Stagflation In Extremis and The Explosive Rise Of Gold

Commodities / Gold and Silver 2012 Sep 18, 2012 - 04:06 AM GMTBy: Darryl_R_Schoon

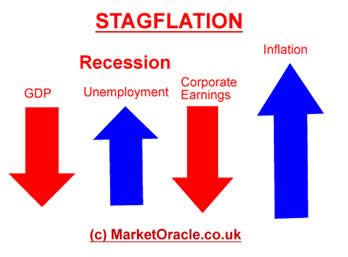

Stagflation is where economic growth slows, unemployment is high and prices rise.

Stagflation is where economic growth slows, unemployment is high and prices rise.

Stagflation’s appearance in the 1970s was like an outbreak of three-headed children. It wasn’t supposed to happen. Prevailing wisdom—an oxymoron among economists—held that high employment and rising prices were economic handmaidens; and that, conversely, slowing economies and inflation were mutually exclusive

In the 1970s, for the first time in capitalism’s history stagflation appeared, i.e. prices rose and economic growth stagnated; and, while economists would search for reasons to explain the apparently inexplicable, it was only because they avoided the obvious that they did not find the answer.

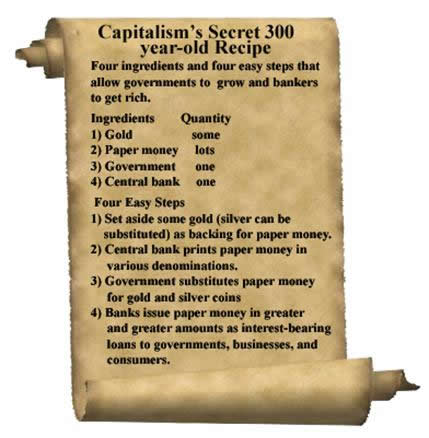

In August 1971, President Nixon upon the advice of Milton Friedman—the same Milton Friedman who erroneously taught Ben Bernanke economic contractions can be reversed by monetary expansion—ended the convertibility of the US dollar to gold.

The consequences of cutting ties between paper money and gold were not what Friedman expected. Friedman believed—belief is the operant word here—that ‘free-market forces’ would bring floating currencies into orderly market-driven valuations. Friedman was wrong—again.

The historic severing of ties between money and gold instead would result in extreme currency swings along with slowing growth, rising unemployment and rising prices, i.e. stagflation. Friedman’s advice would make a mockery of the Phillip’s Curve—the inverse relationship between the rate of unemployment and the rate of inflation—as it later would make a mockery of money itself.

In Time of the Vulture: How to Survive the Crisis and Prosper in the Process (3rd edition, 2012), I discussed what happened when Nixon cut the ties between the US dollar and gold in 1971:

It was as if someone removed a pin from the axle of international commerce when the US dollar was no longer convertible to gold. Previously, the US dollar was linked to gold, and other currencies were linked to the dollar. Everything was stable. It is no longer so. Once the pin connecting gold and paper money was removed, everything changed. The axle of international commerce began to vibrate and lately it’s been getting much worse. The fear is that the wheels are now about to come off.

Stagflation was the result. No longer constrained by the need to exchange costly gold for increasingly worthless pieces of paper money, governments began to debase their currencies until monetary restraint was as rare as celibacy in an era of drug induced free-love.

Cutting the link between the US dollar and gold not only allowed governments to debase their currencies (the US dollar had previously connected all currencies to gold), it would eventually bring about the destruction of capitalism itself via excessive levels of debt.

John Exter, central banker extraordinaire, opposed cutting the ties between the US dollar and gold. His objections, however, were overridden by Paul Volker, then President Nixon’s Under-Secretary of the Treasury for Monetary Affairs.

Instead of raising the price of gold as Exter recommended, Volker decided to instead cut all ties between the US dollar and gold, the course of action Milton Friedman had recommended to President Nixon.

Exter later commented on the significance of that act:

The final link between the dollar and gold was broken. The dollar became nothing more than a fiat currency and the Fed [and especially the banks] were then free to continue monetary expansion at will. The result..was a massive explosion of debt

Gold Wars, Ferdinand Lips, The Foundation for the Advancement of Monetary Education, New York

After 1971, the era of gold-backed money was over. All currencies are now paper coupons issued by heavily-indebted governments with expiration dates written in invisible ink.

STAGFLATION AND GOLD

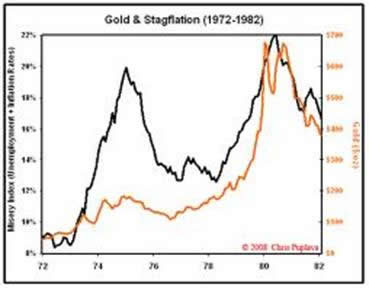

As prices rose in the 1970s, so, too, did the price of gold. In less than 10 years, gold went from $35 to $850. But the de-linking of the US dollar from gold not only ushered in higher gold prices but the heretofore unseen phenomena of stagflation and a level of economic instability commensurate with a monetary unit of now uncertain value.

Removing gold from paper money led not only to an era of economic instability; but it would eventually bring about the collapse of capitalism itself. Capitalism needed gold-convertible money to instill confidence in its debt-based paper banknotes; and without gold, capitalism’s confidence game would collapse, a collapse Buckminster Fuller had predicted.

Removing gold from capitalism is no different than removing lime from cement. It’s not going to work as well as before. In fact, it’s not going to work at all. Without gold, capitalism is like cement without lime, a recipe for disaster. The more cement, the larger the disaster.

Capitalism’s demise could well result from today’s hyper-variant form of stagflation—stagflation in extremis. Instead of a slowing economy and rising prices as in the 1970s, today we are facing a contracting economy along with unceasing money printing by central banks.

As a result, hyperinflation, not inflation, may accompany today’s contracting economies. In that scenario, inflation may well become virulent and once that line is crossed there is no going back—an outcome Friedman and Volker didn’t consider when they removed gold from capitalism’s fraudulently leveraged foundation of fractional reserve banking and paper banknotes.

STAGFLATION IN EXTREMIS AND THE EXPLOSIVE RISE OF GOLD

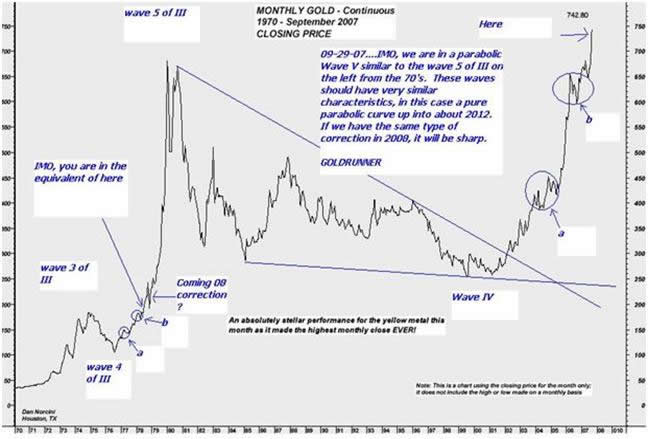

Today, we are about to experience stagflation but this time it will be stagflation in extremis; and this time gold’s rise will be explosive. The below chart (2007) shows the similarities between gold’s rise in 1979-80 (wave 5 of III) and today’s similar positioned projected take-off point to far higher prices.

Regarding the above chart, its authors, goldrunnerfractalanalysis, stated:

…We developed a price target back in 2006/2007 for Gold to reach the $10,000 to $12,000 range during this Gold Bull. Anything above that range would mean that the "Stagflation" comparison to the late 70's was exceeded and "Hyper-inflation" would become a real possibility. [bold, mine]

… The Dollar Printing since December of 2011 fulfills the need for a pretty constant acceleration of Dollar printing in effect to stave off a true period of deflation. The parabolic printing of Dollars leads to a parabolic devaluation of the Dollar and parabolic Gold. This is all about Dollar devaluation, not so much where the Dollars are going. Thus, the economy will continue to deteriorate creating the need for more Dollar printing, QE.

http://www.mineweb.com/mineweb/...

Stagflation compared to the 1970s, i.e. in extremis, is now in motion. Hyperinflation is a possibility and gold’s explosive rise, measured in hyper-inflated US dollar could easily surpass the previously estimated $10,000-$12,000 range. What that price will be is anyone’s guess—and, at this point, a guess it will be.

Gold’s final resting place will be atop the banker’s crematorium where the ashes of their paper money will be the only evidence left of the immense power they once held over humanity.

PRINTING MONEY IN THE ENDGAME

The bankers’ money printing in the endgame, QEetc, has staved off capitalism’s inevitable collapse but at an extremely high price; as the coming rendering will be of an even greater magnitude than if the collapse been allowed to take its ‘natural’ course.

Of course, the word ‘natural’ is unknown in the bankers’ dark lexicon drawn from the recesses of their self-serving and societally destructive self-interests. The bankers’ world, however, is ending; an ending predicted in 1981 by Buckminster Fuller in The Critical Path.

In my current video, Bucky’s vision of the coming better world, I discuss Buckminster Fuller’s extraordinary vision, a vision that gives direction as well as hope as we enter ever deeper into the crisis Bucky foretold.

Buy gold, buy silver, have faith

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.