ECB Debasement Is Akin To Work Of Devil – Risk Of “Rapid Currency Depreciation”

Commodities / Gold and Silver 2012 Sep 19, 2012 - 12:02 PM GMTBy: GoldCore

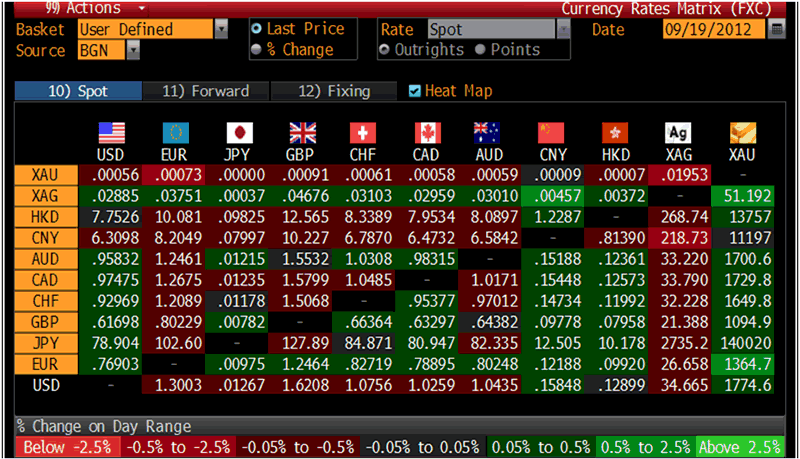

Today’s AM fix was USD 1,774.50, EUR 1,361.44 and GBP 1,092.54 per ounce.

Today’s AM fix was USD 1,774.50, EUR 1,361.44 and GBP 1,092.54 per ounce.

Yesterday’s AM fix was USD 1,756.75, EUR 1,344.31 and GBP 1,081.81 per ounce.

Silver is trading at $34.66/oz, €26.76/oz and £21.48/oz. Platinum is trading at $1,632.00/oz, palladium at $666.70/oz and rhodium at $1,300/oz.

Gold climbed $13.00 or 0.74% in New York yesterday and closed at $1,770.60. Silver surged to $35.015 before it also dropped off, but it finished with a gain of 2.23%.

Mephistopheles: Persuaded the Emperor to Print Paper Money

Gold hit its highest level in 6-1/2 months today after Japan followed Europe and the USA in embarking on stimulus measures to boost its economy, increasing the safe haven’s appeal as an inflation hedge.

The rash of central bank massive liquidity injections is continuing to support gold as traders bet on the inflationary consequences of such significant largesse.

The BOJ (Bank of Japan) ramped up its asset buying and loan programme, by ¥10 trillion ($127 billion) to ¥80 trillion which led to Japan’s total public debt surging over the 1 quadrillion mark.

1 quadrillion is a very large number and is ¥1,000,000,000,000,000 or 1 with 15 zeros after it.

Japan could clearly do with their own Jens Weidmann right now.

The most vocal critic of the ECB’s recent ultra loose monetary policy, Jens Weidmann, the influential head of the German Bundesbank, has again attacked current ECB monetary policy.

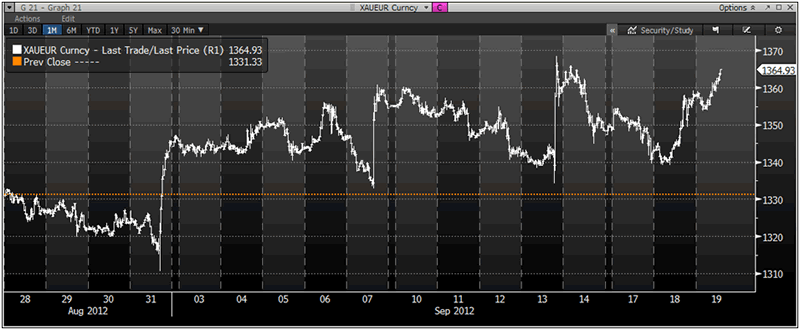

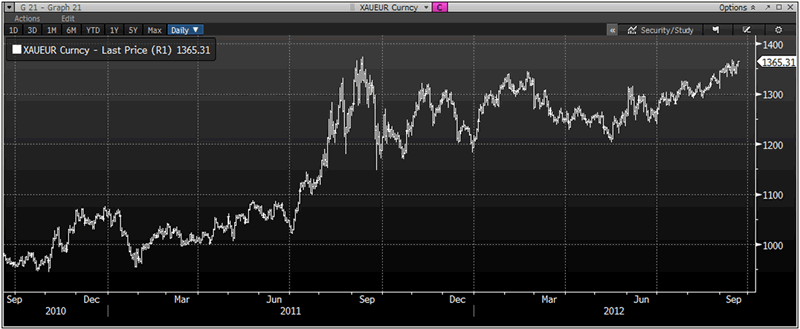

XAU/EUR Currency – (Bloomberg)

Weidmann has been trenchant in his criticism of EBC policy but has gone further by analogizing recent monetary stimulus to "the scene in Faust, when the devil Mephistopheles, 'disguised as a fool,' convinces an emperor to issue large amounts of paper money."

His criticism has been picked up by media internationally (see news) and has been featured on the front page of the Financial Times (UK edition) today including an image of Mephistopheles and the caption ‘Mephistopheles: Persuaded the Emperor to Print Paper Money.’

XAU/EUR Currency – (Bloomberg)

As the FT reports today “In early scenes from Goethe’s tragedy, Mephistopheles persuades the heavily indebted Holy Roman Emperor to print paper money – notionally backed by gold that had not yet been mined – to solve an economic crisis, with initially happy results until more and more money is printed and rampant inflation ensues.”

The classic play highlighted, Weidmann argued, “the core problem of today’s paper money-based monetary policy” and the “potentially dangerous correlation of paper money creation, state financing and inflation”.

In yesterday’s speech in Frankfurt, Goethe’s birthplace, he said: “The state in Faust Part Two is able at first to rid itself of its debts while consumer demand grows strongly and fuels a strong recovery. But this later develops into inflation and the monetary system is destroyed by rapid currency depreciation.”

The name Mephistopheles as used by Goethe comes from the Hebrew word for destroyer or liar.

Mephistopheles is a fallen archangel, one of the 7 great princes of Hell and in Goethe’s ‘Faust.’ Mephistopheles is acting for his overlord Satan and seals the pact with Faust.

Weidmann is suggesting that the ECB’s current monetary policies are a Faustian pact or a pact with the Devil and that they secure short term gain but will end in the disaster of rampant inflation.

Cross Currency Table – (Bloomberg)

The consensus among many experts today, such as Paul Krugman, is that Draghi and Bernanke are protecting people and economies by their radical monetary policies. This is the same consensus and many of the same experts who said there was no risk from the global property and debt bubbles until they blew up in our face.

It is interesting that many of the same experts who denied there were property and debt bubbles are often most vehement in supporting the very central bankers who helped create this crisis and whose monetary policies of piling debt upon more debt risk worsening the crisis in the long term.

History will not judge Draghi’s supporters and Draghi’s stewardship of the ECB kindly.

Weidmann is right to warn regarding the real and increasing dangers of inflation and “rapid currency depreciation”.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.