Jackals of Jekyll Island - Federal Reserve Audit

Politics / Central Banks Sep 12, 2012 - 06:47 AM GMTBy: BATR

The supreme illicit fraud of central banking embodied in the Federal Reserve, acts as a private piggybank for favored cartel thieves. The liquidity of unlimited credit transfers to banksters, especially at zero interest, financed by unimaginable new Treasury Bonds, indebting the American public; is a crime committed by outlaws. The significance of the evidence for the extent of the crony financial manipulations, that the controllers of international capital use to maintain their power strangle hold on humanity, needs to be fully exposed. Only when the beleaguered and downtrodden become sufficiently indignant to usury incarceration, will heads start to roll.

The supreme illicit fraud of central banking embodied in the Federal Reserve, acts as a private piggybank for favored cartel thieves. The liquidity of unlimited credit transfers to banksters, especially at zero interest, financed by unimaginable new Treasury Bonds, indebting the American public; is a crime committed by outlaws. The significance of the evidence for the extent of the crony financial manipulations, that the controllers of international capital use to maintain their power strangle hold on humanity, needs to be fully exposed. Only when the beleaguered and downtrodden become sufficiently indignant to usury incarceration, will heads start to roll.

Vermont Senator Bernie Sanders announces on his web site page, The Fed Audit.

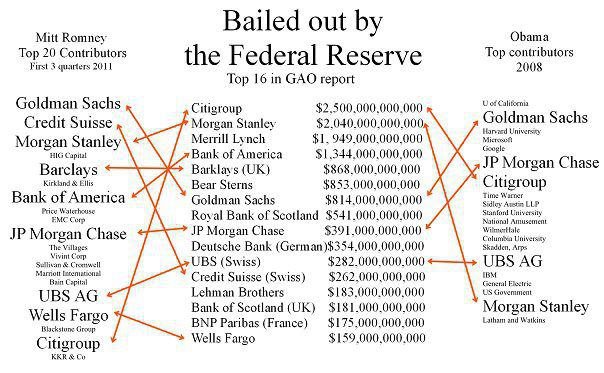

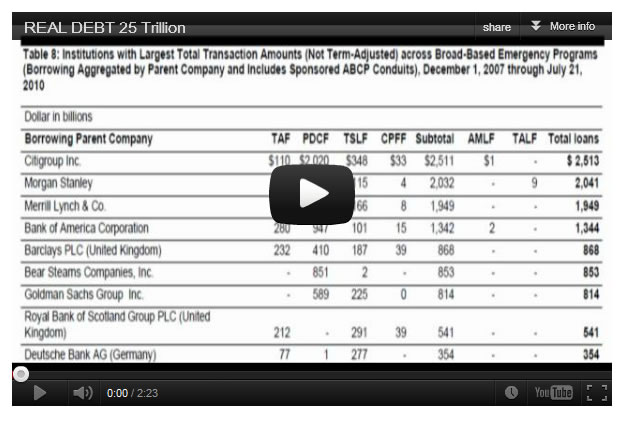

"The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression. An amendment by Sen. Bernie Sanders to the Wall Street reform law passed one year ago this week directed the Government Accountability Office to conduct the study. "As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world," said Sanders. "This is a clear case of socialism for the rich and rugged, you're-on-your-own individualism for everyone else."

Yes, you read that correct, 16 TRILLION DOLLARS. When originally disclosed, there was minimal outrage.

"The FOMC approved these swap line arrangements to help address challenges in the global market for interbank lending in U.S. dollars. Many foreign banks held U.S. dollar-denominated assets and faced challenges borrowing in dollars to fund these assets. In contrast to U.S. commercial banks, foreign banks did not hold significant U.S. dollar deposits, and as a result, dollar funding strains were particularly acute for many foreign banks. The Board of Governors of the Federal Reserve System (Federal Reserve Board) staff memos recommending that the FOMC approve swap lines noted that continuing strains in dollar funding markets abroad could further exacerbate strains in U.S. funding markets. For example, foreign banks facing difficulties borrowing against U.S. dollar assets may have faced increased pressure to sell these assets at a time of stress, potentially putting downward pressure on prices for these assets. The dollar swap lines allowed foreign central banks to make dollar loans to banks in their jurisdictions without being forced to draw down dollar holdings of foreign exchange reserves or to acquire dollars directly in the foreign exchange market. An FRBNY staff paper noted that the dollar reserves of many foreign central banks at the start of the crisis were smaller than the amounts they borrowed under the swap lines and that efforts by foreign central banks to buy dollars in the market could have crowded out private transactions, making it more difficult for foreign banks to obtain dollars. This paper further noted that the Federal Reserve System (the Federal Reserve Board and Reserve Banks collectively) was in a unique position to provide dollars needed by foreign central banks to provide lender-of-last-resort liquidity to banks in their jurisdictions. The increase in reserves was offset through sales of Treasury securities and increasing incentives for depository institutions to hold excess reserves at FRBNY."

The last statement regarding using Treasury securities to increase banking reserves admits that monetizing the balance sheet of the FED, to unheard of levels, continues unabated. The absence of mainstream media reports on this historic, more than doubling, of the officially disclosed debt is beyond belief. Now that the Federal Reserve openly acknowledges that, the privately held banking cabal is buying up Treasury Notes, because the marketplace has refused to accept and buy the excessive float of new Treasury obligations, should be the most sobering consequence of the greatest bubble of all time.

This off the books concealment reporting by the FED illustrates the importance of the audit.

Watch the video, REAL DEBT that provides a short analysis of the Fed audit.

"The recent audit of the Federal Reserve by the Government Accountability Office is particularly disturbing if read alongside the last report to Congress by the Fed’s Inspector General.

The GAO audit found a huge number of serious conflicts of interest at the Fed. Employees and contractors were allowed to own stock in the companies receiving financial assistance from the central bank."

The fact that the FED and their enablers in Congress prevented a complete and comprehensive forensic audit of the books of the "Jackals of Jekyll Island" indicates just how much is at stake.

"Another mystery that I would like to see addressed is the trillions of dollars of "off balance sheet transactions" that are unaccounted for at the Federal Reserve. This was brought up once during a Congressional hearing, but nobody seemed to have any answers."

The $9,000,000,000,000 MISSING From The Federal Reserve YouTube captures the absurdity of Congressional oversight. The financial community that created fractional reserve banking is in total control of the political election process. As long as there is no accountability and consequences for outright theft, the money magicians continue to operate their fraudulent scheme of deception as the cornerstone of international economic transactions.

James Hall – September 12, 2012

Source : http://www.batr.org/negotium/091212.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2012 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.