Bond Market Investors Set up for a Shock, Major Top in Bond Markets

Interest-Rates / US Bonds Sep 20, 2012 - 01:37 AM GMTBy: EWI

During market pullbacks, financial advisors use a boilerplate response: "Let's rebalance the portfolio." Investors have heard that one for years.

During market pullbacks, financial advisors use a boilerplate response: "Let's rebalance the portfolio." Investors have heard that one for years.

The recommended allocation varies depending on a client's age and risk tolerance, but it typically involves shifting funds from stocks to bond holdings.

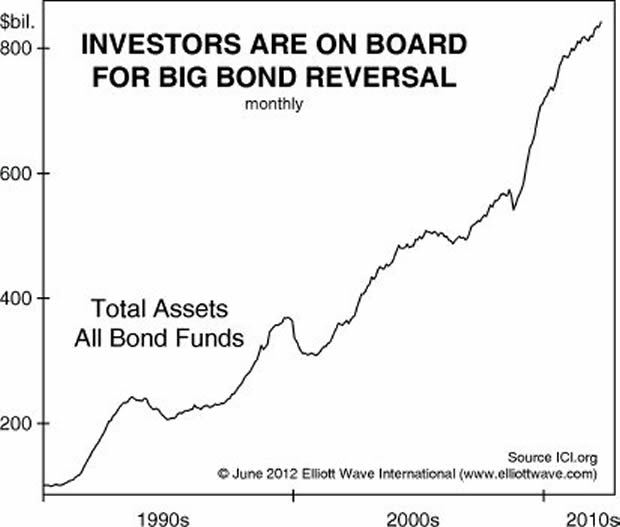

The evidence shows that many investors did just that in response to the 2007-2009 financial crisis - at the fastest rate in decades. Bond fund assets have risen eight-fold over the past 22 years.

Investors now hold more than $800 billion in bond funds. Just take a look at this chart from a June 6, Elliott Wave Theorist Special Report.

Investors who increased their bond allocation probably feel financially safer.

After all, bond funds have been more stable than stock funds, and they provided higher returns than money market funds.

Yet extrapolating the past into the future is often a major mistake.

During the coming collapse in the value of debt, investors' interest in diversified funds of all stripes-debt, equity and commodity-will fall precipitously. The drop will come as a shock, especially to those who "rebalanced" from stocks and commodities to bonds after the markets panicked in 2008.

The Elliott Wave Theorist, Special Report, June 2012

What should safety-conscious investors do?

The Theorist Special Report offers a clear answer, one that's just as relevant now as when it was published in June.

You will also learn about a striking parallel between the bond market of 1929-1932 and today and what to expect next.

Free 10-Page Report: Major Top in the Bond Market on the Way Prechter's message to bondholders today: Beware. Prechter warned investors about looming destruction in tech stocks, real estate, blue chips and commodities -- all at a time when conventional wisdom considered them "safe." Here's what he's saying now: Whether you have your money directly in bonds or your mutual fund does, your savings could be at risk. You're just one click away. Follow this link for instant access to the first four pages of Prechter's free report. Read the first 4 pages now, zero obligation, no email address required >> |

This article was syndicated by Elliott Wave International and was originally published under the headline Unsuspecting Bond Fund Investors Are Set Up for a Shock. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Best Regards,

About the Publisher, Elliott Wave InternationalFounded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.