What Happens When a Fixed Rate Bonds Mature?

Personal_Finance / Savings Accounts Sep 26, 2012 - 05:59 AM GMTBy: MoneyFacts

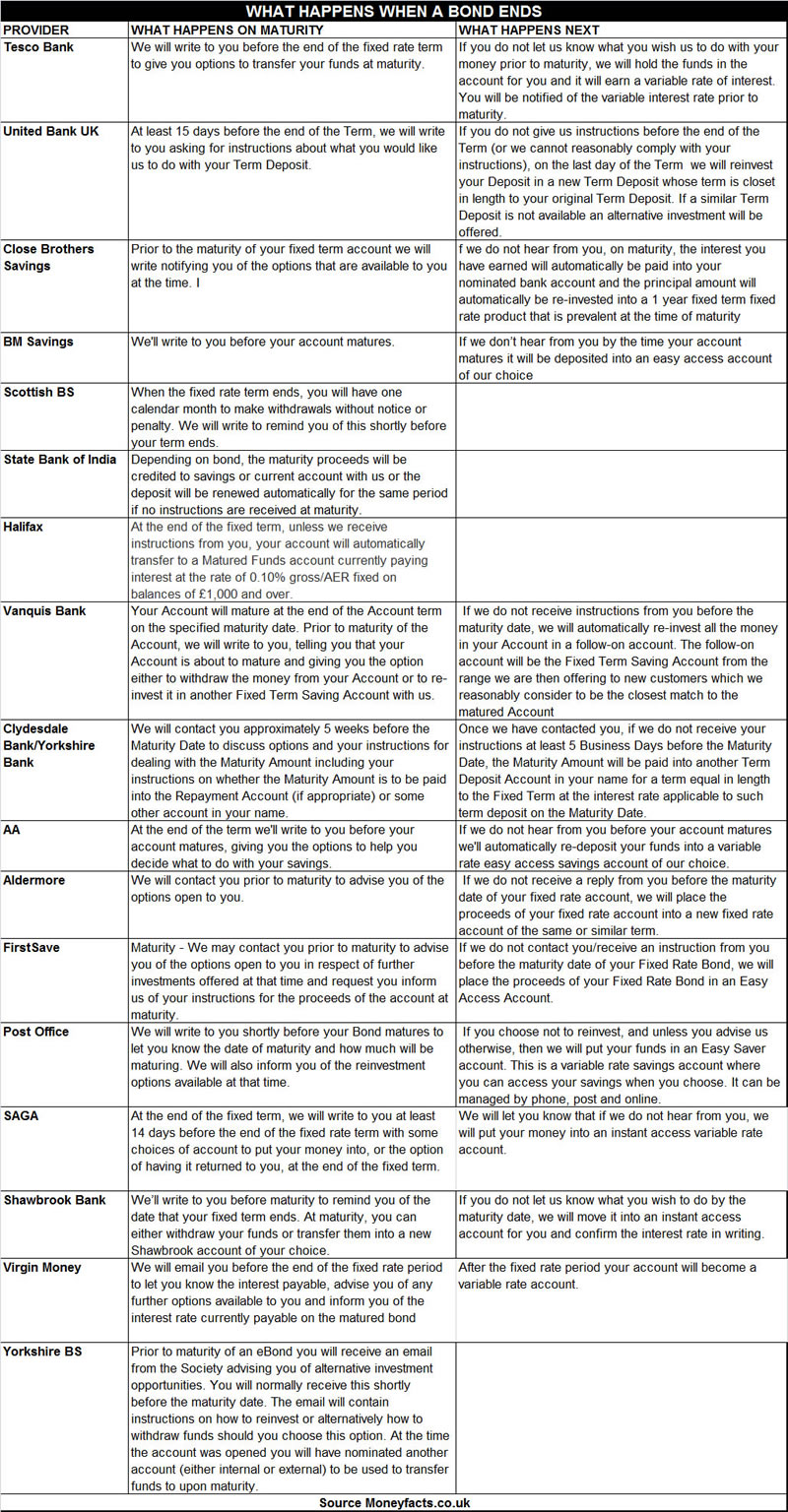

In these days of low returns, fixed rate bonds have for many become the savings vehicle of choice but what happens when the term comes to an end? Confusingly, there are three correct answers to this question.

In these days of low returns, fixed rate bonds have for many become the savings vehicle of choice but what happens when the term comes to an end? Confusingly, there are three correct answers to this question.

- Some providers will send you your money back

- Some providers will put your money into a pre-designated account

- Some providers will contact you

Without one clearly defined system it is essential that you not only remember when the bond ends but also what you have agreed will happen next.

Sylvia Waycot, financial expert at Moneyfacts.co.uk, said:

“Moneyfacts research has shown that ‘contacting you’ could mean a month before the bond ends, two weeks before the bond ends or even an unspecified time before the bond ends.

“The purpose of the contact could be to find out where to put your money or it could be to tell you where the provider has decided to put it.

“This could be an unattractive back of the cupboard account that pays virtually nothing and it could stay there indefinitely unless you spring into action and move it to a better account.

“If you ignore the letter, or you were on holiday for two weeks when it arrived, you could find that the provider has reinvested your savings into a similar account. If the original bond was for five years, so the new one could also be for five years, but the rate may be quite different from five years ago.

“If you find you have been locked into another fixed rate bond, then all the penalties for early withdrawal will apply. This could mean an interest penalty, which is in effect a fine for early withdrawal, or it could mean you can’t get your hands on your money at all for the duration of the term.

“Fixed rate bonds are an attractive option for anyone willing to tie their money up for a set period of time and the operating rules for the life of the bond are very clear.

“However, what happens at the end of the term is less clear and would benefit from an industry standard. Until that happens we are left to the mercy of a varied and confusing journey that could end in a loss of money.”

www.moneyfacts.co.uk - The Money Search Engine

Moneyfacts.co.uk is the UK's leading independent provider of personal finance information. For the last 20 years, Moneyfacts' information has been the key driver behind many personal finance decisions, from the Treasury to the high street.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.