Gold and Silver Price October Correction Is Seasonally Weak

Commodities / Gold and Silver 2012 Sep 25, 2012 - 09:14 AM GMTBy: GoldCore

Today’s AM fix was USD 1,766.75, EUR 1,369.36, GBP 1,088.37 per ounce. Yesterday’s AM fix was USD 1,758.50, EUR 1,361.91 and GBP 1,084.96 per ounce.

Today’s AM fix was USD 1,766.75, EUR 1,369.36, GBP 1,088.37 per ounce. Yesterday’s AM fix was USD 1,758.50, EUR 1,361.91 and GBP 1,084.96 per ounce.

Silver is trading at $34.23/oz, €26.58/oz and £21.18/oz. Platinum is trading at $1,633.75/oz, palladium at $643.00/oz and rhodium at $1,100/oz.

Gold fell $8.60 or 0.49% in New York yesterday and closed at $1,764.50. Silver slipped to a low of $33.594 then rebounded in New York, but it still finished with a loss of 1.62%.

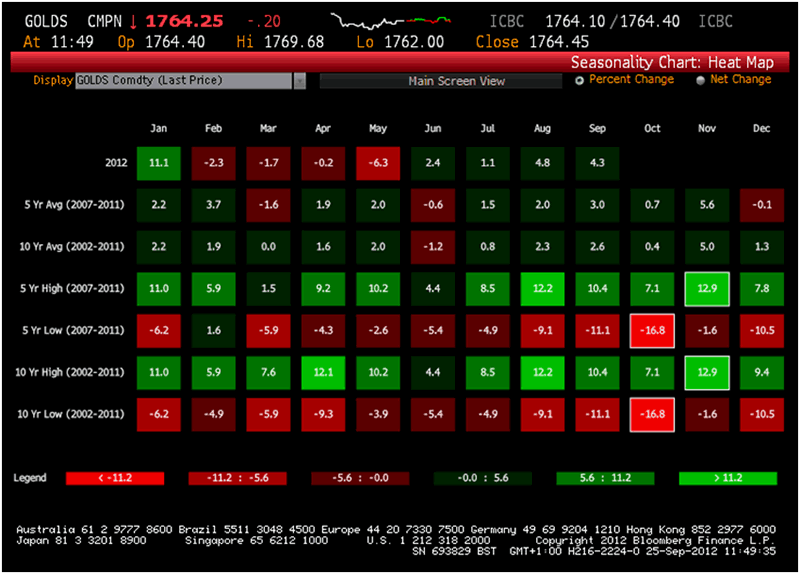

Gold Seasonality Chart - Heatmap

Gold edged up today, on investor expectations for continued strength in the yellow metal linked to recent ‘stimulus’ packages employed by central banks globally.

With all major central banks now engaged in some form of QE, we now have ‘QE Everywhere’ and the race to competitively devalue national and supranational currencies has intensified.

In the ‘beggar thy neighbour’ great game that is the global currency war, the only winners will be those that are fully diversified with physical gold and silver and those that own their bullion and other assets in the safest ways possible.

German business sentiment dropped for a 5th straight month this September. The Munich-based IFO Institute’s Monthly Sentiment Index hit its lowest level since early 2010 and the outlook component hit its worst level since May 2009.

The sentiment highlights the scepticism that many German companies have towards Mario Draghi’s plan to ‘stimulate’ the European economy.

The German experience with ‘stimulation’ was not a pleasant one and they are rightly wary of inflation and currency depreciation.

With the eurozone debt crisis dragging into its 3rd year, it is inevitable that Germany would begin to feel the pain that other countries have been living with for the past few years. However, German businesses and tax payers are increasingly concerned about the risk that contagion poses to the German bond market, economy and the single currency.

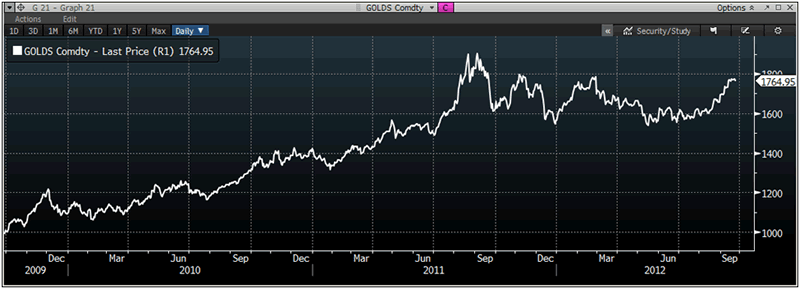

In recent weeks, gold and silver have seen the strong gains that were anticipated by the bulls.

Gold is 11.5% higher and silver is a sharp 24% higher in the last three months alone.

In the past month silver is up 11% and gold is up 5.7%.

As in all bull markets - two steps forward are often followed by one step back and a period of correction and consolidation is quite possible.

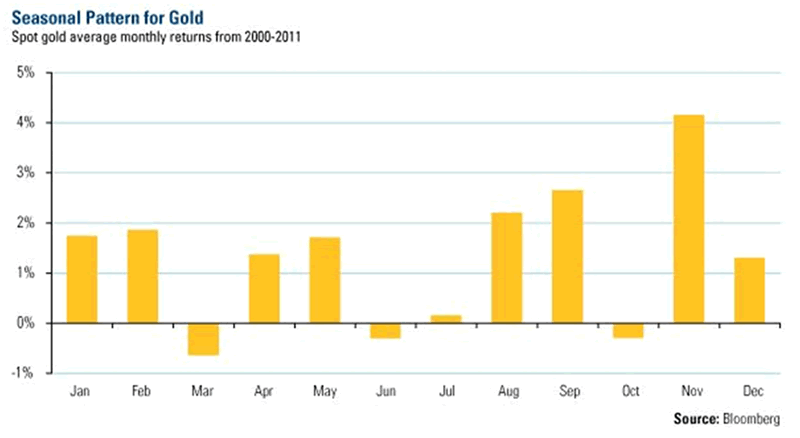

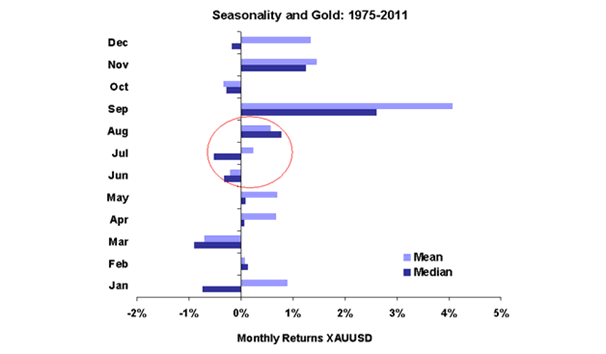

This week will see the end of September trading and September is, along with November, one of the strongest months to own gold.

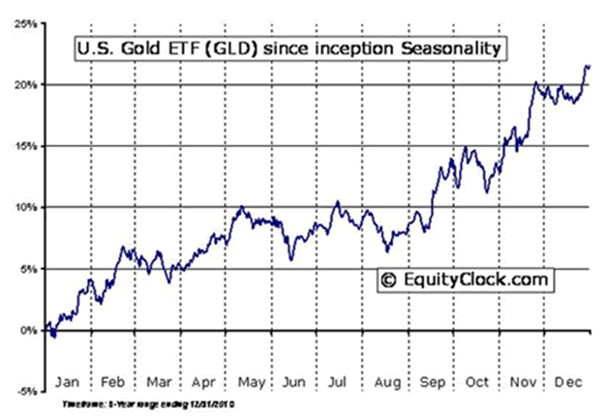

Next Monday (October 1st ) we commence volatile October and October is one of the weakest periods for gold and has often seen sell offs (See Graphics). This may be due to gold’s short term correlation with equities and October can often be a brutal month for stocks.

Traders might be advised to tighten up stop loss positions and or take profits. The majority of investors should continue to buy and hold as selling and buying again incurs costs and there is always the risk that October may see gold strength – especially this year given the very strong fundamentals.

However, investors who wish to book a profit and were considering selling, for whatever reason (sometimes out of necessity), would be advised to try and sell prior to October.

After the very strong gains in stock markets in recent years there is a real risk of a stock market correction now and gold could again show short term correlation with stocks.

Gold in Dollars Daily 20009-2012 – (Bloomberg)

We believe that while a correction in stocks and gold is quite possible we do not believe it will be significant for either asset class and the risk of a 16.8% fall in gold as was seen in October 2008 is quite low.

Should a correction materialise very strong support will be seen at the $1,600/oz level.

However, we think that gold may come under pressure in the run into the U.S. Presidential election on November 6th and therefore advise caution until early November.

For more information on gold’s monthly performances over the last 11 years and over the last 40 years, see our recent blog ‘September And November Best Months To Own Gold’.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.