Marc Faber Warns the Fed Will Take Your Gold Away From You One Day

Commodities / Gold and Silver 2012 Sep 17, 2012 - 04:45 AM GMTBy: LewRockwell

Today’s AM fix was USD 1,767.25, EUR 1,349.36 and GBP 1,089.42 per ounce.

Today’s AM fix was USD 1,767.25, EUR 1,349.36 and GBP 1,089.42 per ounce.

Friday’s AM fix was USD 1,772.50, EUR 1,359.70 and GBP 1,093.53 per ounce.

Silver is trading at $34.52/oz, €26.44/oz and £21.36/oz. Platinum is trading at $1,699.00/oz, palladium at $685.50/oz and rhodium at $1,050/oz.

Gold rose $5.30 or 0.3% in New York and closed at $1,771.60. Silver climbed to $34.91 then dropped before bouncing back higher, and finished with a loss of 0.06%. Gold was up 2.02% for the week and silver another 3% for the week.

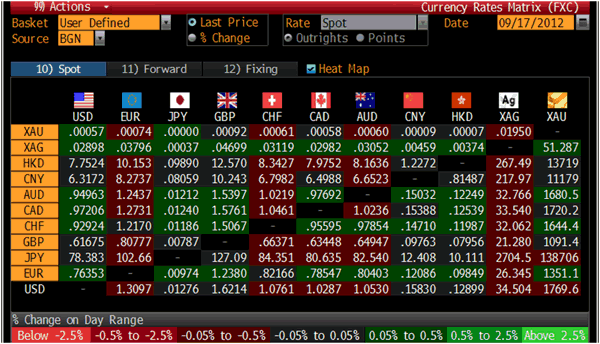

Currency Table – (Bloomberg)

Gold is slightly weaker today but hovering near a 7 month high, as the US Fed’s announcement of QE3 has led to some investors diversifying into bullion as a hedge against inflation risk.

The yellow metal rose as high as $1,777.51 on Friday, a high not seen since February 2012 when it hit this year’s peak. Last September 2011, it reached a nominal high of nearly $1,920/oz.

QE3 will allow the Fed to print dollars to buy $40 billion worth of bonds every single month for the foreseeable future. Dollars, euros and pounds are being made to grow on trees – the precious metals do not.

November marks the festival season of Diwali in India, the Hindu festival of lights and demand has picked up as both jewellers and investors scaled up purchases before prices rise any further.

Marc Faber, one of the few analysts, to have predicted the current crisis correctly and to have protected his clients in the process, remains very bullish on gold.

In another excellent Bloomberg interview, Faber said that “the trend for gold prices will be steady but the trend for the dollar and other currencies will be down. So in other words gold in dollar terms will trend higher.”

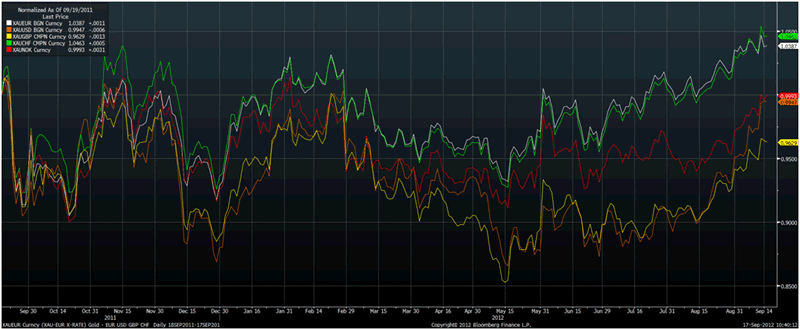

Gold in Dollars, Euros, Pounds, Norwegian Krone – 1 Year

“How high it will go, you will have to call Mr Bernanke and at the Fed there are other people who actually make Mr Bernanke look like a hawk and so they are going to print money.”

Faber is on record as to the importance of owning physical gold and he again warned about the importance of owning gold but not storing it in the U.S.

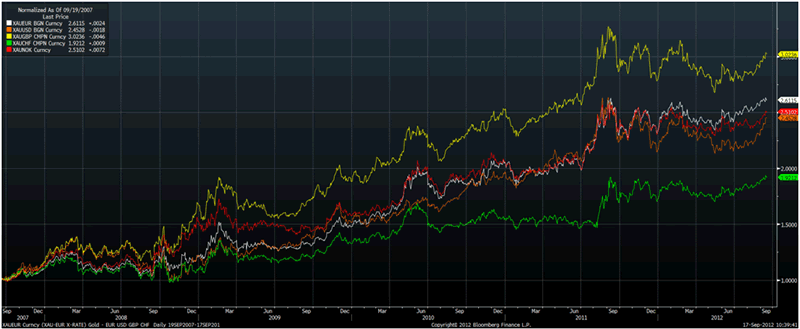

Gold in Dollars, Euros, Pounds, Norwegian Krone – 5 Year

“You ought to own some gold but don’t store it in the U.S., the Fed will take it away from you one day,” Faber astutely noted.

He said that Bernanke is a money printer and this could lead to massive inflation and the Dow Jones at 20,000, 50,000 or 10 million.

Faber cheerily predicted that the “the Federal Reserve’s monetary policy will destroy the world” and “eventually we will have a systemic crisis and everything will collapse.”

Faber’s long term historical financial and economic perspective remains astute.

The full interview is a must see and can be seen in our commentary section today.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.