Gold New Euro Record High

Commodities / Gold and Silver 2012 Sep 10, 2012 - 07:57 AM GMTBy: GoldCore

Today’s AM fix was USD 1,732.75, EUR 1,355.09, and GBP 1,082.63 per ounce.

Today’s AM fix was USD 1,732.75, EUR 1,355.09, and GBP 1,082.63 per ounce.

Friday’s AM fix was USD 1,696.00, EUR 1,337.75 and GBP 1,062.06 per ounce.

Silver is trading at $33.50/oz, €26.32/oz and £21.05/oz. Platinum is trading at $1,596.50/oz, palladium at $655.70/oz and rhodium at $1,025/oz.

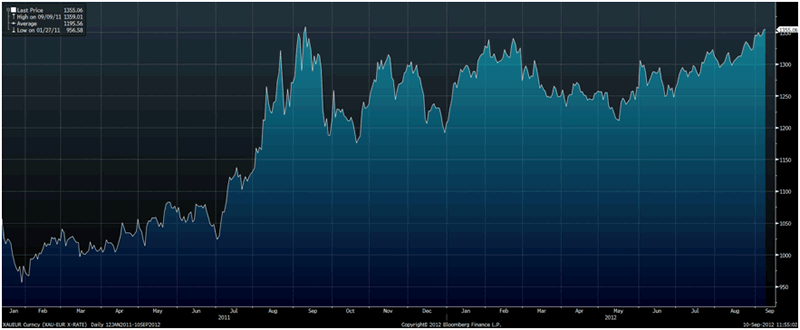

Gold in Euros – January 2011 to Today

Gold has risen to new record highs in euro terms overnight in Asia when gold consolidated on last week’s 3% gains and rose above €1,360/oz for the first time.

Significant consolidation has been seen in the last year between €1,200/oz and the previous record high at €1,359.01/oz. This record high was seen almost exactly a year ago on September 9th 2011.

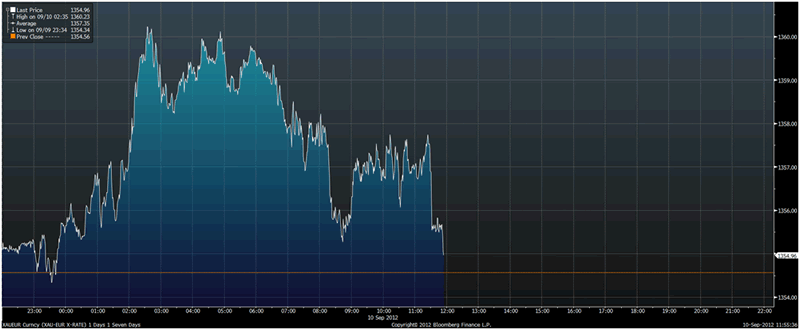

Gold in Euros Today - Gold’s new record euro high at EUR 1,360.23 Per Ounce

This consolidation will likely give rise to further weakness in the euro versus gold in the coming weeks. The record high shows an increasing lack of investor confidence in the single currency.

It shows that there is concern that Mario Draghi’s ultra loose monetary policies at the ECB may lead to further euro weakness and to inflation in the eurozone.

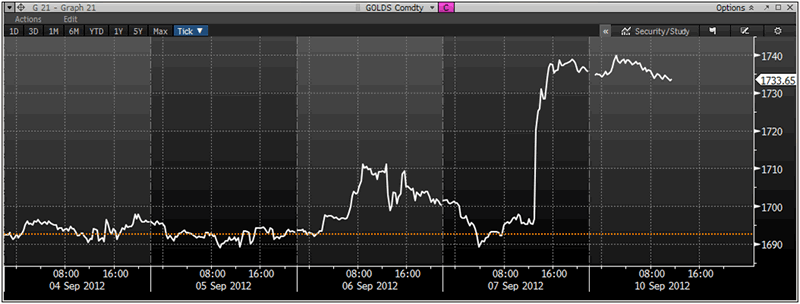

Gold surged in all currencies on Friday and rose 2.13% in dollar terms and closed at $1,736.50. Silver soared to a high of $33.707 and finished with a gain of 3.09%.

The nonfarm payrolls figure came in at 96,000 and the market expected 130,000 which showed the US economy is in a very poor state which led to safe haven gold buying.

Gold is consolidating near 6 and a half month highs in dollar terms with a variety of strong fundamental factors leading to higher prices. It is only a matter of time before gold records new record nominal highs in dollar terms over $1,900/oz.

Gold in USD - 5 Days (Tick) – Bloomberg

Gold is being supported by the unrest in South Africa which continues to destabilise the mining sector.

Gold Fields said this morning that some 15,000 workers were still on strike at one of its gold mines outside of Johannesburg. The tally of workers on strike at the West Section of the KDC Gold Mine is about 3,000 higher than last week. All production at the mine has been brought to a standstill.

With the US job growth contracting significantly in August, investors see that the Fed will be inclined to announce QE3 at this week’s policy meeting on the 12th & 13th.

US gold futures and options climbed to 6-month high 144,775 contracts in the week ended September 4, according to data from the U.S. Commodity Futures Trading Commission.

Gold ETF’s grew to a record high of 72.125 million ounces on Friday.

Also, Hong Kong's July gold shipments to China was almost double on the year and exports for the first 11 months were greater than 2011, suggesting China will overtake India as the world's top gold consumer.

UBS has joined JP Morgan, Goldman, Bank of America and others in revising upwards its gold forecast. UBS raised its one-month gold forecast to $1,850 an ounce, from $1,700 and the three-month estimate to $1,850 from $1,750 an ounce in a report e-mailed today.

UBS also revised higher their estimates for silver and see silver 10% higher at $37 an ounce in one and three months from $33.50 today. UBS previous silver forecast was from $32 and $35.

JP Morgan has said that they expect gold prices to rise another 6% in 2013 and another 2% in 2014.

Central banks may purchase 489 metric tons of gold this year, JPMorgan Chase & Co. said.

The purchases along with investor buying of exchange-traded products should drive demand this year, said Yuriy Vlasov, an analyst at the bank, in a report released Friday

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.