A Decade of Volatility: Demographics, Debt, and Deflation

Economics / Deflation Sep 11, 2012 - 06:15 AM GMTBy: John_Mauldin

Harry Dent gave a speech I listened to a while back, and I got him to transcribe it for this week's Outside the Box. One thing about Harry is, you are never left wondering what he thinks about a topic. He sees inevitable demography-caused deflation in our future and makes some very intriguing arguments that deserve pondering.

Harry Dent gave a speech I listened to a while back, and I got him to transcribe it for this week's Outside the Box. One thing about Harry is, you are never left wondering what he thinks about a topic. He sees inevitable demography-caused deflation in our future and makes some very intriguing arguments that deserve pondering.

At the end is a link to another report and a way to subscribe to his letter, if you are interested in more of his perspective. But first, I suggest you read this straightforward, informative presentation. There is also a link to the actual video of him speaking, should you prefer that.

This evening I am still in Carlsbad, California, where it has been an absolutely marvelous night. Rather than go back to Dallas before I have to be in Palo Alto on Thursday, I am staying in California and splitting my time between resorts in Carlsbad and Palo Alto. Tough life on the road and all that.

I got to spend the evening with my great friend David Brin (Science Fiction Hall of Famer, whose latest book, Existence, is totally a boffo experience – get it!), along with Doug Casey and Doug Hornig (a serious writer of about ten books, including a few sci-fi books, and now works for Casey Research). The topics ranged all over the spectrum. It was one of those nights you live for. And the next few days are going to be solid, as well. I get to see some cool new stuff and some old friends in Palo Alto while waiting to speak on Thursday at the Altegris event there. And then it's back to Dallas on Friday, where I get to write another letter for you. Until then, have a great week!

Your wanting Southern California weather in Texas analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

A Decade of Volatility: Demographics, Debt, and Deflation

By Harry S. Dent, Jr., author of The Great Crash Ahead and editor of Boom & Bust

To watch a video version of this presentation by Harry Dent, please click on the following link: http://survive-prosper.com/A-Decade-of-Volatility/

Most of you reading this expect inflation in the years ahead, right? Well, I don't. In fact, I am firmly in the deflation camp.

Just think about it. What has happened after every major debt bubble in history? What happened after the 1873-74 bubble? Or after the 1929-32 bubble? Did prices inflate or deflate?

We got deflation in prices… every time.

This time around, with the latest bubble peaking in 2007/08, the outcome will be exactly the same. There is deflation ahead. Expect it. Prepare for it.

But the bubble-bust cycle that history has allowed us to see is not the only reason I'm so certain we're heading for deflation and a great crash ahead. I have other, irrefutable evidence…

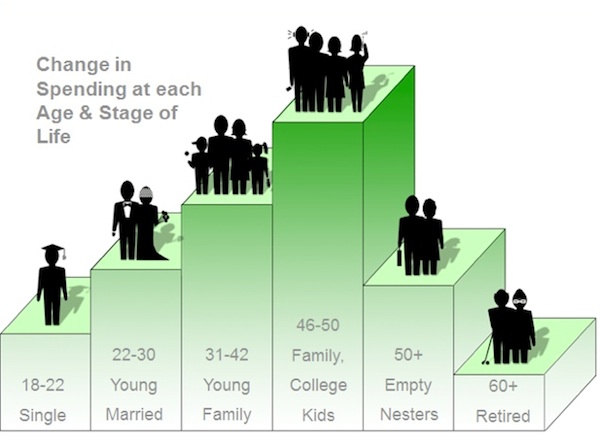

For one, there is the most powerful economic force on Earth: demographics. More specifically, the power of the number 46. You see, that's the age at which the average household peaks in spending.

When the average kid is born, the average parent is 28. They buy their first home when they're 31… after they had those kids. When the kids age into nasty teenagers, the parents buy a bigger house so they can have space. They do this between the ages of 37 and 42. Their mortgage debt peaks at age 41. And like I said, their spending peaks at around 46.

From cradle to grave, people do predictable things… and we can see these trends clearly in different sectors of our economy, from housing to investing, borrowing and spending, decades in advance.

This demographic cycle made the crash in the '30s and the slowdown in the '70s unavoidable. Now it is happening again... with the biggest generation in history – the Baby Boomers.

Consumer spending makes up more than two-thirds of our gross domestic product (GDP). So knowing when people are going to spend more or less is an incredibly powerful tool to have. It tells you, with uncanny accuracy, when economies will grow or slow.

Why Deflation Is the Endgame

Think of it this way: the government is hellbent on inflating. It's doing so by creating debt through its quantitative easing programs (just for starters). But what's the private sector doing? It's deflating.

And the private sector is definitely the elephant in the room. How much private debt did we have at the top of the bubble? $42 trillion. How much public debt did we have back then? $14 trillion.

That looks like a no-brainer to me. Private outweighs public three to one. And the private sector is deleveraging as fast as it can, just like what happened in the 1870s and 1930s. History shows us that the private sector always ends up winning the inflation-deflation fight.

Now, I will concede that this is an unprecedented time. Today governments around the world have both the tools and the determination to fight deflation. And they are desperate to keep it at bay because they know how nasty it is (they, too, are students of history).

How bad is it? Think of deflation like what your body would do with bad sushi. It would flush it out as fast as possible. That's what our system is trying to do with all the debt we accumulated during the boom years. It's what the system did in the 1930s. Back then we went from almost 200% debt-to-GDP to just 50% in three years. It hurt like hell. The government doesn't want this painful deleveraging.

The problem is, the longer the government tries to fight this bad sushi, the sicklier the system becomes. I know this because it's what happened to Japan…

Japan's bubble peaked in the '80s. When the unavoidable deleveraging process began, the country did everything in its power to stop it. How is Japan doing today, 20 years after its crash? It is still at rock bottom. Its stock market is still down 75%.

Japan has gone through everything we'll go through in the next few years. Does Japan have an inflation problem? That's a rhetorical question. Did its central bank stimulate frantically? Also a rhetorical question.

Think of it another way: what is the biggest single cost of living today? Is it gold? Oil? Food? It's none of these. It is housing. And what is housing doing? Dropping like a rock. It can't muster a bounce, despite the lowest mortgage rates in history and the strongest stimulus programs anywhere… ever.

The Fed is fighting deflation purposely. It will fail.

Why the Fed Will Fail in All Its Efforts

There is simply no way the Fed can win the battle it's currently waging against deflation, because there are 76 million Baby Boomers who increasingly want to save, not spend. Old people don't buy houses!

At the top of the housing boom in recent years, we had the typical upper-middle-class family living in a 4,000-square-foot McMansion. About ten years from now, what will they do? They'll downsize to a 2,000-square-foot townhouse. What do they need all those bedrooms for? The kids are gone. They don't visit anymore. Ten years after that, where are they? They're in 200-square-foot nursing home. Ten years later, where are they? They're in a 20-square-foot grave plot.

That's the future of real estate. That's why real estate has not bounced in Japan after 21 years. That's why it won't bounce here in the US either. For every young couple that gets married, has babies, and buys a house, there's an older couple moving into a nursing home or dying.

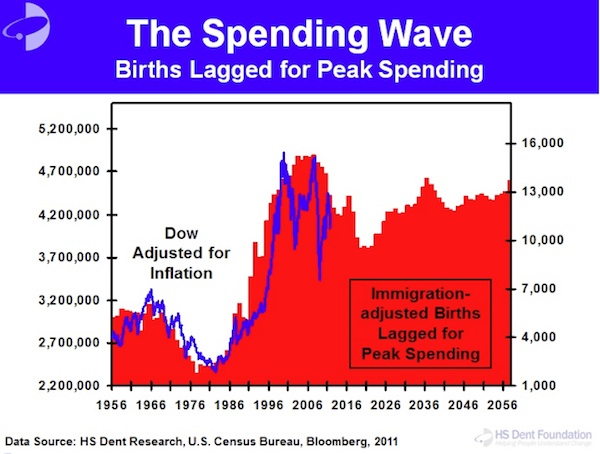

I watch this same demographic force move through and affect every other sector of the economy. The tool I use to do so is my Spending Wave. This is a 46-year leading indicator with a predictable peak in spending of the average household.

Here's how it works: the red background in the chart above is the Dow, adjusted for inflation. The blue line is the spending wave, including immigration-adjusted births and lagged by 46 years to indicate peak spending. If you ask me, that correlation is striking.

The Baby Boom birth index above started to rise in 1937. It continued to rise until 1961 before it fell. Add 46 to 1937, and you get a boom that starts in 1983. Add 46 to 61, and you get a boom that ends in 2007.

Today demographics matters more than ever because of the 76 million Baby Boomers moving through the economy. That's why I don't watch governments until they start reacting in desperation. Then I adjust my forecasts accordingly.

Don't Hold Your Breath for the Echo Boomer Generation

But all this talk about Baby Boomers inevitably births the question: "Surely the Echo Boom generation is coming up right behind their parents. They'll fill the holes, right?"

Let me make this clear. If I hear one more nutcase on CNBC say, "The Echo Boom generation is bigger than the Baby Boom," I might go ballistic. They are wrong. The Echo Boomer generation is NOT bigger than the Baby Boom generation. In fact, it's the first generation in history that's not larger than its predecessor is, even when accounting for immigrants.

It's not all doom and gloom, though. We will see another boom around 2020-23. But for now, all the Western countries will slow, thanks to the downward demographic trend sweeping the world. Some are slowing faster than others are. For example, Japan is slowing the fastest (it actually committed demographic kamikaze, but that's a discussion for another day). Southern Europe is next along in its decline. Eastern Europe, Russia, and Asia are following quickly behind.

Which brings me back to my point: there is no threat of serious inflation ahead. Rather, deflation is the order of the day. The Fed thinks it can prevent a crash by getting people to spend. To that I say, "Good luck." Old people don't spend money. They bribe the grandkids, and they go on cruises where they just stuff themselves with food and booze.

Do you know how to tell if you're buying a car from an older person? It's going to be ten years old and have only 40,000 miles on it. They drive 4,000 miles a year. They just go down the street to get a Starbucks coffee and a newspaper. Then they go back home. How do you know you're buying a car from a soccer mom? It's driven 20,000 miles a year, carting the kids around all day… to school, soccer practice, whatever. This is the power of demographics.

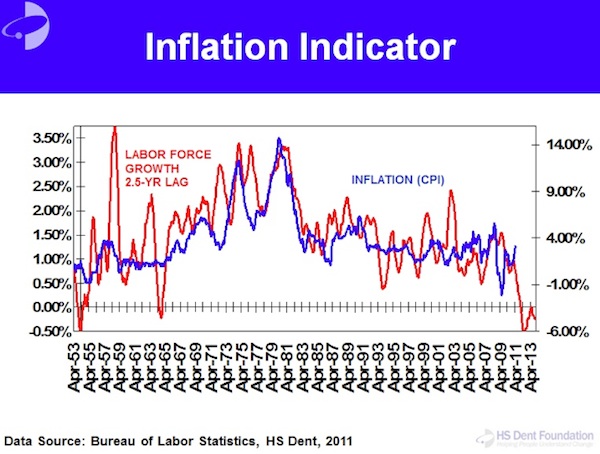

So let me tell you what causes inflation. It's young people. Young people cause inflation. They cost everything and produce nothing. That's inflation in people terms.

Why did we have high inflation in the '70s? Because Baby Boomers were in school, drinking, spending their parents' money. While this was going on, we experienced the lowest-productivity decade in the last century.

Do you remember the 1970s? We had worsening recessions as the old Bob Hope generation began to save more while the Baby Boomers entered the economy en masse… at great expense. It costs a lot of money to incorporate young people, raise them, and put them into the workforce.

Then suddenly, in the early '80s, like some political genius did something brilliant, the economy started growing like crazy, and inflation fell. You know what that was? That was the largest generation in history transitioning en masse from being expensive, rebellious, young people to highly productive yuppies with young new families. It was the move from cocaine to Rogaine.

The correlation between labor force growth and inflation is crystal clear…

When lots of young people come into the labor force, it's inflationary. When lots of old people move out of the labor force and into retirement, it's deflationary. Right now, where is the highest inflation in the world? It's in emerging countries. Do they have more old people or young people? They have more young people.

We saw it in the 1970s, we see it in emerging markets, and we'll see it ahead as the Baby Boomers head off into the sunset. First, there was inflation. Ahead is deflation. No doubt about it.

Harry Dent, the editor of Boom & Bust, has put together a free report for John Mauldin's readers, called: Survive and Prosper in This Winter Season: Take These Steps Now... Before Dow 3,300 Arrives. You can access this free report by clicking on this link: http://www.boomandbustinvestor.com/reports/current/BoomandBustInvestor_WinterSeason.pdf

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.