Gold and Silver for WHEN Inflation Gets Out of Hand

Commodities / Gold and Silver 2012 Sep 05, 2012 - 06:25 AM GMTBy: Jeff_Clark

Jeff Clark, Casey Research writes: The cheek of it! They raised the price of my favorite ice cream.

Jeff Clark, Casey Research writes: The cheek of it! They raised the price of my favorite ice cream.

Actually, they didn't increase the price; they reduced the container size.

I can now only get three servings for the same amount of money that used to give me four, so I'm buying ice cream more often.

Raising prices is one thing. I understand raw-ingredient price rises will be passed on.

But underhandedly reducing the amount they give you… that's another thing entirely. It just doesn't feel… honest.

You've noticed, I'm sure, how much gasoline is going up.

Food costs too are edging up.

My kids' college expenses, up.

Car prices, insurance premiums, household items – a list of necessities I can't go without. Regardless of one's income level or how tough life might get at times, one has to keep spending money on the basics. (This includes ice cream for only some people.)

According to the government, we're supposedly in a low-inflation environment. What happens if price inflation really takes off, reaching high levels – or worse, spirals out of control?

That's not a rhetorical question. Have you considered how you'll deal with rising costs? Are you sure your future income will even keep up with rising inflation?

Be honest: will you have enough savings to rely on? What's your plan?

If price inflation someday takes off – an outcome we honestly see no way around – nobody’s current standard of living can be maintained without an extremely effective plan for keeping up with inflation.

It's not that people won't get raises or cost of living adjustments at work, nor that they will all neglect to accumulate savings.

It's that the value of the dollars those things are in will be losing purchasing power at increasingly rapid rates. It will take more and more currency units to buy the same amount of gas and groceries and tuition. And ice cream.

I'm not talking science fiction here.

When the consequences of runaway debt, out-of-control deficit spending, and money-printing schemes come home to roost, it's not exactly a stretch to believe that high inflation will result.

We need a way to diffuse the impact this will have on our purchasing power. We need a strategy to protect our standard of living.

How will we accomplish this?

I suspect you know my answer, but here's a good example. You've undoubtedly heard about the drought in the Midwest and how it's impacted the corn crop. The price of corn has surged 50% in the past two months alone.

Commodity analysts say the price could rise another 20% or more as the drought continues.

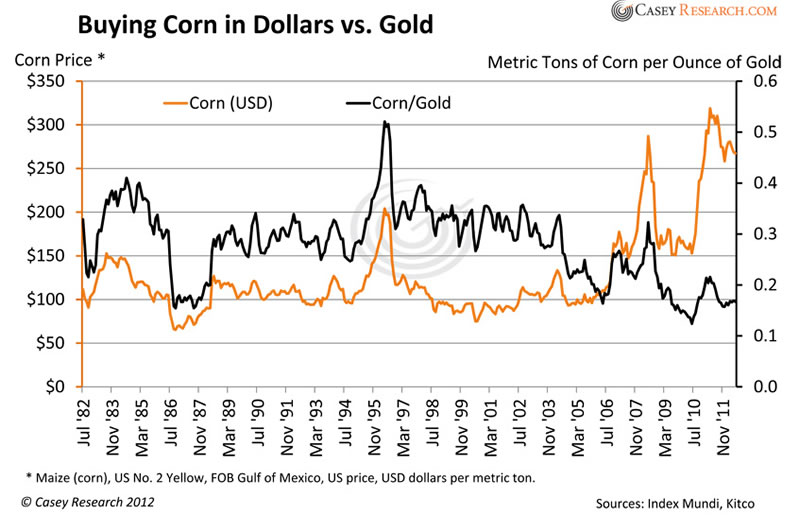

While the price of gold constantly fluctuates, you would have experienced, on average, no inflation over the last 30 years if you'd used gold to purchase corn. Actually, right now, it'd be on the cheap side.

When you extrapolate this to other food items – and virtually everything else you buy – it's very liberating. Think about it: gold continues its safe-haven role as a reliable hedge against rising inflation.

I believe that those who save in gold will experience, on average, no cost increases in the things they buy and the services they use.

Their standard of living would not be impacted.

I think this kind of thinking is especially critical to adopt when you consider that supply and demand trends for gas and food dictate that prices will likely rise for a long time, and perhaps dramatically.

So how much will you need to make it through the upcoming inflation storm and come out unscathed?

Like all projections, assumptions abound. Here are mine for the following table. I'm assuming that:

- The price of gold, on average and at a minimum, tracks the loss in purchasing power of whatever currency you use, and that it does so from current prices. Given gold's history, this is an easy assumption to make.

- Gold sales, over time, capture the gain in gold and silver so that your purchasing power is preserved. (This doesn't mean I expect to sell at the top of the market; I expect we'll be selling gold as needed – if gold has not itself become a widely accepted currency again.)

- We pay taxes on the gain. This will decrease our net gain, but there should still be gains. In the famous Weimar Germany hyperinflation, gold rose faster than the rate of hyperinflation.

To calculate how much we'll need, I looked at two components, the first being average monthly expenses. What would we use our gold and silver for? From corn to a house payment, it could be used for any good or service. After all, virtually nothing will escape rising inflation. Here are some of my items: groceries, gas, oil changes and other car maintenance, household items, eating out, pool service, pest service, groceries and gas again, eating out again, vitamins, movie tickets, doctor appointments, haircuts, pet grooming, kids who need some cash, gifts, and groceries and gas yet again. Groceries include ice cream, in my case. How many ounces of gold would cover these monthly expenses today?

And don't forget the big expenses – broken air conditioner, new vehicle, vacation… and I really don't think my daughter will want to get married at the county rec hall. How many ounces of gold would I need to cover such likely events in the future?

The point here is that you're probably going to need more ounces than you think. Look at your bank statement and assess how much you spend each month – and do it honestly.

The other part of the equation is how long we'll need to use gold and silver to cover those expenses. The potential duration of high inflation will dictate how much physical bullion we need stashed away. This is also probably longer than you think; in Weimar Germany, high inflation lasted two years – and then hyperinflation hit and lasted another two. Four years of high inflation. That's not kindling – that's a wildfire roaring through your back yard.

So here's how much gold you'll need, depending on your monthly expenses and how long high inflation lasts.

Every corn-based product on the grocery shelf will soon take a lot more dimes and dollars to buy. But wait – what if I used gold to buy corn?

If my monthly expenses are about $3,000/month, I need 45 ounces to cover two years of high inflation, and 90 if it lasts four years. Those already well off or who want to live like Doug Casey should use the bottom rows of the table. How much will you need?

Of course many of us own silver, too. Here's how many ounces we'd need, if we saved in silver.

A $3,000 monthly budget needs 1,285 ounces to get through one year, or 3,857 ounces for three years.

I know these amounts probably sound like a lot. But here's the thing: if you don't save now in gold and silver, you're going to spend a whole lot more later.

What I've outlined here is exactly what gold and silver are for: to protect your purchasing power, your standard of living.

It's like having your own personal financial bomb shelter; the dollar will be blowing up all around you, but your finances are protected.

And the truth is, the amounts in the table are probably not enough. Unexpected expenses always come up. Or you may want a higher standard of living. And do you hope to leave some bullion to your heirs?

It's sobering to realize, but it deserves emphasis: if we're right about high inflation someday hitting our economy…

Most people don't own enough gold and silver.

If you think the amount of precious metals you've accumulated might be lacking, I strongly encourage you to put a plan in motion to save enough to meet your family's needs.

We have top recommended dealers in BIG GOLD, ones we've vetted that are trustworthy and have highly competitive prices. We also recommend a service that will deduct whatever amount you chose from your bank account and buy bullion for you automatically. And now, given how concerned we've been about the inflation that's coming, we've actually started our own service. You can check it all out in the current issue of BIG GOLD, risk-free. I can tell you that purchase premiums are incredibly low, due to a proprietary system that bids your order out to a network of dealers that compete for your business. We're already using it, and the response from other investors has been tremendous.

Whatever plan you adopt, my advice is to make sure you have a meaningful amount of bullion to withstand the firestorm that's almost mathematically certain to occur at this point. And now you know exactly how much gold you're going to need.

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.