Monetary “Floodgates” And Geopolitical Unrest To Support Gold and Silver

Commodities / Gold and Silver 2012 Sep 13, 2012 - 10:49 AM GMTBy: GoldCore

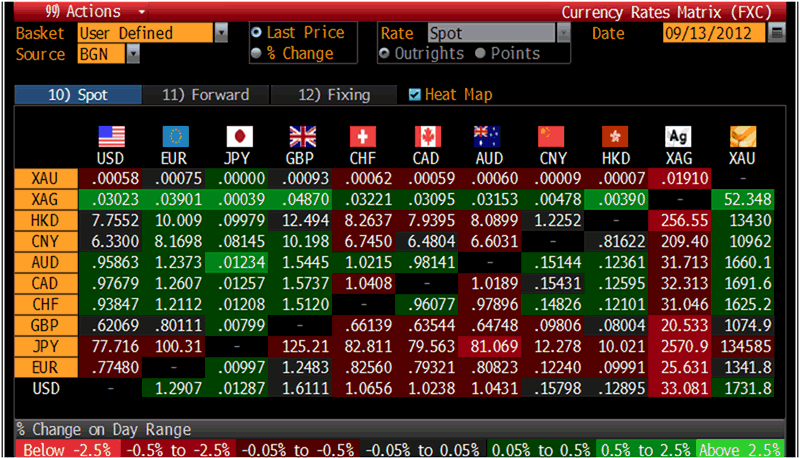

Today’s AM fix was USD 1,730.50, EUR 1,339.81 and GBP 1,073.64 per ounce.

Today’s AM fix was USD 1,730.50, EUR 1,339.81 and GBP 1,073.64 per ounce.

Yesterday’s AM fix was USD 1,742.75, EUR 1,352.23 and GBP 1,081.71 per ounce.

Silver is trading at $33.15/oz, €25.78/oz and £20.56/oz. Platinum is trading at $1,657.75/oz, palladium at $676.80/oz and rhodium at $1,025/oz.

Gold is a tad higher today in most major currencies. Investors await the policy decision by the US Federal Reserve and Fed Chairman Ben Bernanke’s news conference at 1815 GMT.

Yesterday’s German Constitutional Court’s decision allowing Germany to ratify the €500 billion ESM with strict conditions sent gold to its highest price since last February (in dollars) and silver back above $34/oz briefly.

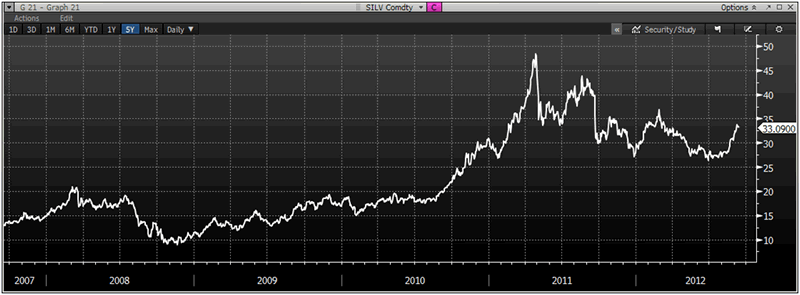

Silver 5 Year Chart – (Bloomberg)

Gold was down only $0.10 or 0.01% in New York yesterday and closed at $1,732.00. Silver hit $34.065 yesterday and then dropped to as low as $32.482 and then also rebounded, but it finished with a loss of 0.6%.

It is worth remembering that gold, silver and the platinum group metals (PGMs) have seen strong gains in the last 30 days and therefore a correction is possible.

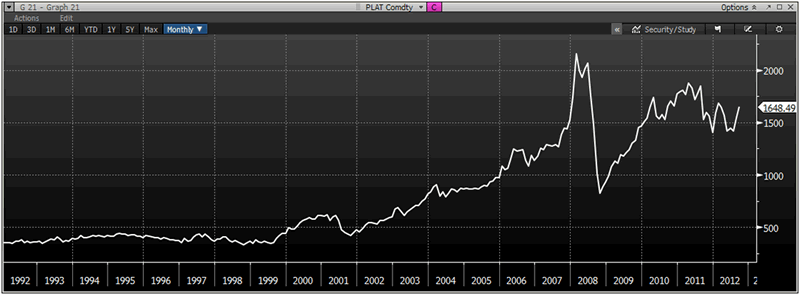

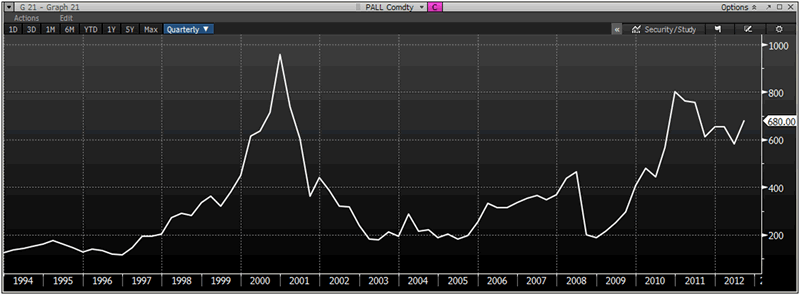

In the last 30 days (since August 13th), platinum has risen by 18.9%, silver by 18.7%, palladium by 18.4% and gold by 7.6%. All remain well below their nominal record highs (see charts) and more importantly well below their inflation adjusted highs.

All will most likely continue to rally especially if the Fed announces QE3 today as investors turn to precious metals to hedge substantial money printing by governments and the real risk of future inflation.

"The Euro bailout measures and the opening of the monetary policy floodgates by the central banks are likely to result in higher inflation in the medium to long term," says today's Commerzbank commodities note.

The strikes and violence in South Africa's gold and platinum industries are supporting and may contribute to higher prices.

Machete-wielding strikers forced Anglo American Platinum, the world's No.1 platinum producer, to shut down some of its operations in South Africa, sending spot platinum to a five month high of $1,654.49.

Spot palladium gained 0.9% to $677.20, and reached $680.50 earlier in the session -- a four-month high yesterday.

Platinum Monthly Chart 1992-2012 – (Bloomberg)

Palladium’s record nominal high was $1,045/oz back in January 2001.

South Africa gold production fell 5% versus a year ago further confirming South Africa’s has reached peak gold.

Spreading labor unrest in the nation’s mining industry has deepened concern of a credit-rating downgrade for South Africa. South Africa’s bonds slumped and the cost of insuring the nation’s debt jumped more than any other country yesterday.

Palladium Quarterly 1994-2012 – (Bloomberg)

The rand weakened 2% against the dollar, extending its loss over the past month to 3.1%, the worst performer among 16 major currencies.

Geopolitical risk continues to support gold with riots and attacks aimed at American interests spreading across the Middle East, North Africa and even into West Africa.

In the aftermath of the storming of the US embassy in Libya and killing of the U.S. ambassador, violence has flared in Egypt, Tunisia and in Yemen this morning and there are concerns of violence in Nigeria.

Hundreds of Yemeni demonstrators stormed the US embassy in Sanaa today and security guards tried to hold them off by firing into the air. Once inside the compound, they brought down the US flag and burned it.

Nigeria boosted security at foreign diplomatic buildings and Nigerian police are on “red alert” and ensuring “24-hour water-tight security in and around all embassies and foreign missions in Nigeria,” spokesman Frank Mba said today in an e- mailed statement from Abuja, the capital.

Cross Currency Table – (Bloomberg)

Protesters have attacked the U.S. embassies in Cairo and Tunis. In Tunisia, police used tear gas to stop hundreds of protesters from storming the United States Embassy. US embassies in Tunisia and Algeria warned Americans to avoid crowded places because of expected protests.

In Egypt, the powerful Muslim Brotherhood called for peaceful nationwide protests tomorrow “outside all the main mosques.” Security guards maintained the Egyptian U.S. embassies' perimeter against protesters, some who hurled Molotov cocktails.

Geopolitical risks remain elevated and means that an allocation to gold remains important.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.