Stock Market Finally at the Top!

Stock-Markets / Stocks Bear Market Sep 12, 2012 - 06:32 AM GMT Things are speeding up on several fronts, including the markets. I will fall back to doing one closing Commentary on Wednesday and a Weekend Report on Saturday until further notice. I will still attempt to bring you breaking news as it happens.

Things are speeding up on several fronts, including the markets. I will fall back to doing one closing Commentary on Wednesday and a Weekend Report on Saturday until further notice. I will still attempt to bring you breaking news as it happens.

I wish to inform you that I am being vetted for a position with a much larger RIA firm with a possible start date of October first. I still don’t know if or how that will affect my newsletters. Until then, I intend to keep the letters going, at least until further notice.

As with any new position, I will have to adjust to the new culture and follow their compliance rules, which I am not yet privy to. Having said that, I wish to reports on the progress of the cycles so far this week.

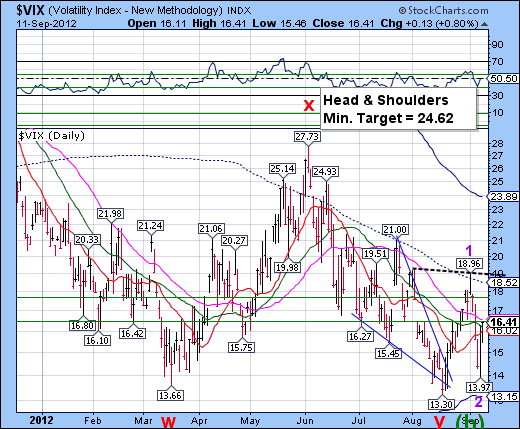

The VIX has completed its minor wave 2 retracement and has advanced to the 50-day moving average at 16.56. I understand that it may have risen above it in the overnight markets already. This leaves one final resistance at the mid-Cycle at 18.52 and the inverted Head & Shoulders Neckline at 18.90. Crossing either of these resistances will launch the VIX beyond its Daily Cycle Top resistance at 23.89 in its third wave. This would give intermediate degree wave [1] a target near 28.00, possibly positioning it for a new Head & Shoulders pattern roughly level with the 27.73 top. I will discuss new targets at we come to that point.

SPY has spent the last three days at Cycle Top resistance at 144.39. Folks, this model was designed to show where the Cycle Tops are supposed to be, and it is working flawlessly. In addition, I would like to point out that equities are within 8.6 days of a 43-month cycle from March 9, 2009 to September 20, 2012. It is a little shy of 43 calendar months, but September 20 is 1290 days from March 9, 2009. SPY does not have to wait until September 20 to break down. In fact, most cycle tops fall within the 8.6 day, 13 day or 17.2 day variance. The March 9, 2009 Cycle low was 13 days early, as a matter of fact. Last Year’s Master Cycle low was 13 days late. The October 17, 1987 low was 17.2 days early.

The point that I am trying to make is that 9 of 11 cycles currently show either major highs or lows due in the next 8.6 days, or possibly longer with extensions. That is what we have to prepare for. These Cycle Tops often break violently and the Broadening Top formations all lend credence to that idea. The daily chart show that the top is already in.

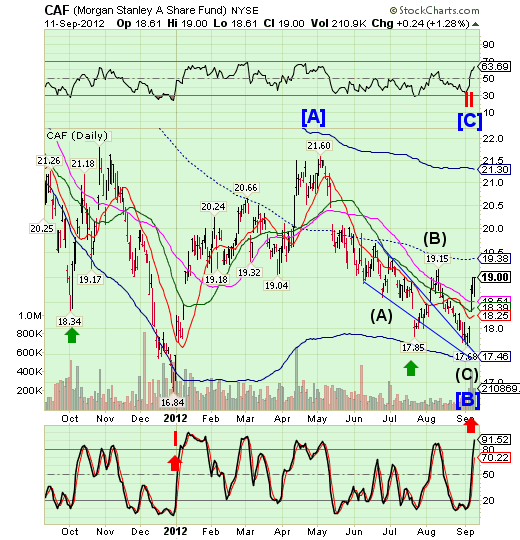

Finally, after being two weeks early, CAF is finally doing what it has to do. It has already made up for the initial losses of an early placement, and has plenty further to go. Be aware that there will be retracements along the way, so if you wish to add longs, please attempt to find a decent pullback. If it pulls back here, a decent interval may be the 50% retracement at 18.36, which is close to intermediate-term support at 18.39. Wave (3) seems to have an attraction to the Cycle Top at 21.30. Wave (5) still appears targeted to 22.25 or higher. By the way, Jeff Gundlach agrees with my analysis on the Shanghai Index as well as SPY/SPX.

Well, that’s it for now. There’s plenty more to discuss, but I feel that tomorrow will bring even more information to the table.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.