Gold Bugs Rejoice At Signs of Bull Market Resumption

Commodities / Gold and Silver 2012 Sep 05, 2012 - 06:49 AM GMTBy: Simit_Patel

Cries of euphoria have been emanating from the gold bug community of late, as signs that the upward trend is getting ready to resume are growing stronger. Consider the following:

Cries of euphoria have been emanating from the gold bug community of late, as signs that the upward trend is getting ready to resume are growing stronger. Consider the following:

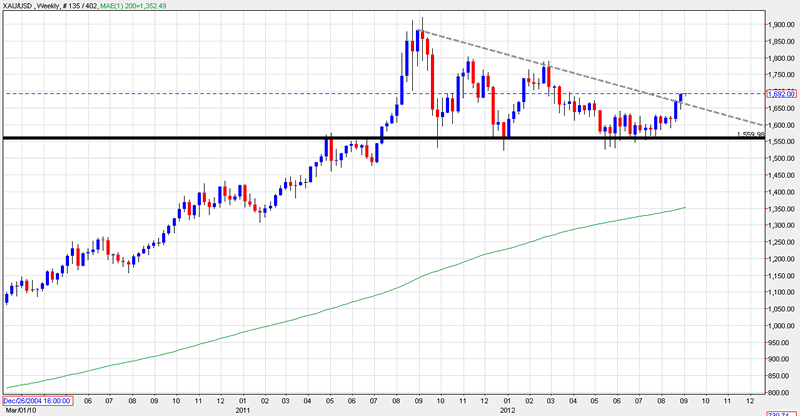

1. First and most important is the descending triangle on the weekly chart, a pattern that had been celebrated by many who are bearish on gold. That gold has broken out to the upside of this pattern invalidates it as a bearish sign, and suggests the consolidation from $1520 to $1620 was the foundation for a bullish leg up.

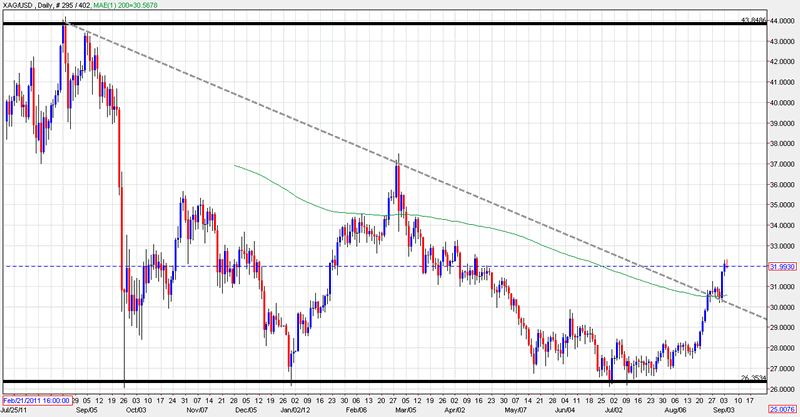

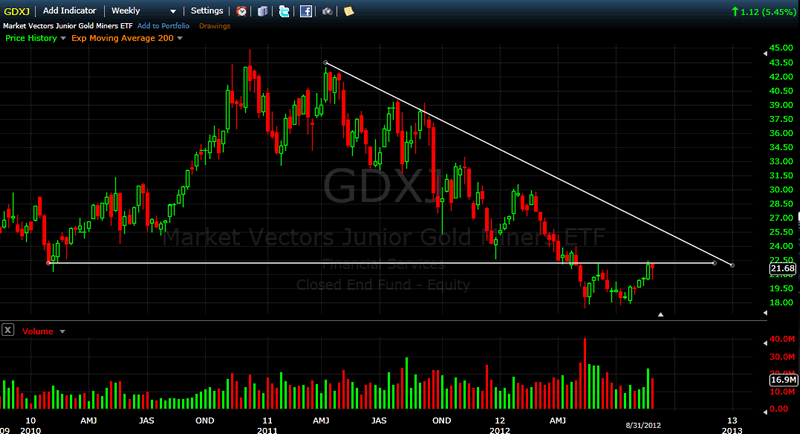

2. Mining stocks and silver also appear to have bottomed. Consider the charts below: silver was also experiencing a descending triangle, from which it has convincingly broken out; junior gold mining stocks, as represented by the Market Vectors Junior Gold Miners ETF (GDXJ) also appear to have found a support level from which they are strongly rallying -- though still need to go a bit more before breaking past key trendlines.

Silver:

GDXJ:

3. More easing is on the way. The latest announcement from Bernanke suggested an openness towards more easing. At least, that is how the markets interpreted it, as mining stocks and precious metals rallied sharply upon the statement. Personally, I’m in the camp that regards “QE to infinity” as being the highest probability outcome. But even if there is no QE, I think a higher gold price is very likely; after all, gold did rally from under $300 at the turn of the century to over $1000 in early 2008, all before QE had entered our vernacular. The US public debt is quickly approaching $16 trillion at the time of this writing, and is still growing; it is this number that I believe will most directly drive the price of gold. The price of gold that makes it possible for the US to pay off its debt with its gold store -- 261,499,000 ounces. If we take the outstanding debt and divide it by the gold the US Treasury claims to have, we get an amount over $61,000. This is not to say that gold will go there -- I find it hard to say that with much certainty -- but only to illustrate how deeply undervalued gold is fundamentally, and thus by implication, how big the US debt problem is. Bear in mind the US is still running deficits.

In sum, now is a great time to buy, in my opinion. I think the lows we’ve seen -- $1520 on gold, $26 on silver, and $17.50 on GDXJ -- won’t be re-visited.

By Simit Patel

http://www.informedtrades.com

InformedTrades is an online community dedicated to helping individuals learn to trade the world's financial markets. Members earn prizes for sharing their knowledge, and the best contributions are compiled into InformedTrades University, the largest collection of free organized

learning material for traders on the web.

© 2012 Copyright Simit Patel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.