Gold and Silver Prices On Fire!

Commodities / Gold and Silver 2012 Sep 14, 2012 - 03:49 AM GMTBy: GoldSilverWorlds

What a day for gold and silver … September 13th 2012 could become a historic day for the precious metals.

What a day for gold and silver … September 13th 2012 could become a historic day for the precious metals.

At the center of the stage today was the US Fed meeting and the announcement of their decisions by Mr Bernanke at 14h15 EST. Here is what came out of it in a nuthsell:

- A new round of quantitative easing was decided, with a key objective to decrease the unemployment rate in the US. Mr Bernanke said that “We’re looking for ongoing, sustained improvement in the labor market”. He calls the current unemployment rate of approximately 8% a “grave concern.”

- The monetary stimulus includes 40 billion US dollar per month of bond buying; that amount could be extended by an additional 40 billion per month if required to meet the objectives.

- Zero interest rate policy will be extended till 2015.

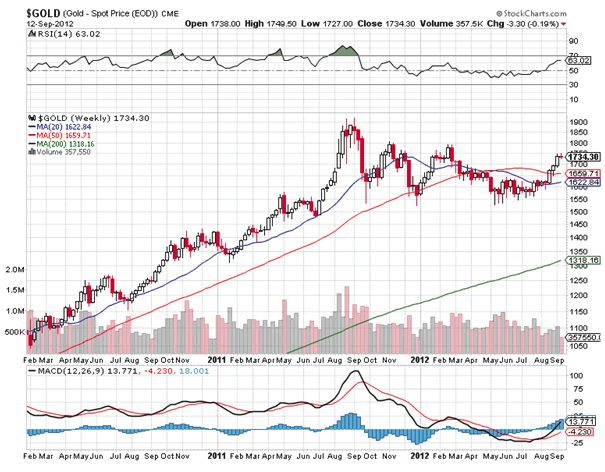

It seems like “QE to infinity”, a term that was introduced by the much respected Jim Sinclair, is for real. Jim Sinclair whose nickname is “Mr Gold”, has been forecasting for a long long time that $ 1764 was a key pivot point in the long term bull market, marking the start of the third and final phase. In the last phase of a bull market, prices tend to accelerate to the upside. That’s where incredible gold prices of $5000 or $10000, forecasted by several experts quite some time ago already, could eventually be reached.

Now we have seen gold touching the magic $ 1764 a couple of times before. But here is what Jim Sinclair had to say on his website today. It’s maybe the shortest but potentially the most powerful blog post ever: “It looks like Gold hit $1764 for the 3rd time. Gold is usually 3 hits and out.”

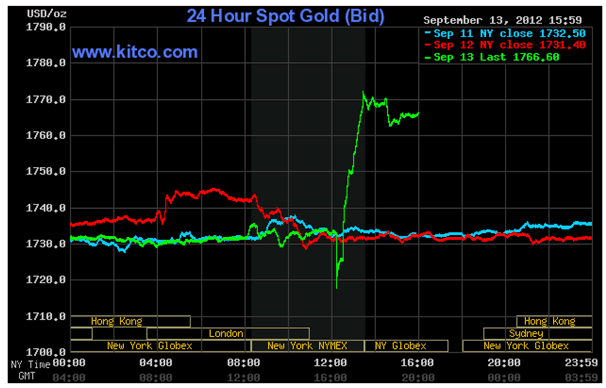

Today’s gold price chart doesn’t need too much explanation. The surge in the price is phenomenal and was obviously the result of Mr Bernanke’s speech. Look how quiet the markets have been today and the past few days, in anticipation of the speech of the Fed.

Now look at what’s happening on the weekly gold price chart. Gold has now clearly broken out of the descending pattern of the past 12 months. What’s more, the price is holding above the key moving averages. On the weekly chart, a golden cross over is nearing as well. Volume is simply decent, not extremely strong. Momentum is clearly there on the weekly chart.

Silver has blast through all resistance levels and moving averages in just two weeks. The positive note here is that silver is leading gold higher, which is a sign of strength. The daily chart start looking overbought though. There is a very strong resistance level at $ 35.50, so probably silver will need some energy to overcome that point. Thereafter, the metal should be able to surge fast to $ 40.

In closing, we should mention that the gold and silver stocks are doing very well. The outlook for the shares is extremely good if bullion prices will continue their surge. We should not forget that most of those mining companies have been valued by the markets with a gold price of approximately $ 1200. Gold stocks are undervalued; their value will become clear as soon as the rise of bullion will be here to stay and clear for everyone.

Looking to buy gold? Start here with one of our recommended gold bullion partners.

Source - http://goldsilverworlds.com/gold-silver-price-news/gold-silver-prices-today-on-fire/

© 2012 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.