'Golden Cross' For Gold and Silver Signals Further Gains

Commodities / Gold and Silver 2012 Sep 20, 2012 - 06:44 AM GMTBy: GoldCore

Today’s AM fix was USD 1,760.00, EUR 1,360.33 and GBP 1,088.03 per ounce.

Today’s AM fix was USD 1,760.00, EUR 1,360.33 and GBP 1,088.03 per ounce.

Yesterday’s AM fix was USD 1,774.50, EUR 1,361.44 and GBP 1,092.54 per ounce.

Silver is trading at $34.31/oz, €26.61/oz and £21.28/oz. Platinum is trading at $1,619.50/oz, palladium at $663.50/oz and rhodium at $1,225/oz.

Gold fell $0.10 or 0.01% in New York yesterday and closed at $1,770.50. Silver hit $34.958 in Asia and fell to $34.27 in early New York trade and it then bounced back higher, but finished with a loss of 0.49%.

Gold edged down today due to dollar strength and profit taking as speculators and some investors booked profits on 16% price gains from this year’s low.

Gold continues to see smart money diversification as central banks from the ECB and the Fed to the BOJ have all announced ‘stimulus’ or money debasement measures which has led investors to seek gold as an inflation hedge.

All eyes will be on China as perhaps the next to announce action after today’s data showed further contraction in its manufacturing sector for the 11th consecutive month.

The UK will then follow and then other central banks may announce their own measures as competitive currency devaluations or currency wars intensify in the coming months.

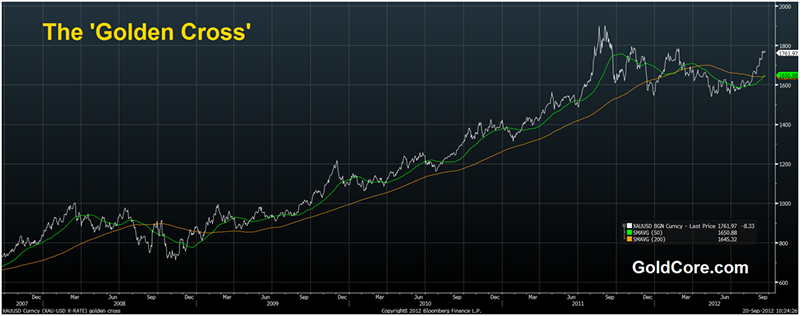

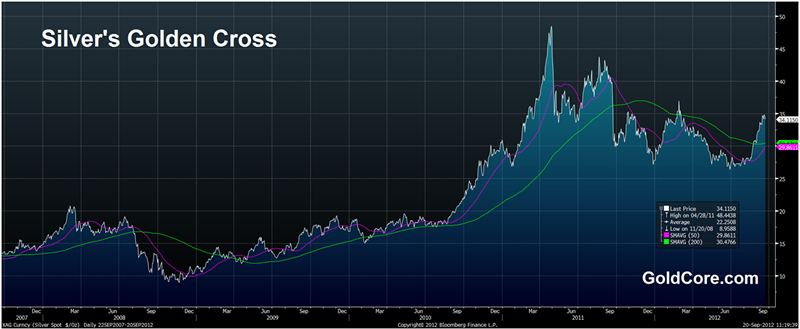

We have seen consecutive weeks of bullish strength in the gold and silver markets. Gold has completed what is known as a ‘Golden Cross’ and silver is poised to complete one in the coming days.

A ‘Golden Cross’ occurs when not only the current price, but also shorter-term moving averages such as the 50 day moving average “cross” or rise above the longer term 200 day moving average.

Gold’s 50 day moving average (simple) has risen to $1,651/oz and is now comfortable above the 200 day moving average (simple) at $1,645/oz and accelerating higher.

Silver’s 50 day moving average (simple) has risen to $29.86/oz and will soon challenge the 200 day moving average (simple) at $30.47/oz.

These are important indicators of longer term technical strength and in conjunction with the recent positive technical picture are bullish.

The 18 months of sideways-to-lower price action has “built a base”, a very large foundational base, in markets that are in the middle of two of the longest and strongest bull markets in history.

It is another indication that both markets are capable of moving higher in the coming months.

John Bollinger the president of BollingerBands.com said in January that “the golden cross is a great tool in a big, roaring bull market, like the bull market from 1982 to 1998, when it tells you when you’re supposed to be in the market and tells you periods in which the risk is somewhat higher of corrections and such,” he said.

Gold and silver are in such secular bull markets and the combination of these long term bull markets, the recently trending higher markets and the 'Golden Cross' is important technically.

The last time there was a 'Golden Cross' for gold was in early February 2009 (see chart) and gold subsequently rose 103% in the next two years.

Similar gains are quite possible today given the strong fundamentals. Were gold to replicate those gains, it could see gold rise to double today's value of $1,756/oz or to over $3,500/oz.

Silver, too, saw a ‘golden cross’ in late February 2009 when silver was trading at under $14/oz.

It subsequently surged 257% to over $49/oz in April 2011 for a 257% increase in just 2 years and 2 months. Given silver’s very strong fundamentals similar gains may be seen in the coming months.

As ever physical bullion should not be bought in expectation of capital gains. They have the potential to reward with massive capital gains but they should be bought for diversification and financial insurance reasons.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.