"Do You Own Gold?" Ray Dalio at CFR: "Oh Yeah, I Do"

Commodities / Gold and Silver 2012 Sep 24, 2012 - 07:37 AM GMTBy: GoldCore

Today’s AM fix was USD 1,758.50, EUR 1,361.91, GBP 1,084.96 per ounce. Friday’s AM fix was USD 1,773.75, EUR 1,361.28and GBP 1,089.19 per ounce.

Today’s AM fix was USD 1,758.50, EUR 1,361.91, GBP 1,084.96 per ounce. Friday’s AM fix was USD 1,773.75, EUR 1,361.28and GBP 1,089.19 per ounce.

Silver is trading at $33.87/oz, €26.31/oz and £20.98/oz. Platinum is trading at $1,614.00/oz, palladium at $641.80/oz and rhodium at $1,150/oz.

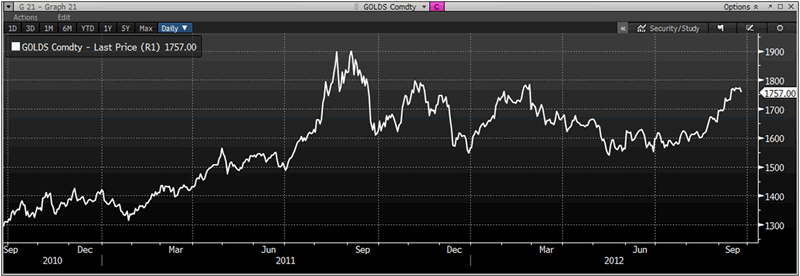

Gold climbed $4.70 or 0.27% in New York on Friday and closed at $1,773.10. Silver hit a high of $35.16 in New York on Friday, but it still finished with a loss of 0.29%. On the week, gold was up 0.08% while silver fell 0.3%.

Ray Dalio, founder and co-chief investment officer of Bridgewater Associates, L.P.

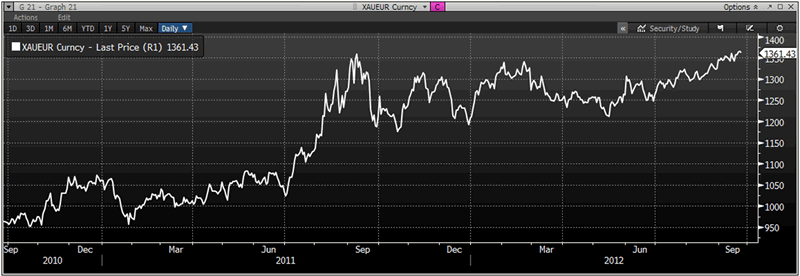

Gold was off its 7 month high on Monday but the recent wave of central banks (ECB, US & BOJ) who started printing money and bond buying again is very supportive for the yellow metal and euro gold remains close to record highs (see chart).

XAU/EUR Exchange Rate Daily, Sept. 2010-2012 - (Bloomberg)

Gold has run up gains of 10% in the past 5 weeks, the biggest since September 2011, after the ECB and Federal Reserve announced new ‘stimulus’ measures to bolster up their economies.

Gold is slightly over bought in the short term and the recent spec activity on the COMEX suggests there may again be short term weakness.

Ultra loose monetary policies will soon send investors to gold like swarming bees to honey in the hive.

Currency debasement and the very slow dawning of what competitive currency devaluations and currency wars will do to paper currencies is leading to wealthier people who had previously ignored gold looking to diversify into the precious metal.

In South Africa, authorities have issued an arrest warrant for ANC militant Julius Malema, a key supporter of wildcat strikes that have spread from platinum to gold producers and caused violence and deaths in the past few weeks.

The situation in South Africa remains very unstable and will be supportive of both platinum and gold prices.

This week US economic data to be released follows: Tuesday - The Case-Shiller 20-city Index, Consumer Confidence, and the FHFA Housing Price Index . Wednesday - New Home Sales. Thursday -Initial Jobless Claims, Durable Goods Orders, GDP, and Pending Home Sales. Friday - Personal Income and Spending, Core PCE Prices, Chicago PMI, and Michigan Sentiment.

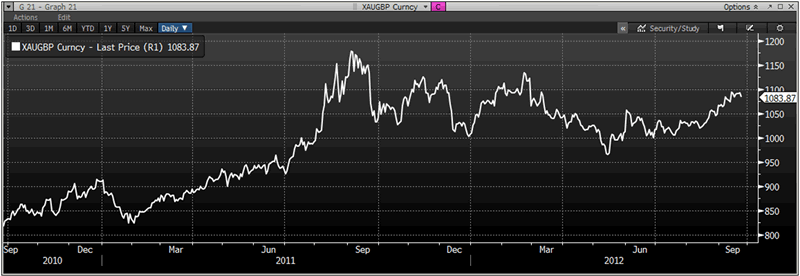

XAU/GBP Exchange Rate Daily, Sept. 2010-2012 - (Bloomberg)

Ray Dalio, founder and co-chief investment officer of Bridgewater Associates, L.P. and one of the most successful hedge fund managers of all time told Maria Bartiromo last week that he owns gold and that he sees no “sensible reason not to own gold”.

The interview was part of the Council on Foreign Relations (CFR) Corporate Program's CEO Speaker Series, which provides a forum for leading global CEOs to share their priorities and insights before a high-level audience of wealthy and influential CFR members.

The respected hedge fund manager suggested that a depression and not a recession was likely and warned of social unrest and the risk of radical politics as was seen with Hitler and the Nazis in the Depression of the 1930’s.

Dalio spoke about how “gold is a currency” and when asked by Bartiromo “do you own gold?”, he smiled and said “Oh yeah, I do.” The admission elicited a laugh from the CFR audience.

He continued:

"Oh yeah. I do. I think anybody, look let's be clear, that I think anybody who doesn't have...There's no sensible reason not to have some. If you're going to own a currency, it's not sensible not to own gold.

Now it depends on the amount of gold. But if you don't own, I don't know 10%, if you don't have that and that depends on the world, then there's no sensible reason other than you don't know history and you don't know the economics of it.

But, I. Well, I mean cash. So cash...view it in terms as an alternative form of cash and also view it as a hedge against what other parts of your portfolio are. Because as traditional financial assets, and so and in that context as a diversifier, as a source of that, there should be a piece of that in gold is all I'm saying.”

With regard to gold being a currency he said that:

"Gold is a currency. Throughout the history, I won't tell you in length, money was like a check in a checkbook and what you would do was get your gold and gold was like a medium. So gold is one of the currencies-- We have dollars, we have euros, we have yen and we have gold.

And if you get into a situation where there's an alternative in this world, where we're looking at 'What are the alternatives?' and the best alternative becomes clearly one thing, something like gold.

There becomes a risk in that. Now it doesn't have the capacity. The capacity of moving money into gold in a large number is extremely limited. So the players in this world that I have contact with that move that money really don't view gold as an effective alternative, but it could be a barometer and it is an alternative for smaller amounts of money.”

Gold Spot $/oz Daily, Sept. 2010-2012 - (Bloomberg)

Dalio is alluding to the very small size of the global supply of gold or investment grade gold (refined, investment grade coins and bars) vis-à-vis stock, bond and currency markets and the shadow banking system.

Dalio’s interview is important as it again indicates how slowly but surely gold is moving from a fringe asset of a few hard money advocates and risk averse individuals to a mainstream asset.

Wealthier people and some of the wealthiest and most influential people in the world are slowly realising the importance of gold as financial insurance in an investment portfolio and as money.

This will result in sizeable flows into the gold market in the coming months which should push prices above the inflation adjusted high of 1980 - $2,500/oz.

The interview section where Dalio is asked about gold by an audience member begins in the 43rd minute and can be seen here.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.