Why Bernanke Refuses to Let Crude Oil Prices Fall

Commodities / Crude Oil Sep 19, 2012 - 02:50 AM GMTBy: Clif_Droke

A prominent symptom of the final deflationary phase of the 60-year/120-year cycle scheduled to bottom in 2014 is, ironically, asset price inflation. While this may seem contradictory at first glance, it makes perfect sense after closer scrutiny. Asset price inflation is the central bank’s response to the destructive undercurrent of economic deflation. It requires a decisive action, as the recent QE3 initiative showed.

A prominent symptom of the final deflationary phase of the 60-year/120-year cycle scheduled to bottom in 2014 is, ironically, asset price inflation. While this may seem contradictory at first glance, it makes perfect sense after closer scrutiny. Asset price inflation is the central bank’s response to the destructive undercurrent of economic deflation. It requires a decisive action, as the recent QE3 initiative showed.

The 60-year long wave cycle is perhaps best represented by a classic sine wave. The bottom left portion of the wave represents the ending of the preceding deflationary cycle and the beginning of a new long-term 60-year cycle of inflation. The mid-point of the sine wave is the halfway point of the 60-year cycle (i.e. 30 years) and coincides with the peak of inflation. In U.S. economic history, this occurred in the late 1970s/early 1980s and was reflected by an $850/oz. gold price (then an all-time high) and double digit interest rates.

The two decades that followed were characterized by a benign period of dis-inflation in which commodity prices and interest rates fell while corporate profits rose steadily. This was a time of great prosperity for virtually everyone, including the middle class. The combination of low input prices, high employment and high productivity was a recipe for a strong economy.

Because the “sweet spot” of the long-term cycle occurred during the 1980s and ‘90s, the economy boomed along with the stock market. This meant that central bank monetary policy wasn’t as necessary to keeping the economy on an even keel. The momentum behind the long wave cycle did most of the work for the Fed.

Although the late ‘90s were a time of prosperity for the U.S. due to the combination of low consumer prices and rising financial asset prices, a critical problem was revealed to the world’s leading central banks. The glue that has always bound the major governments and central banks through the decades has been the drive to achieve a synchronized and fully integrated global economy. This utopian dream was nearly wrecked in 1997-98, beginning with the Asian currency crisis and the Russian ruble crisis, and culminating with the near collapse of the global commodities market in 1998. It was then that the first signs of deflation were felt as the 30-year cycle peak approached by the end of the ‘90s.

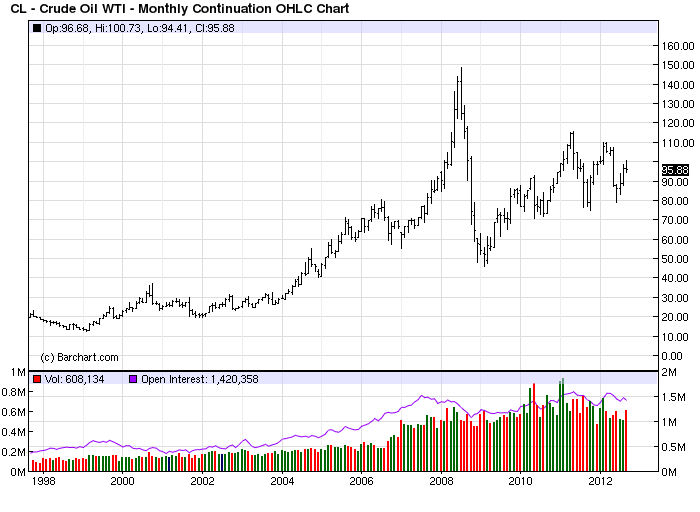

By the year 2000, the benign dis-inflation of the ‘80s and ‘90s was giving way to the deflationary portion of the final 15 years of the 60-year cycle. By the time the 30-year cycle peaked in 2000, it had become obvious to world leaders that a coordinated loose money policy was needed to prop up the price of oil. By the beginning of 1999 the price of crude oil had fallen to a low of $10/barrel.

Oil has long been recognized as the backbone of the global economy and one of the first places where deflation typically makes its presence known. The extremely low oil prices of the late 1990s may have been a boon to consumers, but it was destroying the economies of countries like Russia which rely heavily on oil revenue. “As goes oil, so goes Russia” as the following graph illustrates. Below is a chart comparing the weekly change in the Russia ETF (RSX) with the oil ETF (OIL).

To keep Russia afloat financially it was necessary to artificially boost oil prices beginning in the 2000s, when deflation first became a problem. This involved the use of central bank monetary policy to increase the liquidity available to speculators and hedge funds, which allowed them to push up oil prices through their speculative operations. The commodity exchanges complied to make it even easier for the large speculators to work their magic, and oil prices began a long-term rise which has continued until now.

Richard Hoskins described the importance of the international oil market to the cycle of inflation and deflation in his book War Cycles, Peace Cycles. He wrote, “Long ago Western oil companies went to the Near East and received agreements from the local Islamic governments that the oil companies would be given rights to any oil found with the local governments getting a specified cut. Washington politicians thought it would be good politics if they kept the oil price low by regulation. So it was kept low. Good politics – bad economics.”

Hoskins pointed out that the money supply wasn’t growing fast enough to keep the economy strong and that after Vietnam there were no other “stalemate wars” to provide enough spending to stimulate the economy. But out of this darkness of approaching economic misery came a “beam of light” in Hoskins words. American oil properties in Arab countries and oil prices were raised. “This forced world merchants to borrow new money into existence to pay the increased price,” wrote Hoskins.

Hoskins continued, “This oil price increase was far more creative than the Vietnam War, the War on Poverty, the War on Racial Separation, the War on Rhodesia, etc. The new massive borrowing created new money in sufficient quantities again to stave off [deflation] and in this writer’s opinion was, at the time, one of the few ways left in which this could have been done without the stimulus of a great war.”

As Hoskins wrote, “The modern inconveniences of increased oil prices far outweigh the disadvantages of 1929!”

Acting on this principle, the Bernanke Fed refuses to let the oil price fall to a level deemed unacceptable by the world market. Although short-term political considerations demand the oil price fall periodically in order to give U.S. consumers a temporary break, the oil price hasn’t been allowed to drop below the $70/barrel level in the last three years of the financial market recovery.

It would appear that the announcement of the central bank’s latest “quantitative easing” program (QE3) will maintain the Fed’s policy of keeping the oil price supported during the coming two years of deflation. By Bernanke’s own admission, the Fed intends to keep interest rates low and money loose until the end of 2014, which is precisely when the 60-year long wave cycle is scheduled to bottom.

In Memoriam

I am saddened to report the passing of my long time friend and stock market cycle mentor, Samuel “Bud” Kress, who died last Thursday at his home in Morristown, NJ at the age of 76. A 45-year veteran of the financial industry, Bud ran the SineScope advisory service and was the discoverer of the namesake Kress series of stock market cycles often mentioned in this commentary.

I met Bud some 12 years ago after he introduced himself as a researcher in an “arcane form of market cycles.” I soon discovered that his “arcane” cycles, which were components of the 120-year and 120-week rhythms, were by far the most reliable systems of cycle analysis I had ever encountered. I was continually amazed as Bud made one accurate market prediction after another using his weekly and yearly cycles, and I became convinced that unlike most so-called cycle experts, Bud was definitely onto something.

Over many years of telephone conversations and written correspondence, Bud and I shared several concepts of stock market forecasting. One of Bud’s greatest contributions to the study of technical market analysis (besides his Kress cycles) was his development of the concept of internal momentum. Bud always believed that the new 52-week highs and lows were the best measure of demand for stocks available, and that analyzing the highs-lows using a Fibonacci-based rate of change approach would yield valuable results. He refined his system of hi-lo momentum into a series of indicators he called HILMO (Hi-Lo Momentum), similar to, but with some differences, to the internal momentum system utilized in this commentary. He later added further refinements to his momentum system and called it HILDI (Hi-Lo Directional Indicator), but the basic concept remained the same. I believe this was Bud’s single greatest contribution to the science of technical analysis.

Bud’s primary expertise was in selling short and he relished the opportunity to “bear raid” the stock market whenever his cycles gave him the excuse for it. His greatest successes included calling the 2000 market top and accurately forecasting the 2008 stock market crash, which he navigated beautifully every step of the way. He also correctly called the bottom in early 2009 and rode the initial leg of the bull market until the “flash crash” of 2010, which he again successfully traded.

Bud’s motto when it came to the stock market was “Often right, sometimes wrong, never in doubt.” He strongly believed in taking a position on the stock market at all times and sticking with it until being proven either right or wrong. Despite his many stock market successes, Bud was level-headed in victory and humble in defeat. One of his sayings was, “Sooner or later, everyone has their hat handed to them by Mr. Market.”

Bud was a great friend, a brilliant market analyst and a true original in a homogenous industry. His many contributions to the science of stock market cycles are part of his legacy and will undoubtedly keep his name alive for years to come. He will be sorely missed by those who knew him.

2014: America’s Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to – and following – the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America’s Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form – namely the long-term Kress cycles – the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.