU leaders attempted to pave the way for the direct recapitalisation of troubled banks, is gold bullish.

The IMF has warned that the financial system remains ‘vulnerable’ and is a work in progress.

In Spain, protestors fought with police in Madrid as the government embarks on a new phase of austerity measures for the 2013 budget this Thursday.

The SPDR Gold Trust ETF said its holdings had risen to a record high of 1,331.331 tonnes by Sept. 25.

Unrest in South Africa continues and the fourth largest producer in the world, Goldfields, said that workers reneged on a deal to end a two week strike at its KDC West operation and miners at its Beatrix mine had also downed tools.

AngloGold Ashanti Ltd., the world’s third-largest gold producer, halted production at all of its South African mines as labor unrest that left at least 46 dead in the past two months continues to spread.

Julius Malema, expelled as youth leader from South Africa’s ruling African National Congress, was granted bail on a charge of money laundering.

Germany's Federal Statistical Office is scheduled to release flash inflation data at 8.00 am ET.

Gold in USD, EUR & GBP – YTD 2012

The IMF reported that various countries continued diversifying into gold in July, some significantly.

South Korean gold reserves rose a sharp 16 tonnes for a 30% increase in total gold reserves.

Paraguay became the latest central bank to begin diversifying into gold. Their gold reserves rose sharply - from a few thousand ounces to over 8 tonnes.

Desperate North Korea has exported more than 2 tons to gold hungry China over the past year to earn US $100 million. Even in tough times during the Kim Il-sung and Kim Jong-il regimes, North Korea refused to let go of its precious gold reserves.

Chosun media reports that “a mysterious agency known as Room 39, which manages Kim Jong-un's money, and the People's Armed Forces are spearheading exports of gold, said an informed source in China. "They are selling not only gold that was produced since December last year, when Kim Jong-un came to power, but also gold from the country's reserves and bought from its people."

This is a sign of the desperation of the North Korean regime and also signals China’s intent to vastly increase the People’s Bank of China’s gold reserves.

Data on the International Monetary Fund’s website shows Kazakhstan’s assets rose 1.4 tons to 104.4 tons last month, Turkey’s gold reserves gained 6.6 tons to 295.5 tons, Ukraine’s rose 1.9 tons to 34.8 tons.

While the Czech Republic’s bullion assets fell 0.4 ton to 11.8 tons, data shows.

Nations bought 254.2 tons in the first half of 2012 and may add close to 500 tons for the year as a whole, the London-based World Gold Council said earlier this month.

The trend among central banks to diversify their foreign exchange reserve holdings with gold continues.

This trend is very sustainable considering the still tiny allocations creditor nation’s banks, with massive foreign exchange reserves, have to gold.

Paraguay is a new central bank gold buyer – expect many more central banks to begin increasing their gold reserves in the coming months.

Cross Currency Table – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.