Gold Imports To China From Hong Kong Double Again On Safe Haven Demand

Commodities / Gold and Silver 2012 Sep 07, 2012 - 07:48 AM GMTBy: GoldCore

Today’s AM fix was USD 1,696.00, EUR 1,337.75, and GBP 1,062.06 per ounce.

Today’s AM fix was USD 1,696.00, EUR 1,337.75, and GBP 1,062.06 per ounce.

Yesterday’s AM fix was USD 1,708.50, EUR 1,355.09and GBP 1,074.53 per ounce.

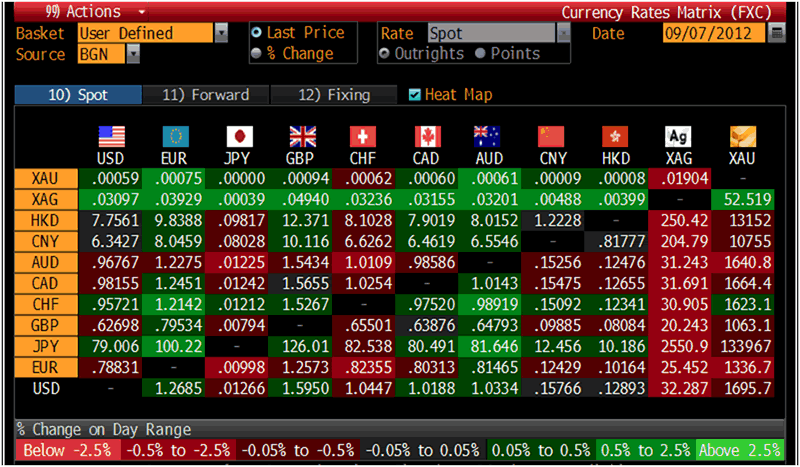

Cross Currency Table – (Bloomberg)

Gold climbed $6.70 or 0.4% in New York yesterday and closed at $1,700.30. Gold in euro’s also rose to near record highs prior to falls soon after the ECB interest rate and bond buying announcement.

Silver outperformed once again and surged to $32.987 and then dropped to $32.346 in early New York trade but then it recovered and finished up 1.24%.

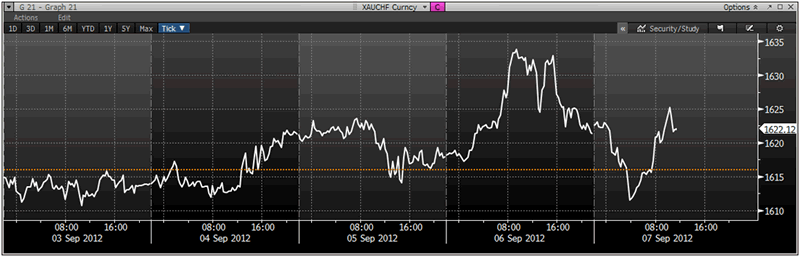

XAU/CHF Currency – (Bloomberg)

Gold is lower in all major currencies today except the Swiss franc which has come under pressure on speculation the SNB will lift their completely unsustainable peg to the euro.

Gold rose in anticipation of the ECB embarking on another money printing exercise with a potentially unlimited bond-buying programme. There was then an element of ‘buy on the rumour and sell on the news’ as gold then saw slight falls on the well-flagged announcement.

Markets rallied around Mario Draghi’s ‘bazooka’ that was able to silence the Bundesbank's Jens Weidmann and force his latest money printing exercise through. The can has been kicked down the road and the euro will survive a bit longer.

At least until the next sovereign debt crisis develops – possibly as soon as next week, on September 12th, when the German Constitutional Court delivers their verdict regarding the 500 billion euro European Stability Mechanism (ESM). The court is reported to be divided in its opinion.

XAU/EUR Currency – (Bloomberg)

Banker ‘Super Mario’ won this battle but the Bundesbank and the will of the German people may ultimately win the war.

Investors will watch the US nonfarm payrolls (1230 GMT) number as a clue as to whether the US Fed will launch QE3 at their policy meeting in September.

South Africa's platinum sector is still in discord as the AMCU union refused to sign a "peace deal" with Lonmin, stifling government-backed efforts to open pay talks and end a 4 week work stoppage that resulted in multiple deaths.

G21 Gold Price – (Bloomberg)

Gold ETF’s hit a record for the third straight day. The amount increased 1.3 metric tons, or 0.1 percent, to 2,471.97 tons, data tracked by Bloomberg showed.

Gold imports by China from Hong Kong rose in July as Chinese people renewed their buying of gold to hedge against financial market’s turmoil and weaker currencies with increasing concerns about the Chinese economy and stock and property markets.

Mainland China bought 75,842 kilograms (75.84 metric tons) of gold in July, including scrap and coins, almost double the 38,143 kilograms a year earlier, according to export data from the Census and Statistics Department of the Hong Kong government which was reported by Bloomberg.

It was the first rise in imports after three months of slightly lower imports. Shipments were a record 103,644.5 kilograms in April, according to the department. China doesn’t publish such data.

Gold shipments from Hong Kong to China surged to 458,628 kilograms (458.628 metric tonnes) in the first seven months of 2012 from 103,090 kilograms (103.09 metric tonnes) in 2011.

Exports of gold to Hong Kong from China were 30,038 kilograms in July, according to a separate Statistics Department statement, up from 27,507.5 kilograms in June.

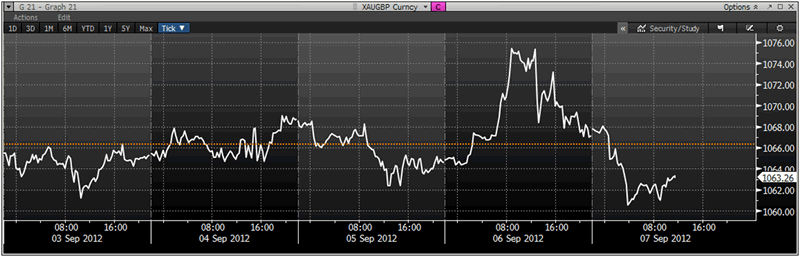

XAU/GBP Currency – (Bloomberg)

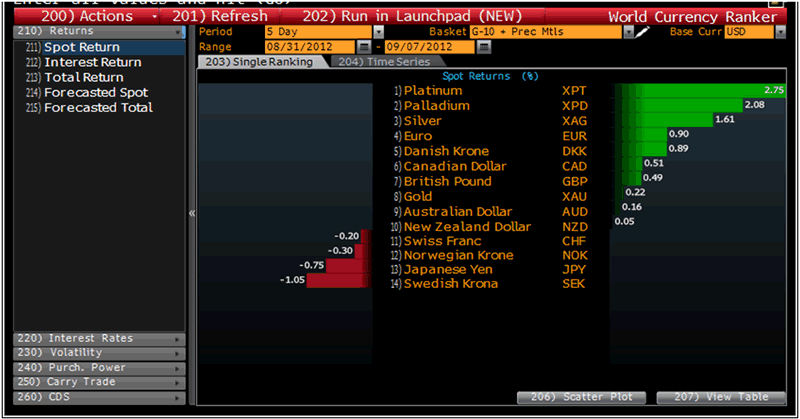

For the week, the precious metals look set to again outperform fiat currencies with all four precious metals higher against the dollar (see G10 and Precious Metals Weekly Returns).

Gold is flat in dollars, slightly lower in euro and pound terms and slightly higher in Japanese Yen, Norwegian Krone and Swiss franc terms for the week.

All in all it was a week of consolidation for gold and further gains for the other precious metals.

G10 and Precious Metals Weekly Returns

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.