Central bankers are a Gold bug’s best friend

Commodities / Gold and Silver 2012 Sep 12, 2012 - 10:30 AM GMTBy: Jan_Skoyles

On Monday we reported the results of our recent survey, where the majority of you told us that your interest in gold had been sparked thanks to a loss of trust in central bankers.

On Monday we reported the results of our recent survey, where the majority of you told us that your interest in gold had been sparked thanks to a loss of trust in central bankers.

Bad news, because actually central bankers are the ones you should trust the most when choosing gold investment.

Well, it’s never a nice thing to hear that you’ve lost trust in your best friend but actually, gold investors know that really they can trust central bankers to do the right thing and continue to drive the price of gold.

It’s a well-known fact, and one frequently cited on these gold news pages, that Western central bankers do not like gold.

Every week we laugh at the short sightedness of central bankers who dismiss the gold standard and keep De La Rue in business. But really, they’re doing all of us who have chosen to invest in gold, a huge favour.

Central bankers are one of the most short-sighted entities in the financial world. For the past 40 years they have been at their leisure to mismanage their national currencies to their hearts’ content.

This week, the gold price has been focussed on two major events; today, when the German Constitutional Court will decide whether or not it will respect the Maastricht Treaty and Thursday when the FOMC will decide whether or not to say yes to another round of QE.

The actions of the both the European and US central banks are all for the benefit of today’s gold investor.

Eager-to-please Draghi

Draghi, bless him, is so keen to please gold investors that he has promised to do ‘whatever it takes’ to save the Euro. Few realised the huge contradiction in his speech last week when the words ‘unlimited’ and ‘sterilized’ were used to describe the new OMT plan.

There is little hope of the latest plan saving the Eurozone, however at present gold shares a positive relationship with the single currency. Given the ECB’s plans and all the Eurozone’s political chatter are Euro positive this will benefit gold.

By keeping the euro on its feet (slumped slightly) the measures are also ensuring further integration and therefore contagion across the union. Considering the euro was destined to fail thanks to huge discrepancies between EU countries, further measures will merely exacerbate these issues. Whilst a positive euro relationship is good for gold at present a final collapse of the currency will also, no doubt, benefit the yellow metal.

Gene Arensberg, in his latest Got Gold Report, is hesitant as to whether or not the Euro crisis will end before 2020 let alone by the end of this year. ‘With European reliance on socialist central planning, technocrats and anti-productive, highly producer-discouraging tax policies, we seriously wonder whether the crisis on ‘The Continent’ will end this decade.’

However, we do not have to just rely on the Europeans to keep our gold bullion investments looking pretty. Over on the other side of the pond speculation is mounting as to whether or not the Federal Reserve will keep up hopes of further QE.

Bernanke drives gold price

Whilst some of the gold price increase has been thanks to ECB speculation, much if it is most likely thanks to faith that Bernanke will do all in his power to drive the gold price and destroy paper money.

Standard Bank believes ‘gold is now pricing in a further $250bn in QE from the Fed.’ This is much more than the estimated amount of QE, should Bernanke announce it at all.

The US election is on the 6th November and naturally the government would like data to show the economy looking pretty strong, but instead it’s looking pretty crappy. Unemployment remains at 8% with Bernanke telling us jobs performance is ‘of grave concern.’

Many expect QE will happen, if not this month then it isn’t far around the corner, and don’t forget the inflationary and devaluing impact of the last two rounds are only just beginning to rear their ugly heads

No doubt Obama will be looking for more QE, as Arensberg writes ‘Why not destroy the currency as long as it results in re-election?’

Central bank printing drives gold

As Bill Gross said late last week, ‘When a central bank starts writing checks and printing money in the trillions of dollars, it’s best to have something tangible that can’t be reproduced.’

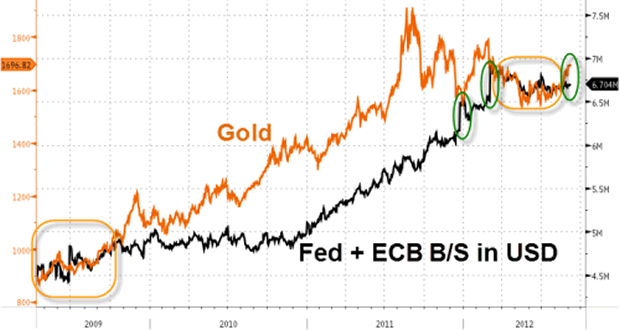

A graph which gains a huge amount of attention during times of QE speculation is shown below, it shows gold’s canny ability to anticipate balance sheet expansion by both the Fed and ECB:

But what if the Federal Reserve decides to tease everyone and once again release a ‘we’ll keep an eye on it and consider QE’ statement? This is likely to create a short-term correction in gold, but it is not as if the USA is the only country which can print its own money. Don’t forget the US Dollar is practically in a race to debase against several other currencies.

China’s export growth disappointed last month, with an increase of only 2.7%. But low imports surprised analysts the most indicating the slowdown is increasing. This has prompted calls for further monetary and fiscal stimulus from the Chinese government. Whether this will happen is debateable considering China’s slightly more sensible view to inflation.

However, whatever the PBoC decide, Chinese citizens are ramping up their gold holdings like nobody’s business and are no on track to top India when it comes to private gold investment.

Meanwhile gold is gaining purchasing power in all major currencies, even the sensible ones like the Canadian Loony.

Central bank gold investment

Of course, not all central bankers are on a covert mission to drive the price of gold. Some are openly supporting gold and selling their paper reserves in order to stock up on gold. This year alone, reports Thomson Reuters GFMS, central banks are reported to have bought 273 tonnes of gold bullion, 34% more than last year. A further 220 tonnes is expected to be added in Q3 and Q4, pushing total central bank gold purchases up by 7% on last year.

Central bank buying is nowhere near the levels that they used to be back in the 1980s, however this does show the clever ones are looking to diversify into more tangible assets, such as gold.

Once again central bankers prove themselves to be a gold investor’s best friend as they push demand for gold and demonstrate to their own citizens the need to save in something more valuable than paper.

Will central bankers let us down?

Draghi, Bernanke and even Sir Mervyn may change their minds when it comes to the so far simple solutions of bond and asset purchases. However, this is unlikely to be thanks to the economy getting better, rather it is likely to be thanks to those measures failing and more loose monetary and fiscal measures being brought in.

Many are predicting sky high levels of inflation just around the corner. Many worry that should this be imposed then Volcker-esque interest rates may be enforced. Would this be good for gold?

At present inflation levels remain officially low. However they can’t hide from gold which acts as a barometer for the future. It has risen on the back of inflation and debasement expectations. By the time governments clock onto high inflation and try to control it with interest rates, gold is likely to have gained by a significant margin and then you will be grateful you trusted your best friend and chose to invest in gold.

Trust central bankers to drive the gold price? Buy gold online in minutes…

Jan Skoyles contributes to the The Real Asset Co research desk. Jan has recently graduated with a First in International Business and Economics. In her final year she developed a keen interest in Austrian economics, Libertarianism and particularly precious metals.

The Real Asset Co. is a secure and efficient way to invest precious metals. Clients typically use our platform to build a long position and are using gold and silver bullion as a savings mechanism in the face on currency debasement and devaluations. The Real Asset Co. holds a distinctly Austrian world view and was launched to help savers and investors secure and protect their wealth and purchasing power.

© 2012 Copyright Jan Skoyles - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.