QE3 Delivers Fresh Ammo for Both Romney and Obama

ElectionOracle / US Presidential Election 2012 Sep 20, 2012 - 06:34 AM GMTBy: Money_Morning

David Zeiler writes:

U.S. Federal Reserve Chairman Ben Bernanke never intended his latest stimulus program, QE3, to become an issue in the 2012 presidential election, but he had to know what would happen.

David Zeiler writes:

U.S. Federal Reserve Chairman Ben Bernanke never intended his latest stimulus program, QE3, to become an issue in the 2012 presidential election, but he had to know what would happen.

"We have tried very, very hard, and I think we've been successful...to be nonpartisan and apolitical," Bernanke said at a news conference Thursday after the official Fed announcement of QE3. "We make our decisions based entirely on the state of the economy....So we just don't take those [political] factors into account. And we think that's the best way to maintain our independence and maintain the trust of the public."

In case you missed it, the Fed's third round of quantitative easing entails the purchase of $40 billion of mortgage-backed securities each month until unemployment shows a marked improvement.

In other words, for as long as it takes.

But with QE3 arriving less than 60 days before a bitterly contested presidential election, the Fed move was bound to get caught up in the campaign.

Both sides reacted immediately, with Republicans criticizing QE3 as unnecessary while Democrats applauded.

A few Republicans even accused Bernanke of timing QE3 intentionally to boost President Obama's re-election chances.

For the record, Bernanke is himself a Republican, appointed chairman of the Federal Reserve by President George W. Bush in 2006 and re-appointed by President Obama in 2010.

But with the Fed becoming a GOP bogeyman in recent years (thanks largely to the attacks from Rep. Ron Paul, R-TX), QE3 was bound to become weaponized in this year's increasingly acrimonious campaign.

Don't be fooled when each political party throws out the following QE3-fueled lines to get your vote.

How Democrats Will Use QE3

Leading Democrats quickly converted GOP criticism of QE3 into political fodder.

"It is unfortunate that Republicansalready have expressed disappointment in this action and are clearly upset that they were unable to intimidate the Fed into putting partisan politics ahead of national economic interests," said House Financial Services Committee ranking member

Rep. Barney Frank, D-MA.

But of most utility to the White House is the QE3 impact on Wall Street. Like its QE predecessors, QE3 should fatten up stock prices.

Thursday's announcement helped the Dow Jones rise to a 287-point gain for the week. The 2.2% pop brought the index to within 600 points of its all-time high.

Previous doses of QE have contributed to the doubling of most market indicators since the March 2009 lows, hit just six weeks after President Obama was sworn in. QE1 gave the Dow a 45% boost and QE2 added about 24% more.

With most key economic indicators slumping - namely growth and unemployment -- the Democrats are only too happy to point to Wall Street's stellar performance over the past three years.

"Did the increase in the stock market before this, and now with this incredible boost, does that help Obama? Of course it does, because it helps the argument are you better off than you were four years ago when Barack Obama took office," Ed Rendell, the former Democratic governor of Pennsylvania, said Friday on CNBC's The Kudlow Report.

What could trip up the Democrats here, and President Obama in particular, is that they have spent the past three years blaming Wall Street for the Great Recession and making much ado about the unfair amount of wealth held by "millionaires and billionaires."

QE3 is doing far more for Wall Street than the general economy. And worse, the biggest benefits of QE3 will end up in the hands of the Wall Street's greatest villains - big banks like JPMorgan Chase (NYSE: JPM) and Goldman Sachs Group (NYSE: GS) -- while doing little to create jobs.

How Republicans Will Use QE3

The GOP will ignore stock prices and say that the need for QE3 in fact proves President Obama's economic policies have failed.

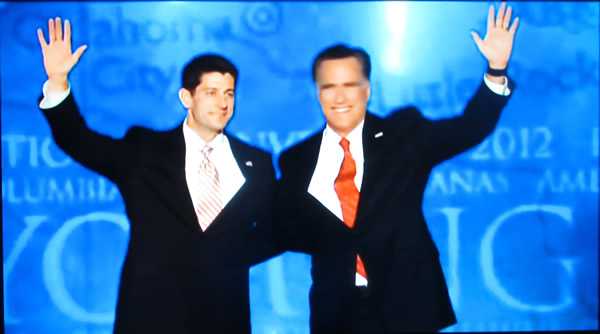

Romney wasted no time adopting this line of attack.

"What [Fed Chairman Ben] Bernanke's doing is saying that what the president's saying is wrong," Romney said on ABC's Good Morning America program Thursday. "The president's saying the economy's making progress, coming back. Bernanke's saying, "No, it's not. I've got to print more money.'"

Other GOP leaders also chimed in. Rep. Kevin McCarthy, R-CA, told The Wall Street Journal that QE3 shows the president's policies have "failed miserably." House Financial Services Committee Chairman Spencer Bachus, R-AL, called the Fed move a "scathing indictment" of President Obama's policies.

James Pethokoukis of the conservative think tank American Enterprise Institute offered the most colorful take on the "Obama has failed" storyline.

"Remember the Greenspan put? This is the Bernanke short," Pethokoukis said on The Kudlow Report. "He is shorting this Obamanomics. He's selling it. He's saying we're not on the right path, we can't stay the course, I have to do some kind of radical experimental monetary policy do something, anything, to boost this economy."

And that was just in the first two days after the QE3 announcement. Expect TV attack ads to follow shortly.

Ironically, both Romney and President Obama should be rooting for QE3 to work, because whoever wins in November will be saddled with an economy so weak almost any disruption could tip it into recession. And that could affect future elections.

"[If Romney wins] he is really going to have to fix the economy, he's not going to walk into any kind of booming recovery, the way team Obama seems to think," a Republican operative told the Washington Post. "If it's Obama and the economy continues in the [toilet] for most of his second term, it has the potential to do lasting damage to his party in the 2014 midterm and the 2016 presidential with a comparatively weak Democratic bench."

Source :http://moneymorning.com/2012/09/19/qe3-delivers-fresh-ammo-for-both-romney-and-obama/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.