JPM and Goldman Forecast Gold Price $1,800/oz By Year End

Commodities / Gold and Silver 2012 Sep 06, 2012 - 09:26 AM GMTBy: GoldCore

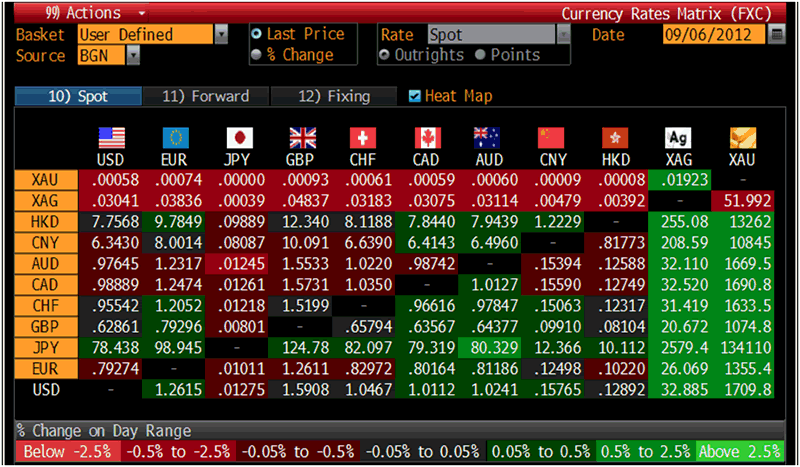

Today’s AM fix was USD 1,708.50, EUR 1,355.09, and GBP 1,074.53 per ounce.

Today’s AM fix was USD 1,708.50, EUR 1,355.09, and GBP 1,074.53 per ounce.

Yesterday’s AM fix was USD 1,689.50, EUR 1,349.23 and GBP 1,065.26 per ounce.

Silver is trading at $32.55/oz, €25.94/oz and £20.55/oz. Platinum is trading at $1,582.50/oz, palladium at $644.80/oz and rhodium at $1,025/oz.

Cross Currency Table – (Bloomberg)

Gold edged down $1.70 or 0.1% in New York yesterday and closed at $1,693.60. Silver fell off in Asia then rallied to a high of $32.35 in New York trading, and finished with a loss of 9 cents.

Gold rose in all major currencies today and topped $1,700/oz in London for the first time since March on speculation ECB will announce further monetary easing. While gold rose 1%, silver surged another 2%.

Bullion rose ahead of the ECB policy meeting and “Super” Mario Draghi’s speech where investors expect to hear announcements on further short term bond buying and possibly an interest rate cut.

Some market participants remain dubious that Draghi’s can resolve the crisis and gold’s rise today may be an indication of that.

Indeed, expectations that ‘Super Mario’ will save the day and in one fell swoop save the euro from collapse are plain silly. At best, Draghi may again manage to buy time by once again ‘kicking the can down the road.’ Thereby, creating much larger problems down the road.

The ECB will announce its decision on interest rates at 12.45pm BST (1.45pm CEST), followed by a press conference 45 minutes later.

BOE will also announce its own decision on monetary policy at noon BST. The 2nd estimate of eurozone 2Q GDP was released this morning and at 0.2% the contraction was in line with estimates.

Volatility can be expected today and we would not be surprised if gold came under pressure during Draghi’s announcement as has happened on previous occasions.

However, all dips in gold should be used as buying opportunities.

XAU/EUR Exchange Rate Daily - (Bloomberg)

Gold at €1,355/oz, just 2.5% from the record high of €1,390/oz, is a sign of a continuing lack of trust in the euro and in Draghi’s stewardship at the ECB.

Investment and diversification demand for gold remains robust as seen in the gold holdings in exchange-traded products or trusts rose to a record for a second straight day. The amount increased 2.85 metric tons, or 0.1 percent, to 2,470.67 tons, data tracked by Bloomberg showed.

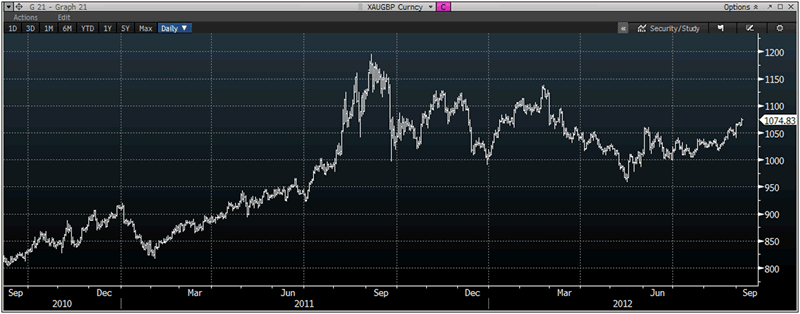

G21 Gold Price Daily - (Bloomberg)

Research houses, analysts and banks are revising their estimates for year end 2012 gold prices higher.

They believe that concerns about inflation and demands for gold as a store of value should lead to higher gold prices by the end of 2012.

JP Morgan and Goldman Sachs have overnight revised upwards there year end forecasts to $1,800/oz and $1,840/oz respectively.

JPMorgan said in a note published today that it expects gold to move toward $1,800/oz by year end, citing negative real interest rates in the U.S., sovereign risk in Europe and instability in the Middle East.

Goldman Sachs sees gold at $1,840/oz by end-2012. Goldman cite the supply side fundamentals and monetary policy easing which are very supportive.

So said Jeffrey Currie, head of commodities research at Goldman in an interview with Linzie Janis on Bloomberg Television.

Currie believes monetary policy easing and FOMC pursuing QE3 “will be critical to putting upward pressure on gold prices”.

Goldman remain most bullish on oil as a trade due to supply issues and the “situation in Iran”.

XAU/GBP Exchange Rate Daily - (Bloomberg)

Bank of America Merrill Lynch have said this morning that gold may reach $2,000/oz by yearend.

Bank of America Merrill Lynch analysts Sabine Schels and Michael Widmer said in an email report that gold prices may climb to $2,000 an ounce by the end of the year because the Federal Reserve probably will announce a third round of bond buying.

“Loose monetary policies with a scope for more aggressive balance-sheet use in the U.S. and Europe will keep real rates in most reserve currencies low (or negative) in 2012,” the analysts said. “We continue to believe this will allow investor demand for gold to remain strong.”

Separately, Australia & New Zealand Banking Group Ltd. said there are “upside risks” to its forecast for gold to end the year at $1,720 an ounce. Commenting in a report today, they said that “gold prices are set to continue their rally, and the increasing likelihood of policy action is creating upside risks.”

Capital Economics see gold rising to $2,000/oz due to demand for gold as a protection of wealth.

The Capital Economics forecast is interesting as they are conservative and were quite bearish on gold up until relatively recently.

Capital Economics remain bearish on silver and say silver will end the year at about $32 an ounce.

We differ with them regarding silver which we remain bullish on in the medium and long term and believe the inflation adjusted silver high of $150/oz will be reached in the coming years.

A close above $1,700 today could lead to a sharp move to challenge the next psychological resistance at $1,800/oz.

Given the now strong technical and strong fundamentals $1,800/oz and €1,400/oz gold could be seen as soon as this month – rather than by yearend

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.